S&P 500 Daily Perspective for Thu 15 Jun 2023

Balance most likely after Fed reaction

GDR Model Insights for the S&P 500

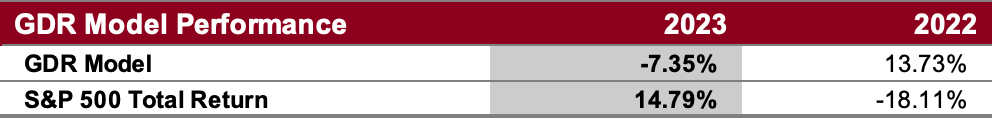

GDR Model Performance

This year has been challenging for the GDR Model’s style due to low confidence in the market.

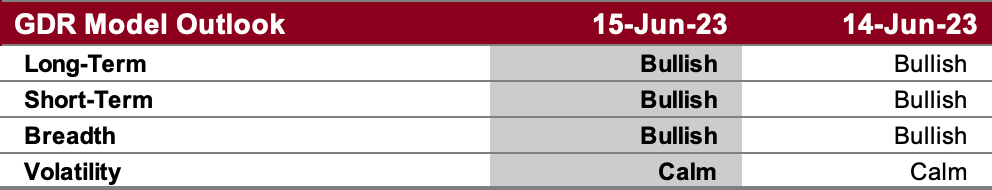

GDR Model Outlook

The GDR Model is now bullish following the recent breakout from consolidation.

GDR Model Position

The GDR Model is currently holding a long position on the market’s strength.

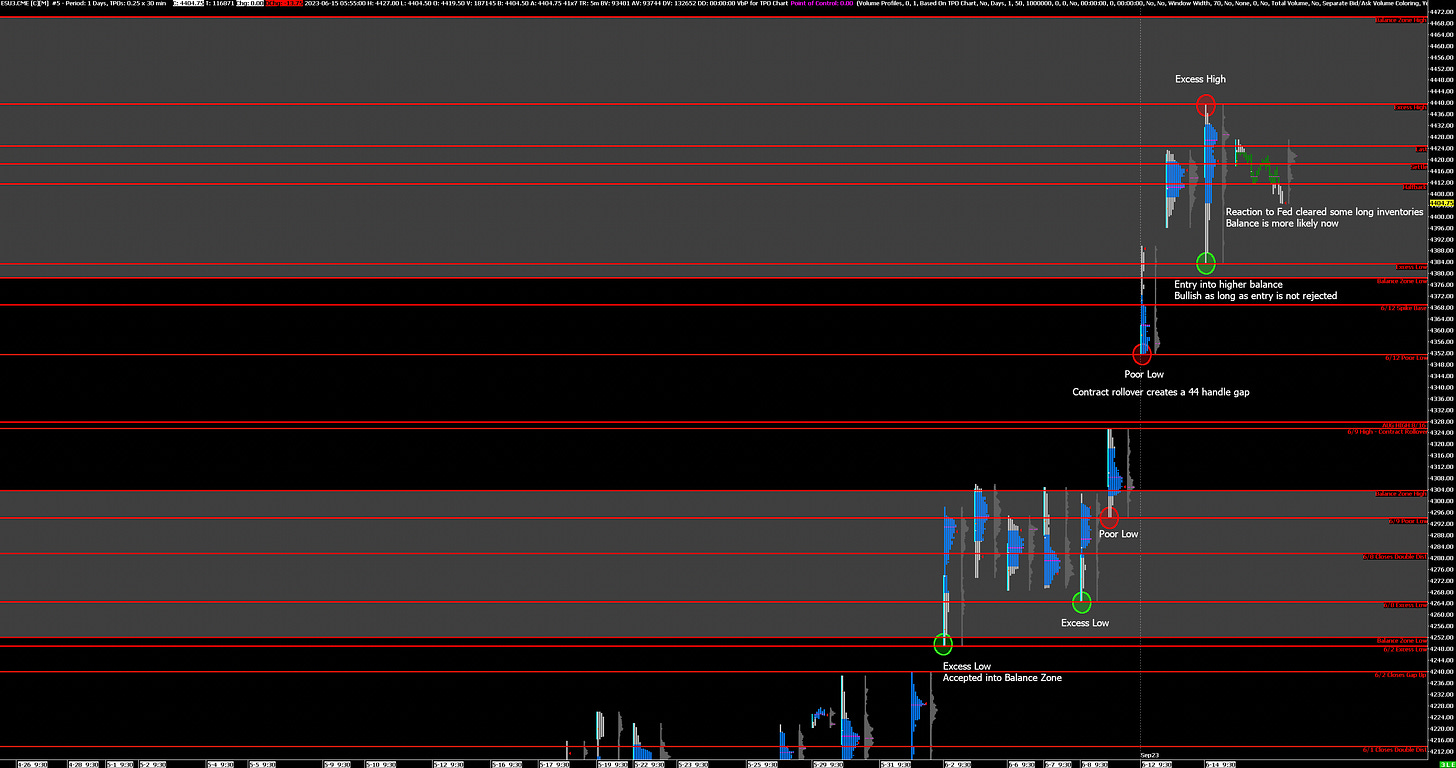

S&P 500 Futures Market Profile Analysis

Near-Term Outlook: balance

Alternate Outlook: test of balance zone edge, tilt bullish but could be either side

Key Levels

Bullish: 4440 (Prev High), 4470 (Top of Current Balance Zone), 4588 (April 2022 High)

Bearish: 4378 (Bottom of Current Balance Zone), 4369 (Spike Base), 4352 (6/12 Poor Low)

Market Narrative

Yesterday the market used the reaction to the Fed’s interest rate announcement to rebalance some overly long inventories before recovering during the press conference. As a result the more likely scenario is that the market enters into a balancing period before making another directional move. You can apply balance trading guidelines today with edges at yesterday’s high and low.

If the market does not balance today then more upside is more likely, but a re-test of the current balance zone low should not be ruled out.

Economic Calendar

8:30am - Retail Sales, Initial Jobless Claims, Philly Fed Manufacturing Index

9:15am - Industrial Production

10:00am - Business Inventories

Tomorrow: Quadruple Witching (quarterly futures and monthly options expiration)