S&P 500 Daily Perspective for Fri 21 Jul 2023

Potential for further balance after look above and fail

GDR Model Insights for the S&P 500

GDR Model Performance

This year has been challenging for the GDR Model’s style due to low confidence in the market.

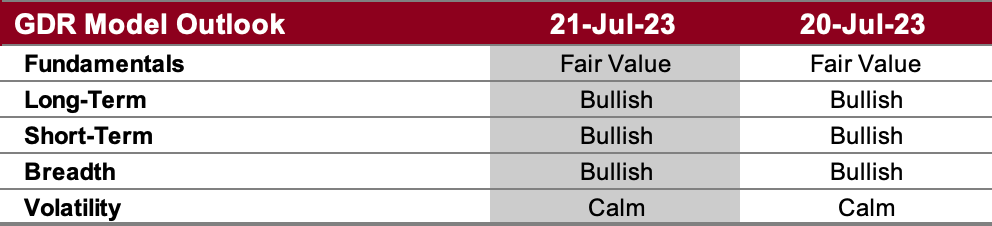

GDR Model Outlook

The GDR Model is bullish.

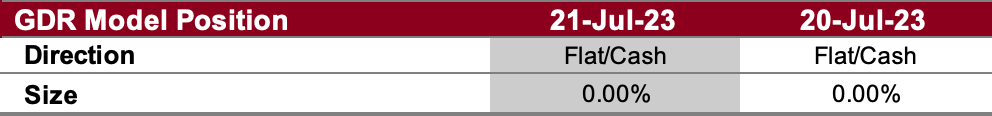

GDR Model Position

Even though the GDR Model remains bullish, it deteced more weakness than prices suggest towards the end of last week. In response, the model has pre-emptively closed its long position. If strength resumes, it would likely reopen the long position.

S&P 500 Futures Market Profile Analysis

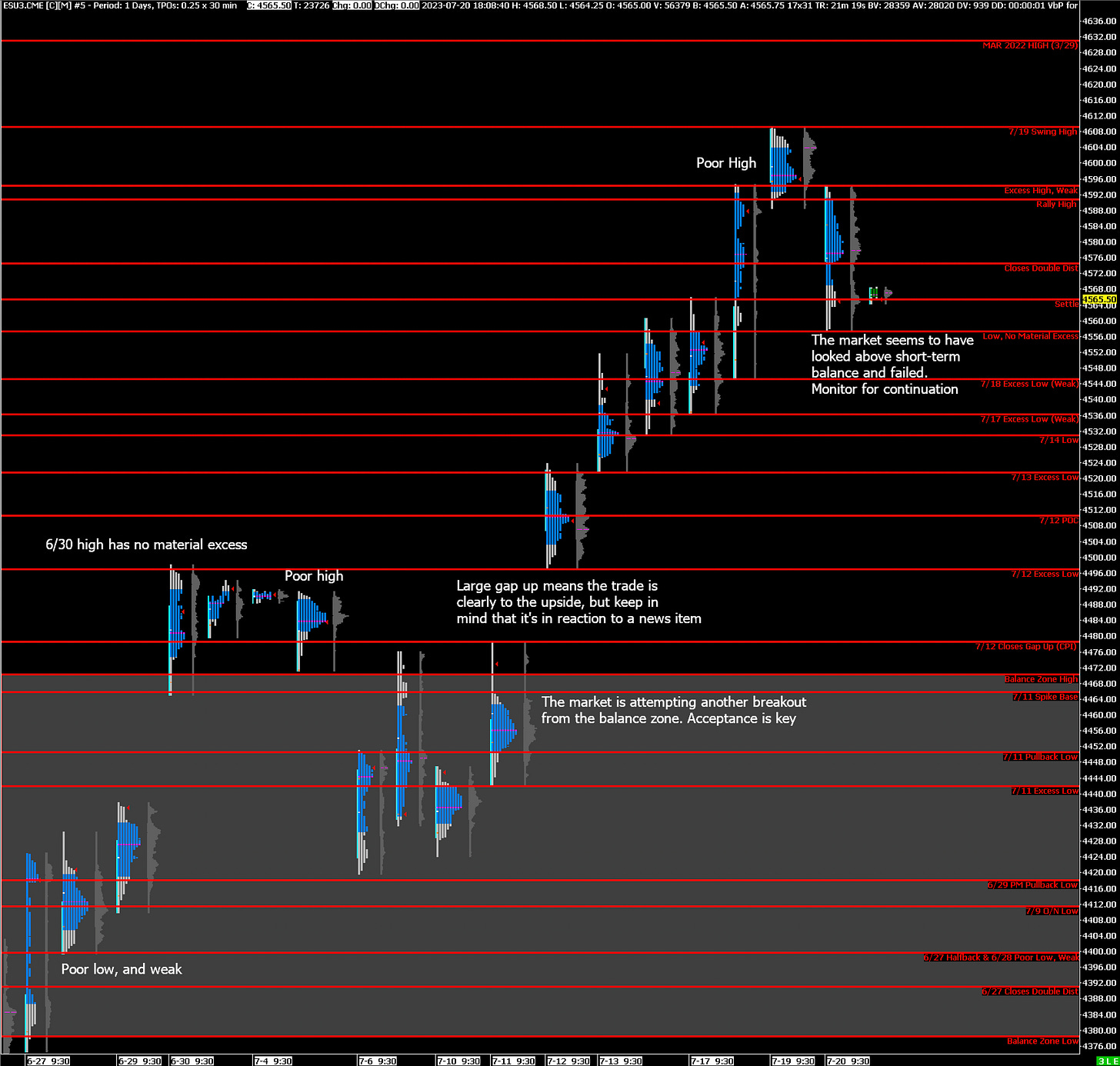

Near-Term Outlook: potential look above and fail into further consolidation

Alternate Outlook: N/A

Key Levels

Bullish: 4575 (Closes Double Dist), 4591 (Rally High), 4594 (Excess High, Weak High)

Bearish: 4557 (Y’day Low), 4566 (7/17 Excess High, Y’day Pullback Low), 4545 (7/18 Excess Low, Weak Low), 4536 (7/18 Excess Low, Weak Low)

Market Narrative

The market had broken out of short-term balance on Tuesday, but now that seems to be turning into a look above and fail, which is when the market feints a break from balance only to return to it soon after. Today seems to have few potential catalysts so further balance seems more likely. Moreover, keep in mind that next week is has plenty of releases that can move the market.

Economic Calendar

Today: none notable

Next Week: CB Consumer Confidence (Tue), Fed Interest Rate Decision (Wed), GDP (Thu), PCE (Fri)