S&P 500 Daily Perspective for Thu 4 May 2023

Bearish FOMC reaction, Spike Trading Guidelines apply

GDR Model Insights for the S&P 500

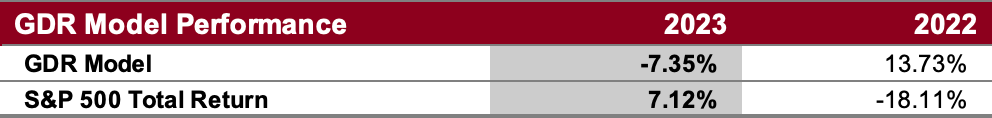

GDR Model Performance

The GDR Model returned 1.82% in April vs the S&P 500’s 1.56%, modestly outperforming the index by 26 basis points. April was marred by possibly the most indecisive market in the last 3 years. Overall this year has been challenging for the Model’s style due to low confidence in the market.

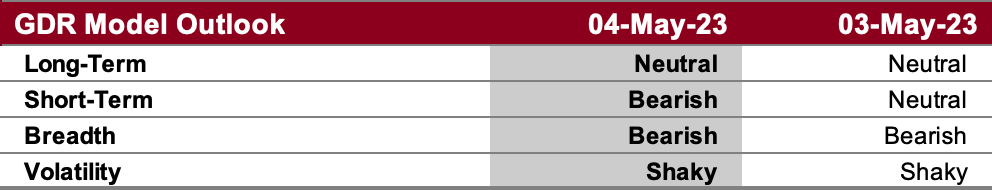

GDR Model Outlook

The overall Model is now well on its way towards Bearish mode following the market’s reaction to the FOMC announcement.

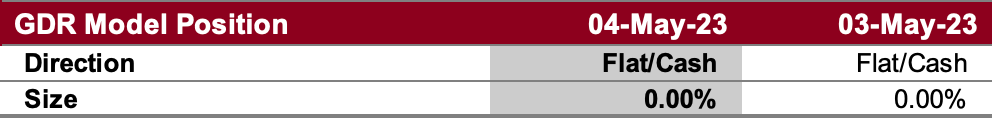

GDR Model Position

Despite the improvement at the end of last week, the model is still not committing to a position as there is not enough conviction. However, the market has clearly deteriorated since the start of the week increasing the likelihood of a Short position.

S&P 500 Futures Market Profile Analysis

Near-Term Outlook: Bearish, Spike Trading Guidelines Apply

Alternate Outlook: Yesterday’s Spike Down is rejected and market Balances or builds Value higher

Key Levels for Today

Bullish: 4131 (Y’day Spike Base), 4172 (Recent Short-Term Balance High), 4188 (Top of Current Balance Zone)

Bearish: 4100 (Go-No-Go Level), 4080 (Bottom of Current Balance Zone), 4068 (April Low)

Market Narrative

The market spiked down yesterday following the FOMC press conference in what was a clearly Bearish reaction. Early on in the O/N Session it tested the bottom of the current Balance Zone before trading back up to yesterday’s Low, which is Weak. The outlook is Bearish and Spike Trading Guidelines apply going into today. Should the market open below yesterday’s Low, Gap Trading Guidelines will apply as well.

While odds certainly favor further downside today, this is a reminder that it’s still just probabilities: the market can trade up despite them. For the ES to gain a more Bullish tone it would first have to trade and accept above yesterday’s Spike Base and then begin building Value above it. This is without a doubt a tall order, but remember that there is still enough key data coming out today and tomorrow that can easily shift the market’s tone.

Economic Calendar

Today at 8:30am - Initial Jobless Claims, Nonfarm Productivity

Earnings After the Close: AAPL 0.00%↑

Tomorrow: Nonfarm Payrolls (8:30am)