S&P 500 Daily Perspective for Wed 5 Jul 2023

Attempting breakout from balance zone with key data pending on short trading week

GDR Model Insights for the S&P 500

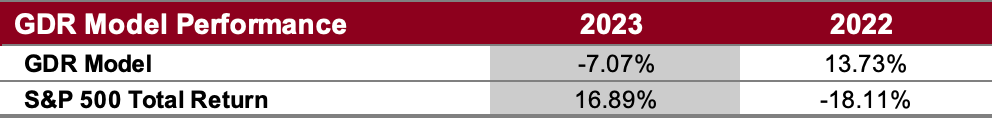

GDR Model Performance

The model returned 3.39% in June, lagging behind the S&P 500 Total Return’s 6.61%. Q2 was a tough quarter with the model returning 2.12%, notably behind the index’s 8.74%. This year has been challenging for the GDR Model’s style due to low confidence in the market.

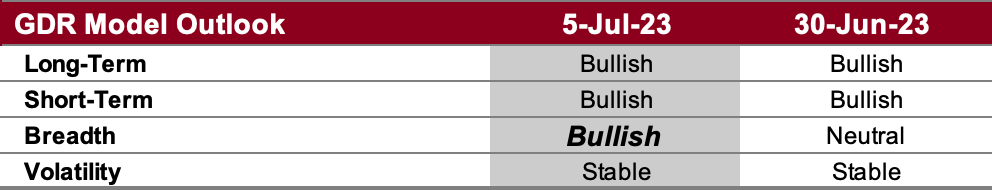

GDR Model Outlook

The GDR Model is now back to bullish following some recent stabilization.

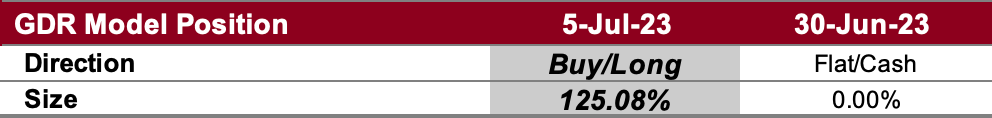

GDR Model Position

The GDR Model has re-opened its long position. However, position size is reduced compared to earlier in the year due to deteriorating fundamentals.

S&P 500 Futures Market Profile Analysis

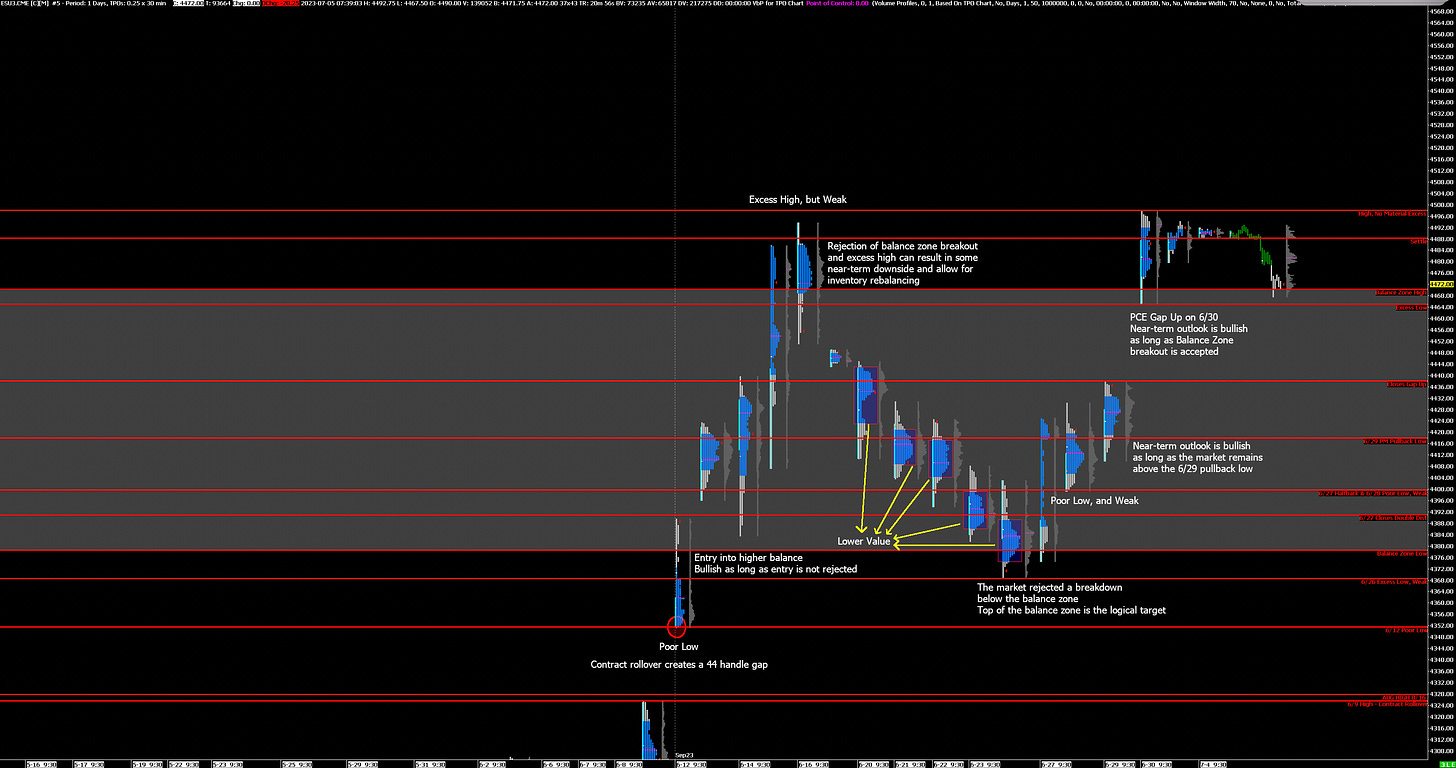

Near-Term Outlook: attempting breakout from balance zone, monitor for continuation

Alternate Outlook: N/A

Key Levels

Bullish: 4498 (High with No Material Excess), 4589 (April 2022 High), 4631 (March 2022 High)

Bearish: 4470 (Top of Current Balance Zone), 4438 (Closes Gap Up), 4400 (Poor Low, Weak Low)

Market Narrative

The market opened on a large gap up on Friday following the release of PCE data and began an attempt to break out of the current balance zone early on. The near-term outlook remains bullish as long as the prices are accepted above the top of the balance zone (4470).

There are few references both above and below current levels, so there are good odds that the market may move quickly in wide ranges regardless of which direction it goes. This may be precipitated by the release of FOMC minutes this afternoon.

Economic Calendar

10:00am - Factory Orders

2:00pm - FOMC Meeting Minutes

Later this Week: Nonfarm Payrolls (Fri)