S&P 500 Daily Perspective for Mon 26 Jun 2023

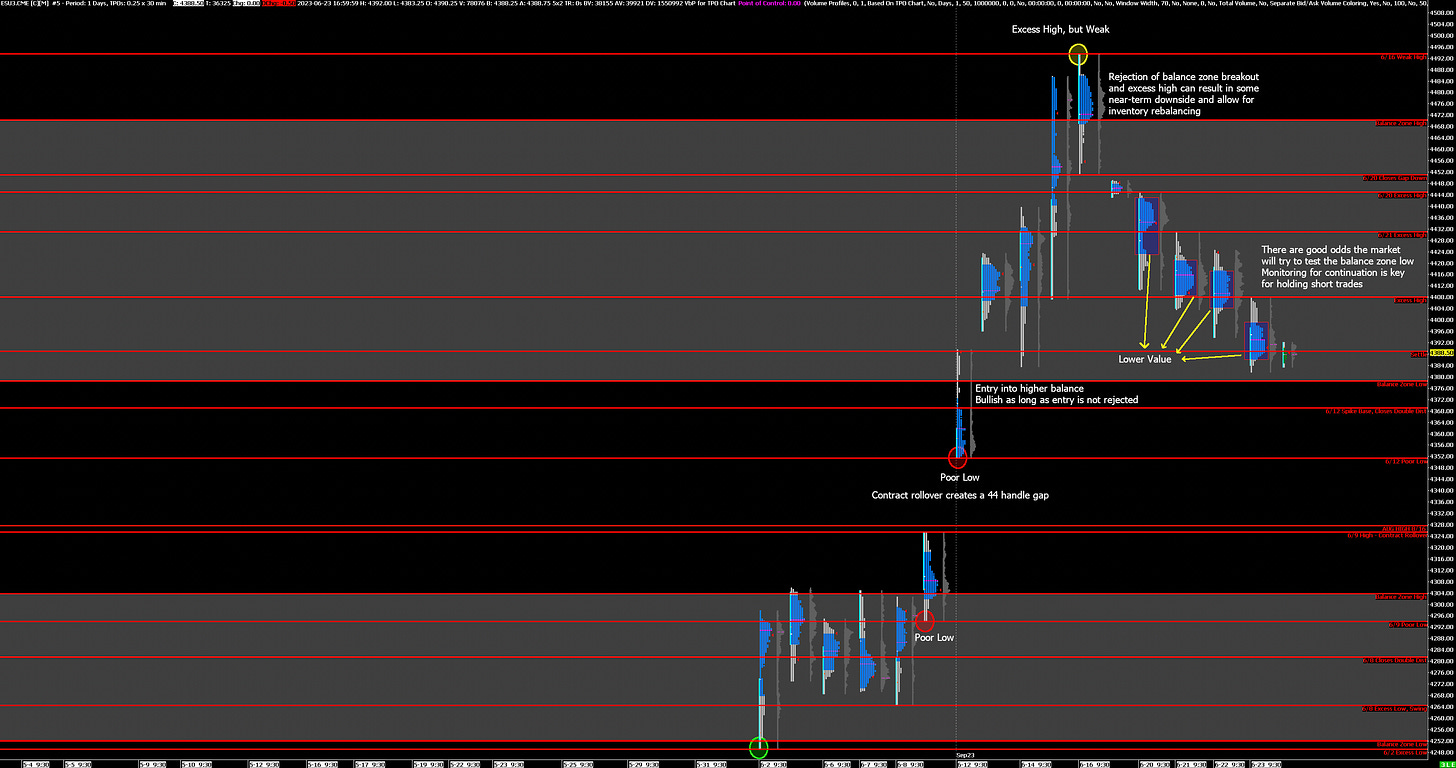

Approaching balance zone low target

GDR Model Insights for the S&P 500

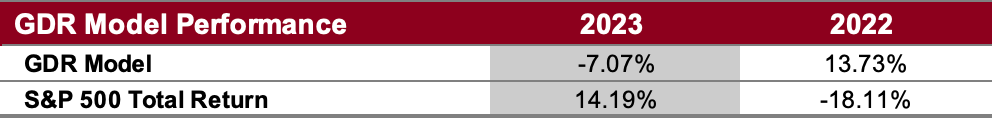

GDR Model Performance

This year has been challenging for the GDR Model’s style due to low confidence in the market.

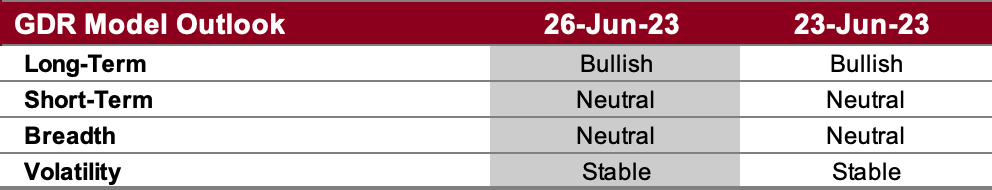

GDR Model Outlook

The GDR Model is now mildly bullish following some deterioration in the market since last week.

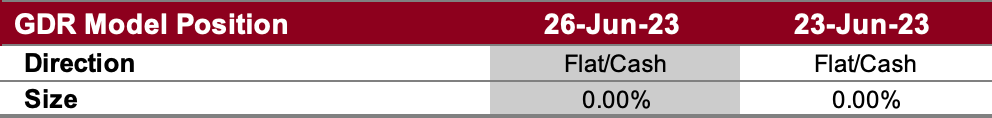

GDR Model Position

The GDR Model has closed its long position as the market showed some deterioration last week.

S&P 500 Futures Market Profile Analysis

Near-Term Outlook: approaching balance zone low target, monitor for continuation

Alternate Outlook: N/A

Key Levels

Bullish: 4408 (Excess High), 4431 (6/21 Excess High), 4451 (Closes Gap Down)

Bearish: 4378 (Bottom of Current Balance Zone), 4369 (6/12 Spike Base, Closes Double Distribution), 4351 (6/12 Poor Low)

Market Narrative

Friday’s trade was idential to Thursday’s in a few ways; the market opened on a gap down that was quickly filled, but value continued to trend lower sustaining the recent bearish trend. The market is now approaching the low of the current balance zone and monitoring for continuation will be key in discerning whether short trades will continue to be profitable.

Should the market find acceptance below the balance zone there are good odds it will continue to trade down to close the ES contract rollover gap from 6/12 at around 4325. On the other hand, if a breakdown is rejected then revisiting the top of the balance zone at 4470 becomes the next logical target.

Economic Calendar

Today - none notable

Next Week: CB Consumer Confidence (Tue), Fed Chair Powell Speaks (Wed), Fed Chair Powell Speaks (Thu), PCE (Fri)