S&P 500 Daily Perspective for Thu 13 Feb 2025

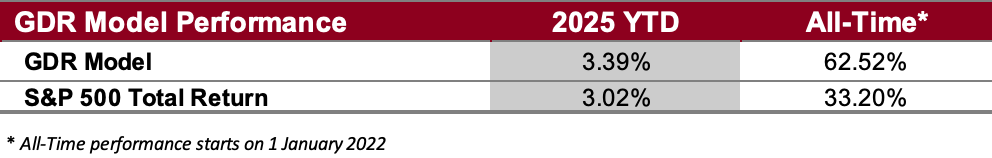

GDR Model Performance

Please see the Performance page for more detailed performance numbers, how they’re calculated, and a chart.

For the fine print (a.k.a. the lawyer-approved stuff), don’t miss the Disclaimers section—it’s where all the “officially important” bits live!

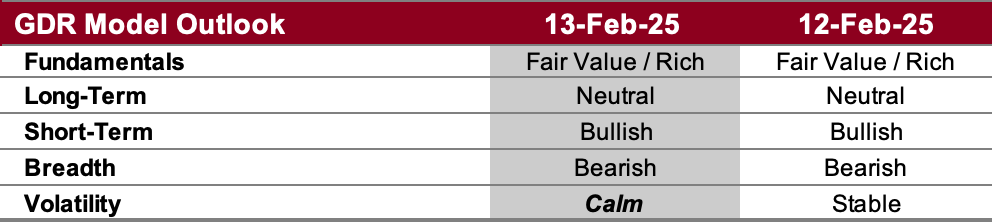

GDR Model Outlook

The GDR Model is neutral to bearish as the initial deterioration that started several days ago has picked up pace. The odds of a multi-week selloff are rising again.

Fundamentals Outlook (as of 31 Jan 2025): the valuation portion of the model has stocks as being richly valued (i.e. overpriced) for about 6 months now. Note that this is just a barometer to help guide longer-term decision-making rather than short-term market timing.

Long-Term Outlook (as of 7 Feb 2025): the long-term outlook is downgraded to neutral. The market continues to show weakness in the long-term timeframe and odds are rising again of a more meaningful selloff.

Short-Term Outlook (as of 12 Feb 2025): the short-term outlook remains bullish, but weakened today. This is still in contrast with the growing weakness in the long-term outlook.

Breadth Outlook (as of 12 Feb 2025): breadth remains bearish, however this is not so important unless the rest of the model is in agreement.

Volatility Outlook (as of 12 Feb 2025): volatility improved to calm. If the market is able to stay between calm and stable then the probability of a meaningful sell-off decreases.

GDR Model Position

The GDR Model remains effectively flat. However, if the outlook continues to deteriorate the model will be likely to open a meaningful short position.