S&P 500 Daily Perspective for Fri 14 Feb 2025

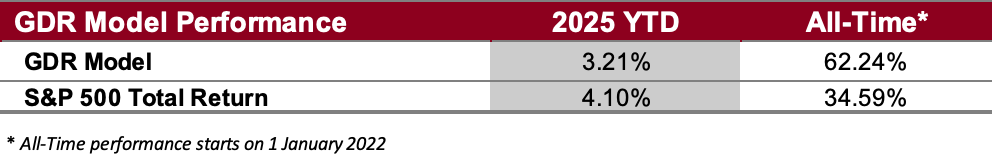

GDR Model Performance

Please see the Performance page for more detailed performance numbers, how they’re calculated, and a chart.

For the fine print (a.k.a. the lawyer-approved stuff), don’t miss the Disclaimers section—it’s where all the “officially important” bits live!

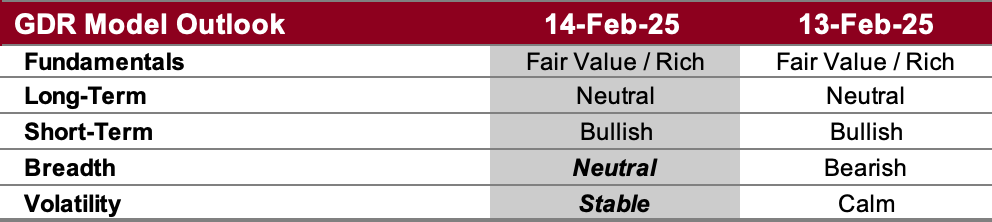

GDR Model Outlook

The GDR Model is neutral to bearish as the initial deterioration that started several days ago has picked up pace. The odds of a multi-week selloff are rising again, but as of now the market remains directionally indecisive.

Fundamentals Outlook (as of 31 Jan 2025): the valuation portion of the model has stocks as being richly valued (i.e. overpriced) for about 6 months now. Note that this is just a barometer to help guide longer-term decision-making rather than short-term market timing.

Long-Term Outlook (as of 7 Feb 2025): the long-term outlook is downgraded to neutral. The market continues to show weakness in the long-term timeframe and odds are rising again of a more meaningful selloff.

Short-Term Outlook (as of 13 Feb 2025): the short-term outlook remains bullish and re-strengthened today. This is still in contrast with the growing weakness in the long-term outlook. There has been a lot of back and forth here, which highlights the market’s directional uncertainty.

Breadth Outlook (as of 13 Feb 2025): breadth improved to neutral, however this is not so important unless the rest of the model is in agreement.

Volatility Outlook (as of 13 Feb 2025): volatility deteriorated back to stable, however the practical difference between stable and calm is minimal. This part of the model remains bullish, which materially decreases the probability of a meaningful sell-off.

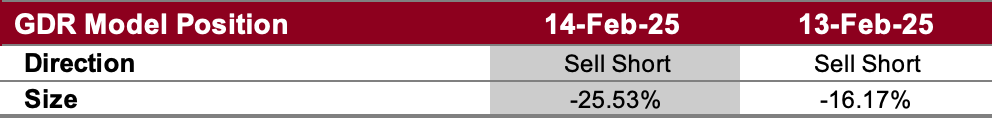

GDR Model Position

The GDR Model remains effectively flat. However, if the outlook continues to deteriorate the model will be likely to open a meaningful short position.