S&P 500 Daily Perspective for Tue 25 April 2023

Three-day short-term balance heading into key earnings

GDR Model Insights for the S&P 500

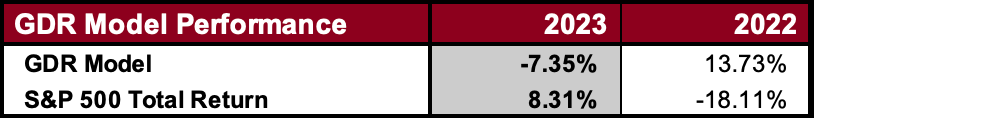

GDR Model Performance

This year has been challenging for the Model’s style due to low confidence in the market.

GDR Model Outlook

The overall Model is Neutral, but it picked up on some weakness towards the end of last week. Breadth is now back to Bearish while the potential for Volatility has increased.

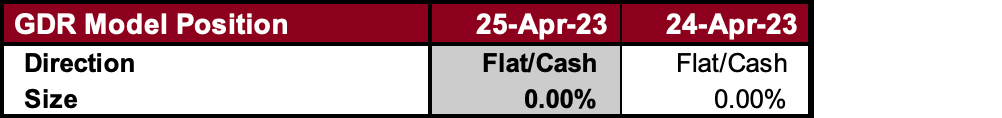

GDR Model Position

Despite the slight deterioration at the end of last week, the model is still not committing to a position as there is not enough conviction.

S&P 500 Futures Market Profile Analysis

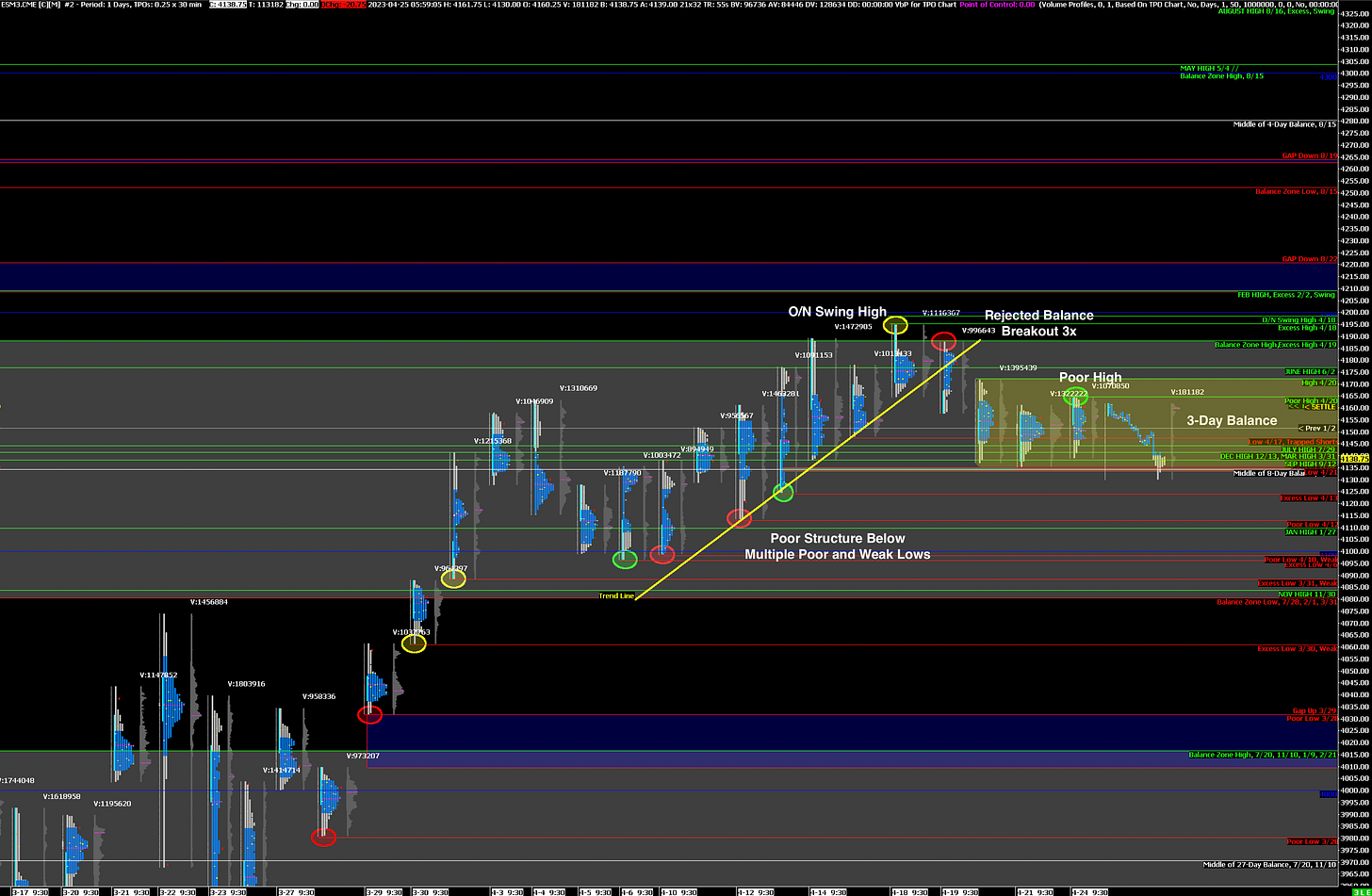

Near-Term Outlook: Short-Term Balance, could go either way

Alternate Outlook: N/A

Key Levels for Today

Bullish: 4172 (Short-Term Balance High), 4188 (Top of Current Balance Zone), 4221 (Closes Gap Down)

Bearish: 4135 (Y’day Low, Short-Term Balance Low), 4113 (Poor Low), 4098 (Poor Low)

Market Narrative

For the second consecutive trading day, the market didn’t change much and therefore the outlook remains similar: a short-term, three-day Balance. There is Excess on the Low, and while yesterday’s High is Poor, it’s well within the short-term Balance so it likely doesn’t carry much significance. Assuming nothing changes materially until the RTH Open, I will again approach the day as a short-term Balance using Balance Trading Guidelines. The edges are Thursday’s High (4172) and Friday’s Low (4135).

Keep in mind there’s a lot more Poor Structure below than above. Moreover, Microsoft and Alphabet report earnings after the close and both of these companies carry significant weight in the S&P 500 index.

Economic Calendar

Today at 9:30am - Building Permits

Today at 10:00am - CB Consumer Confidence, New Home Sales

Earnigs After the Close: MSFT 0.00%↑, GOOGL 0.00%↑, V 0.00%↑

Later this Week: META -0.04%↓ (Wed), GDP (Thu), AMZN -0.14%↓ (Thu), PCE (Fri), XOM 0.00 (Fri)