S&P 500 Daily Perspective for Wed 24 May 2023

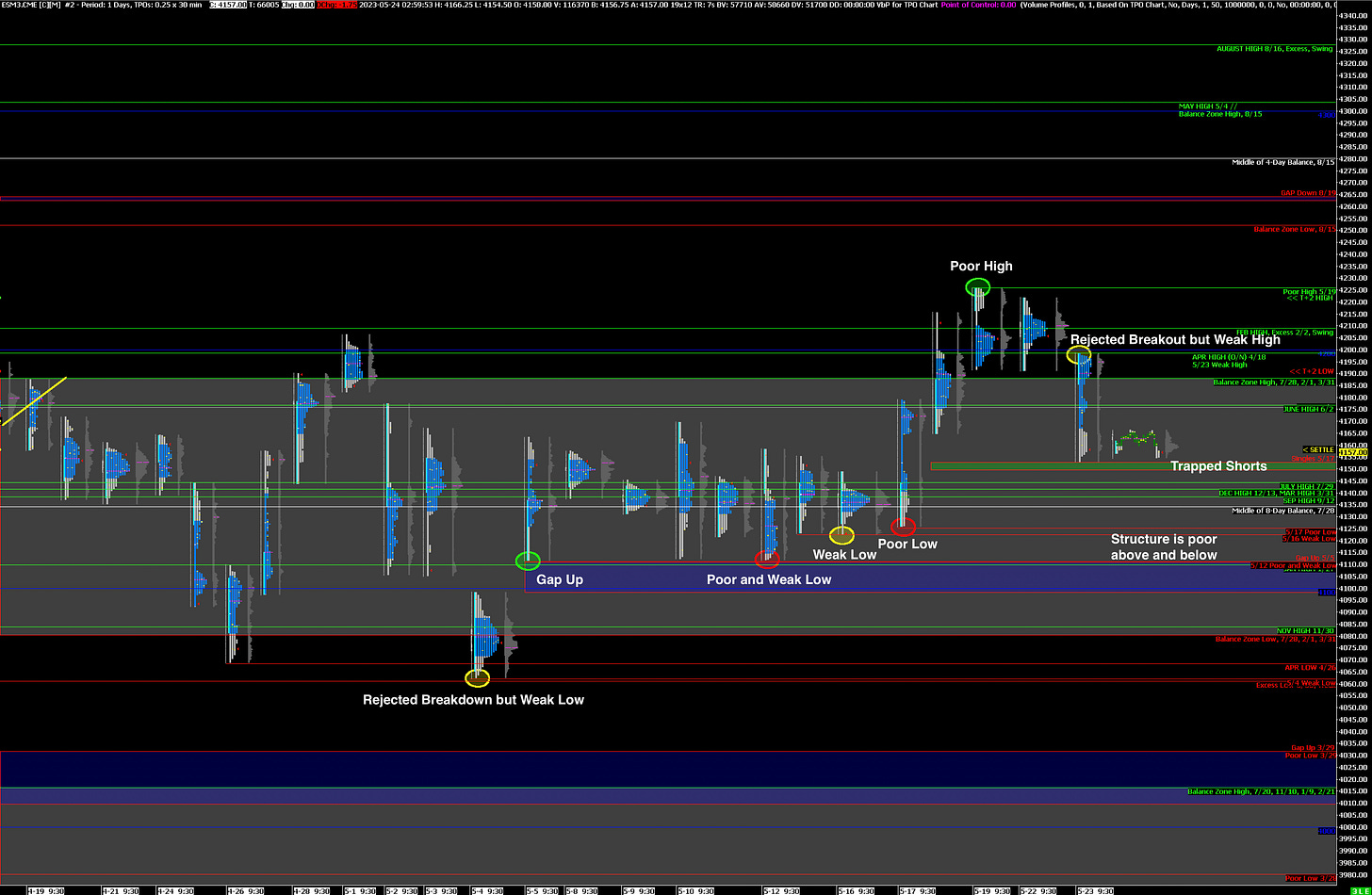

Bearish after rejected breakout

GDR Model Insights for the S&P 500

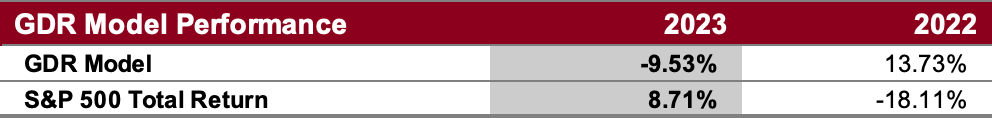

GDR Model Performance

This year has been challenging for the GDR Model’s style due to low confidence in the market.

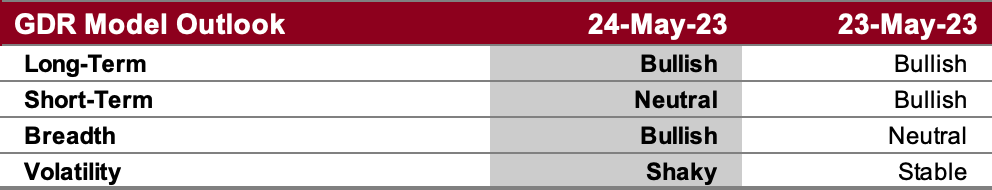

GDR Model Outlook

The overall GDR Model is mostly bullish. This could signal potential for a new uptrend, but it’s still not strong enough to confirm.

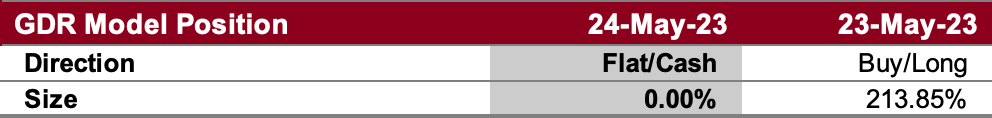

GDR Model Position

The GDR Model is back to cash. Since the recent update, it’s now more defensive, opting to close positions when it detects weakness rather than holding onto them for longer. In other words, it’s a more nimble model now.

S&P 500 Futures Market Profile Analysis

Near-Term Outlook: revisit of balance zone low after rejected breakout

Alternate Outlook: consolidation, balanced trade

Key Levels

Bullish: 4188 (Top of Lower Balance Zone), 4198 (Weak High, April High), 4226 (Poor High)

Bearish: 4149 (Closes Double Distribution), 4126-4123 (Poor Low and Weak Low), 4098 (Closes Prev Gap Up)

Market Narrative

The market rejected the attempted breakout above the balance zone. This is near-term bearish and the target for a re-entry into balance is its opposite extreme, 4080 in this case. This is just an expectation; it may or may not come true.

A bullish day is relatively unlikely for Wednesday, however keep in mind that structure is now poor above and below. Morover, Treasury Secretary Yellen speaks in the morning and the minutes for the most recent FOMC meeting will be released in the afternoon, both of which can lead to increased volatility today.

Economic Calendar

10:05am - Treasury Secretary Yellen Speaks

12:10pm - FOMC Member Waller Speaks

2:00pm - FOMC Meeting Minutes

Earnings After the Close: NVDA 0.00%↑

Later This Week: PCE (Fri)