S&P 500 Daily Perspective for Mon 13 Oct 2025

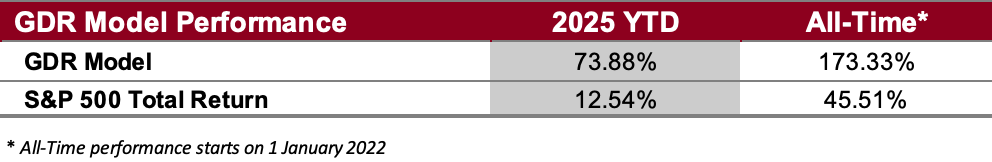

GDR Model Performance

Please see the Performance page for more detailed performance numbers, how they’re calculated, and a chart.

For the fine print (a.k.a. the lawyer-approved stuff), don’t miss the Disclaimers section—it’s where all the “officially important” bits live!

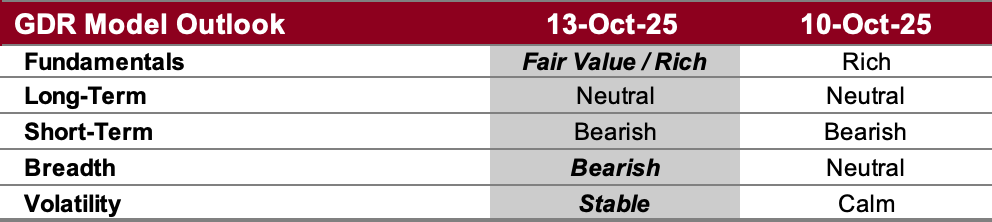

GDR Model Outlook

Overall Outlook (as of 10 Oct 2025): NEUTRAL. The weakness the GDR Model started to pick up on recently has continued for some time now. The strength seen towards the end of last week seems to have mostly vanished. There’s a fair chance that has been replaced with weakness… Time will tell.

Fundamentals Outlook (as of 10 Oct 2025): Fair Value/Rich. The model has adjusted valuations slightly upward following the release of new data. Going forward GDR Model positioning should tactically tilt a little more towards the long side, all else equal. Note that this is just a barometer to help guide longer-term decision-making rather than short-term market timing.

IMPORTANT NOTE: it’s unknown what the impact of tariffs on valuations (or what the ultimate level of the tariffs themselves) will actually be on valuations. Rather than make tariff-related assumptions to adjust the model accordingly, the Fundamentals Outlook will remain fully data-driven as it’s always been. All other portions of the model are entirely unaffected.

Long-Term Outlook (as of 10 Oct 2025): Neutral. Any hope for renewed strength all but vanished at the end of last week. Not only was Friday’s sell-off nasty, the weakness behind was fully confirmed by the model’s read of the market.

Short-Term Outlook (as of 10 Oct 2025): Bearish. The market was extremely weak on Friday, which further adds on the short-term outlook’s current bearishness.

Breadth Outlook (as of 10 Oct 2025): Bearish. Breadth deteriorated further. If the rest of the model’s components drop to bearish, breadth will be solid confirmation.

Volatility Outlook (as of 10 Oct 2025): Stable. The volatility outlook is in calm/stable waters, which, while sustained, is more likely to help protect against serious sell-offs and lift prices higher. However, Friday showed a sharp drop on this front as well, and if it picks up momentum it will not take long for this component to fall to volatile reads.

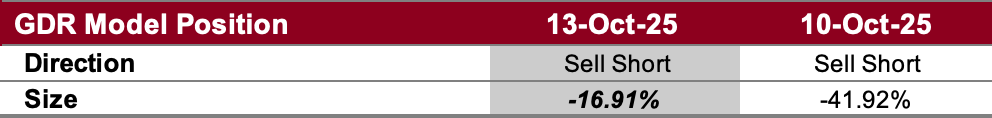

GDR Model Position

The GDR Model went flat around mid September after it picked up on fresh weakness. At the end of last week there was another bout of fresh weakness in the market so the model is more likely to either remain flat or enter a short.