S&P 500 Daily Perspective for Thu 31 Jul 2025

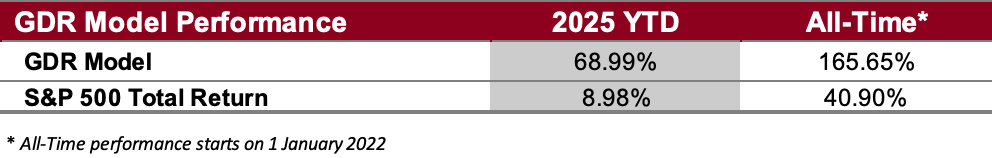

GDR Model Performance

Please see the Performance page for more detailed performance numbers, how they’re calculated, and a chart.

For the fine print (a.k.a. the lawyer-approved stuff), don’t miss the Disclaimers section—it’s where all the “officially important” bits live!

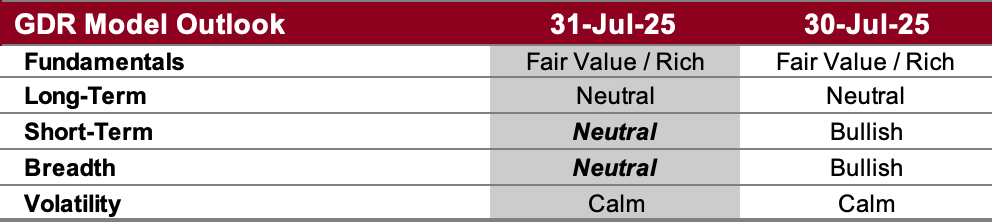

GDR Model Outlook

Overall Outlook (as of 30 Jul 2025): NEUTRAL. The market is in the midst of a breakout. However, there has been plenty of intermittent weakness to go around and the overall outlook has been downgraded. This has the potential to turn into a meaningful sell-off, but it is also possible that it might quietly resolve itself into nothing - at this point, it’s too soon to tell.

Fundamentals Outlook (as of 26 Jun 2025): Fair Value/Rich. The model has adjusted valuations slightly downward following the release of new data. Going forward GDR Model positioning should tactically tilt a little less towards the long side, all else equal. Note that this is just a barometer to help guide longer-term decision-making rather than short-term market timing.

IMPORTANT NOTE: it’s unknown what the impact of tariffs on valuations (or what the ultimate level of the tariffs themselves) will actually be on valuations. Rather than make tariff-related assumptions to adjust the model accordingly, the Fundamentals Outlook will remain fully data-driven as it’s always been. All other portions of the model are entirely unaffected.

Long-Term Outlook (as of 25 Jul 2025): Neutral. The long-term outlook has worsened of recent and is now going through a period of indecision. This can resolve itself without a meaningful impact in the market, but it’s starting to become a concern.

Short-Term Outlook (as of 30 Jul 2025): Neutral. The short-term outlook has been showing weakness yet again. At this point I’d say the market is mostly showing indecision rather than decisive weakness (or strength), especially given that we’re in the middle of earnings season.

Breadth Outlook (as of 30 Jul 2025): Neutral. Breadth is still in line with most of the model’s other components, but now in the sense that it’s also been downgraded to neutral.

Volatility Outlook (as of 30 Jul 2025): Calm. If the volatility outlook remains stable or calm, the market is more likely to continue drifting upwards while at the same time meaningful sell-offs are unlikely. This balance of probabilities remains true regardless of what the rest of the model’s components say.

GDR Model Position

The GDR Model is back to a modest short position after the market made further gains last week. Despite the breakout, the model remains unconvinced of the underlying strength in the market.