S&P 500 Daily Perspective for Fri 16 Jun 2023

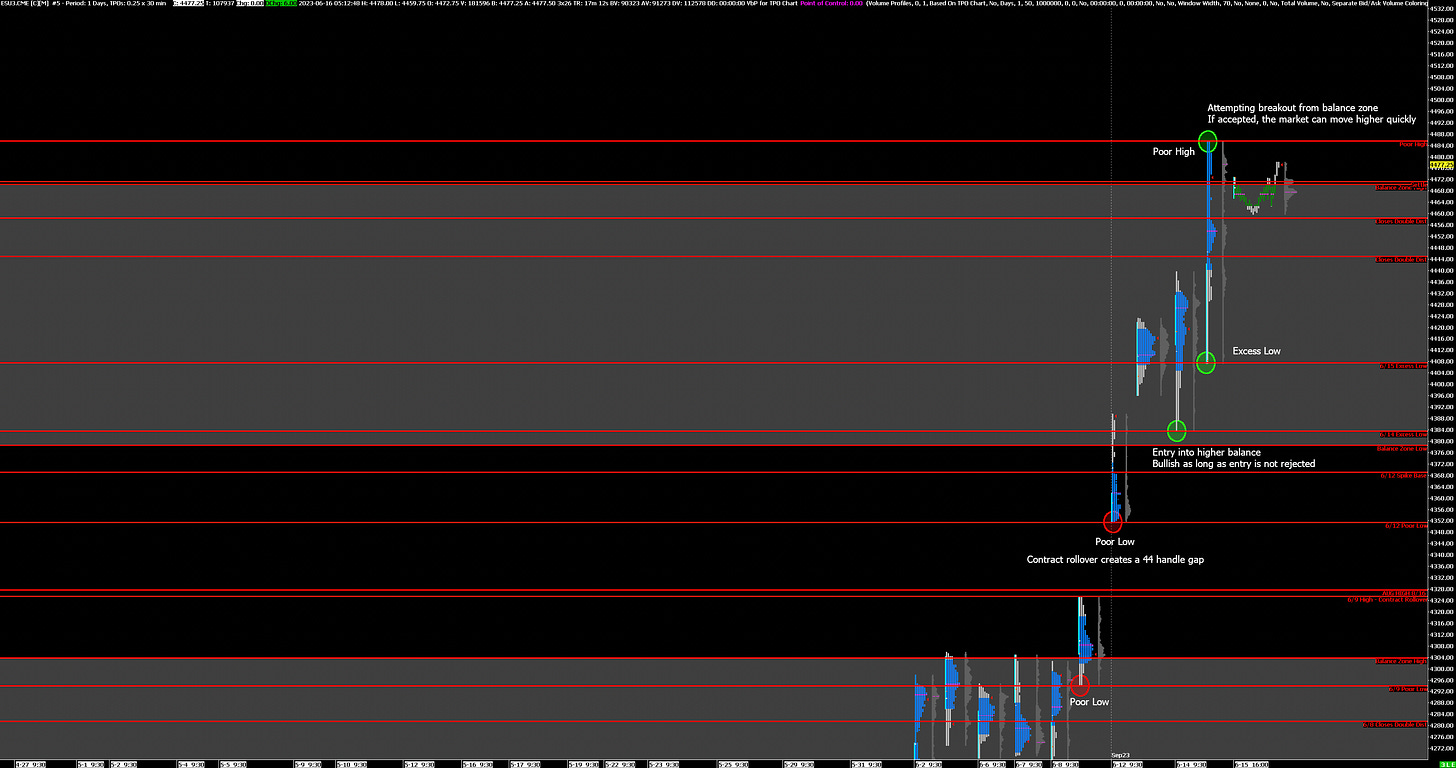

Attempting breakout from balance zone

GDR Model Insights for the S&P 500

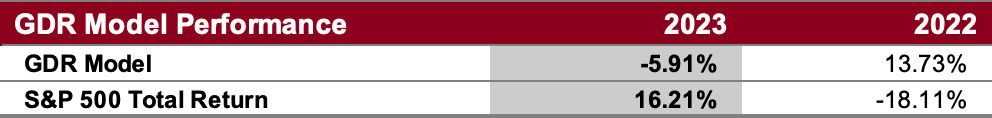

GDR Model Performance

This year has been challenging for the GDR Model’s style due to low confidence in the market.

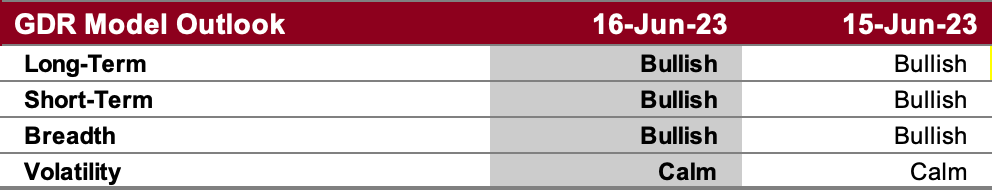

GDR Model Outlook

The GDR Model is now bullish following the recent breakout from consolidation.

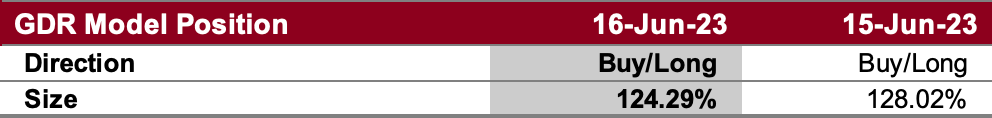

GDR Model Position

The GDR Model is currently holding a long position on the market’s strength.

S&P 500 Futures Market Profile Analysis

Near-Term Outlook: accepted breakout from balance zone

Alternate Outlook: liquidation break due to gamma exposure expiration

Key Levels

Bullish: 4486 (Poor High), 4588 (April 2022 High), 4631 (March 2022 High)

Bearish: 4470 (Top of Current Balance Zone), 4458 (Closes Double Distribution), 4445 (Closes Double Distribution)

Market Narrative

Yesterday the market had a trend day up leaving behind even more poor structure below and a poor high at the top. While this leaves concerns on the sustainability of the current move up, the poor high suggests we are not done yet. The ES is attempting a breakout from yet another balance zone, should it find acceptance above, lack of key references suggests the market could continue moving quickly higher.

Keep in mind that today is quadruple witching and as a result, the market’s gamma exposure is unusually elevated. As monthly and quarterly options expire today it’s possible that - should market participants do not rollover their exposure - the market will lose its footing and tumble so beware of this possibility. Nonetheless, should a sellof happen, it’s likely to not be much more than a liquidation break.

Economic Calendar

7:45am - FOMC Member Waller Speaks

10:00am - Michigan Consumer Sentiment

All Day: Quadruple Witching (quarterly futures and monthly options expiration)

Next Week: Fed Chair Powell Testifies on Monetary Policy (Wed, Thu)