S&P 500 Daily Perspective for Tue 9 May 2023

Market in tight range as it awaits further information

GDR Model Insights for the S&P 500

GDR Model Performance

Overall this year has been challenging for the Model’s style due to low confidence in the market.

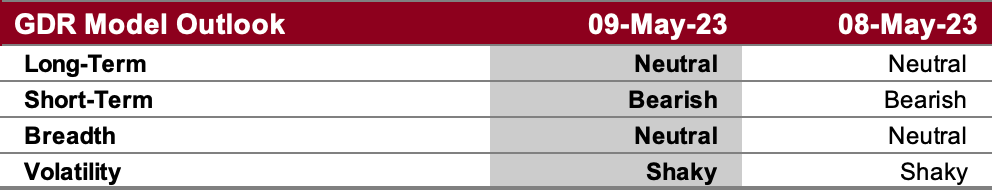

GDR Model Outlook

The overall Model has been improving since the end of last week and is now back to Neutral.

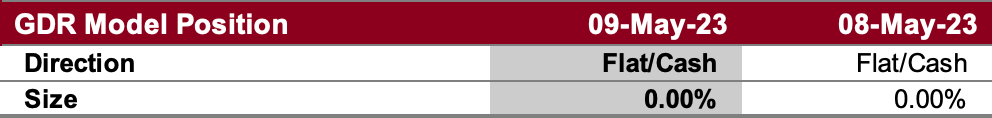

GDR Model Position

The model is still not committing to a position as there is not enough conviction. To say the market has been choppy would be an understatement, but the model is doing what it’s meant to do: stay out of the market when there is no clear established trend.

S&P 500 Futures Market Profile Analysis

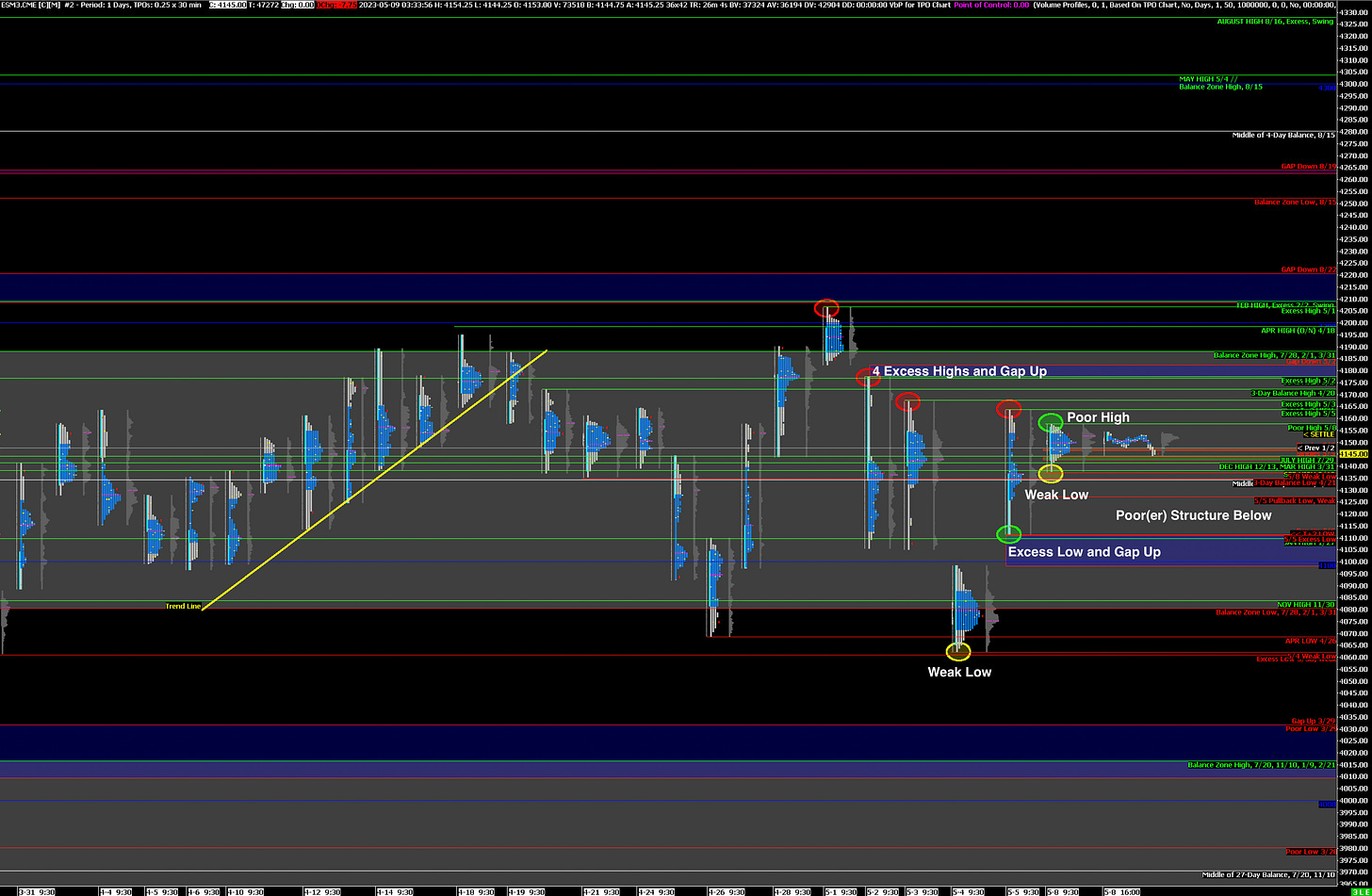

Near-Term Outlook: Short-Term Balance, could go either way

Alternate Outlook: N/A

Bullish: 4158 (Y’day Poor High), 4188 (Top of Current Balance Zone), 4221 (Closes Prev Gap Down)

Bearish: 4137 (Y’day Weak Low), 4127 (Pullback Low, Weak), 4098 (Closes Gap Up)

Market Narrative

The market put in a Balanced day leaving behind a Weak Low and a Poor High. Once again, the character of trading suggests short-term, weak hands traders are back to dominating the market. There is a good chance that the market may be waiting for the inflation data coming out Wednesday and Thursday, so don’t be too hasty to jump into trades before then.

Finally, do note how tight the trading range has been over the last month or so.

Economic Calendar

Today at 12:05pm - FOMC Member Williams Speaks

Later This Week: CPI (Wed), PPI (Thu)