S&P 500 Daily Perspective for Wed 16 Apr 2025

GDR Model Performance

Please see the Performance page for more detailed performance numbers, how they’re calculated, and a chart.

For the fine print (a.k.a. the lawyer-approved stuff), don’t miss the Disclaimers section—it’s where all the “officially important” bits live!

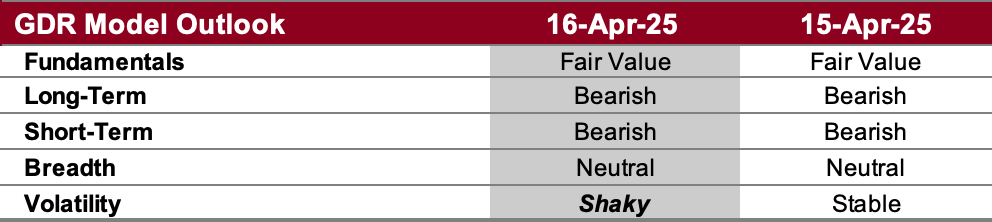

GDR Model Outlook

Overall Outlook (as of 4 Apr 2025): BEARISH. The serious sell-off the model had been pointing towards since February is now well underway. The model’s components remain aligned on the bearish side.

Fundamentals Outlook (as of 27 Mar 2025): Fair Value. The model has adjusted valuations upward following the release of new data. Going forward GDR Model positioning should tactically tilt more towards the long side, all else equal. Note that this is just a barometer to help guide longer-term decision-making rather than short-term market timing.

IMPORTANT NOTE REGARDING THE FUNDAMENTALS OUTLOOK: given the magnitude of the likely economic impact from the tariffs implemented by the US administration, and that the data that goes into this portion of the model comes with a delay, this part of the model is most likely inaccurate for the foreseeable future. I will keep updating it as usual, but please be aware of this. All other portions of the model are entirely unaffected.

Long-Term Outlook (as of 11 Apr 2025): Bearish. There has been persistent weakness over the long-term timeframe and the market is unlikely to fully recover until this weakness gives way to renewed strength.

Short-Term Outlook (as of 15 Apr 2025): Bearish. The market remains weak, but there were a few signs of strength again today.

Breadth Outlook (as of 15 Apr 2025): Neutral. This is not very meaningful at this point given that all the other market timing components of the model are bearish.

Volatility Outlook (as of 15 Apr 2025): Shaky. The Volatility Outlook is going back and forth between shaky and stable. If it stabilizes on the former, a renewed sell-off is more likely, if the latter then a rally will have a higher probability.

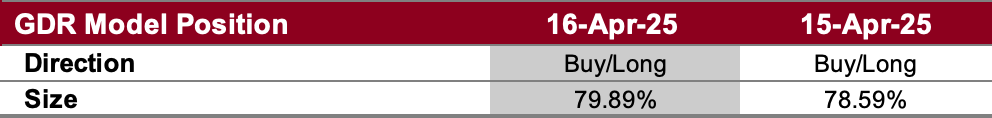

GDR Model Position

At current prices, the GDR Model finds stocks to be better value. As such it will continue slowly building a long position when the market falls and taking partial profits when it rises. However note that despite this, the model certainly doesn’t see the market as nearly strong enough to warrant a substantial long position based on market timing.