S&P 500 Daily Perspective for Fri 7 Jul 2023

Reaction to employment data release will likely determine the tone for today

GDR Model Insights for the S&P 500

GDR Model Performance

The model returned 3.39% in June, lagging behind the S&P 500 Total Return’s 6.61%. Q2 was a tough quarter with the model returning 2.12%, notably behind the index’s 8.74%. This year has been challenging for the GDR Model’s style due to low confidence in the market.

GDR Model Outlook

The GDR Model is now back to bullish, although there was some deterioration yesterday.

GDR Model Position

The GDR Model has re-opened its long position. However, position size is reduced compared to earlier in the year due to deteriorating fundamentals.

S&P 500 Futures Market Profile Analysis

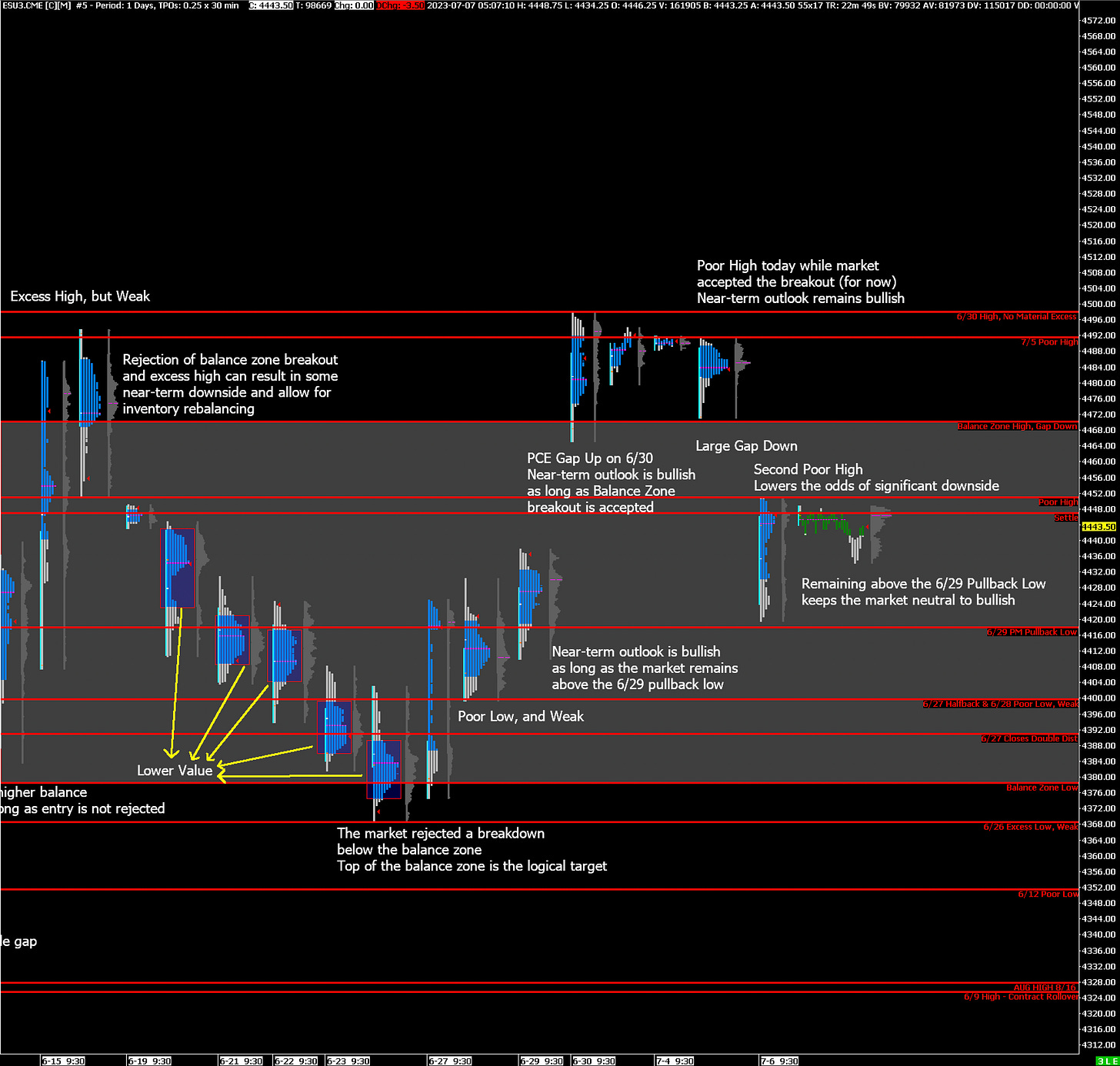

Near-Term Outlook: bullish, consecutive poor highs ahead of employment data

Alternate Outlook: retest of balance zone low following rejected breakdown

Key Levels

Bullish: 4451 (Poor High), 4470 (Top of 2-Day Balance, Closes Gap Down), 4492 (7/5 Poor High)

Bearish: 4418 (6/29 Pullback Low), 4400 (Poor Low, Weak Low), (Closes 6/27 Double Distribution)

Market Narrative

The market opened on a large gap down yesterday and sustained liquidation throught most of the morning before short-term inventories got too short leading to a recovery. Yesterday ended with an unrepaired poor high, which lowers the odds of significant downside in the near-term.

On the other hand, yesterday was an emphatic rejection of a second attempt to breakout of the current balance zone. In these situations, the next logical target is the balance zone low. Given the potential for increased volatility on the back of employment data, the market can go in either direction.

Economic Calendar

8:30am - Nonfarm Payrolls

Next Week: CPI (Wed), PPI (Thu)