S&P 500 Daily Perspective for Fri 3 Jan 2025

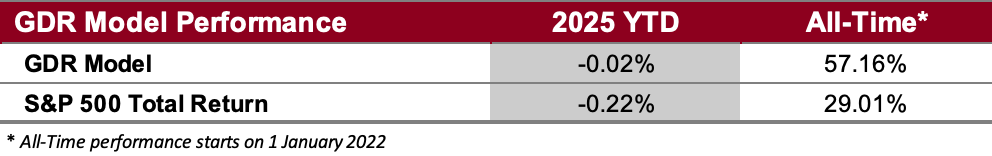

GDR Model Performance

Please see the Performance page for more detailed performance numbers, how they’re calculated and a chart.

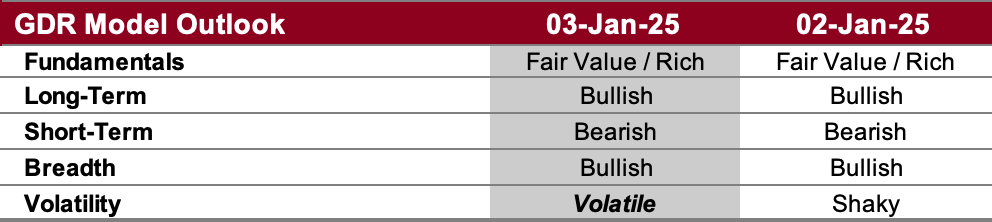

GDR Model Outlook

The GDR Model is neutral. Given the divergence between the Long-Term and Short-Term Outlooks, we may be at the start of a crossroads in markets.

Fundamentals Outlook (as of 17 Jun 2024): for the first time in a while the model showed stocks as being richly valued (i.e. overpriced). Note that this is just a barometer to help guide longer-term decision-making rather than short-term market timing.

Long-Term Outlook (as of 27 Dec 2024): the market weakened significantly through last week. If this persists the model may turn overall bearish, which would significantly increase the odds of a protracted sell-off.

Short-Term Outlook (as of 2 Jan 2025): for two days in a row, the Short-Term Outlook has tried to return to strength, but has failed halfway through the trading day. The fact that the market can’t seem to hold on to strength lately does not bode well.

Breadth Outlook (as of 2 Jan 2025): breadth is bullish, but unless the the market is strong in both the long and short-term timeframes, this doesn’t translate into higher odds of positive daily returns.

Volatility Outlook (as of 2 Jan 2025): the model’s volatility outlook is at its most volatile. Without an improvement here, the path is wide open for significant sell-offs, but this also means the occasional higher daily return due to short-covering rallies.

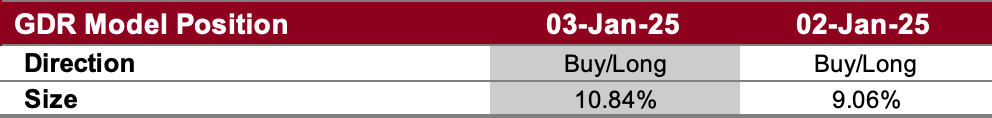

GDR Model Position

The GDR Model is effectively flat at this point. It’s not uncommon for the model to pare back risk as it waits for the market to definitively pick a (longer-term) direction to move in.