S&P 500 Daily Perspective for Mon 30 June 2025

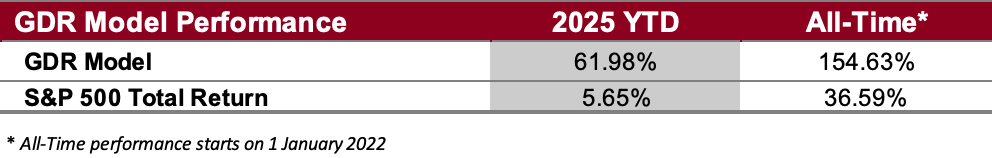

GDR Model Performance

Please see the Performance page for more detailed performance numbers, how they’re calculated, and a chart.

For the fine print (a.k.a. the lawyer-approved stuff), don’t miss the Disclaimers section—it’s where all the “officially important” bits live!

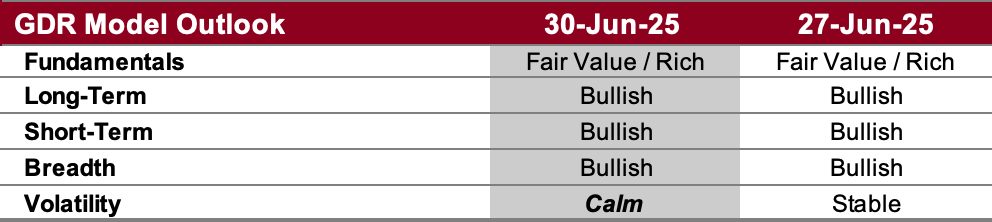

GDR Model Outlook

Overall Outlook (as of 27 Jun 2025): BULLISH. The market is in the midst of an upside breakout.

Fundamentals Outlook (as of 26 Jun 2025): Fair Value/Rich. The model has adjusted valuations slightly downward following the release of new data. Going forward GDR Model positioning should tactically tilt a little less towards the long side, all else equal. Note that this is just a barometer to help guide longer-term decision-making rather than short-term market timing.

IMPORTANT NOTE: it’s unknown what the impact of tariffs on valuations (or what the ultimate level of the tariffs themselves) will actually be on valuations. Rather than make tariff-related assumptions to adjust the model accordingly, the Fundamentals Outlook will remain fully data-driven as it’s always been. All other portions of the model are entirely unaffected.

Long-Term Outlook (as of 27 Jun 2025): Bullish. The market remains strong from a long-term perspective, but for two weeks in a row the market barely closed on a strong note.

Short-Term Outlook (as of 27 Jun 2025): Bullish. The short-term outlook closed strong today yet again.

Breadth Outlook (as of 27 Jun 2025): Bullish. Breadth is once again in line with the rest of the model’s components on the bullish side.

Volatility Outlook (as of 27 Jun 2025): Calm. If the volatility outlook remains stable or calm, the market is more likely to continue drifting upwards while at the same time meaningful sell-offs are unlikely.

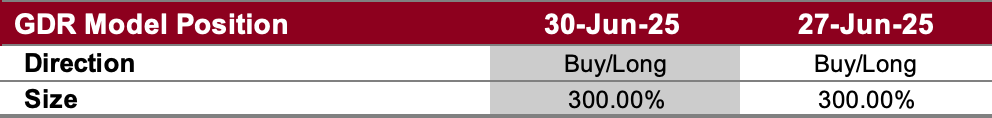

GDR Model Position

In line with current market strength, the GDR Model is holding a meaningful long position.