S&P 500 Daily Perspective for Tue 7 Jan 2025

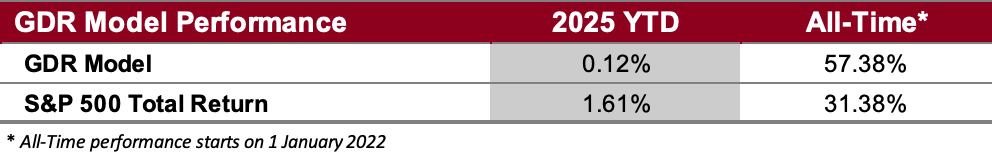

GDR Model Performance

Please see the Performance page for more detailed performance numbers, how they’re calculated and a chart.

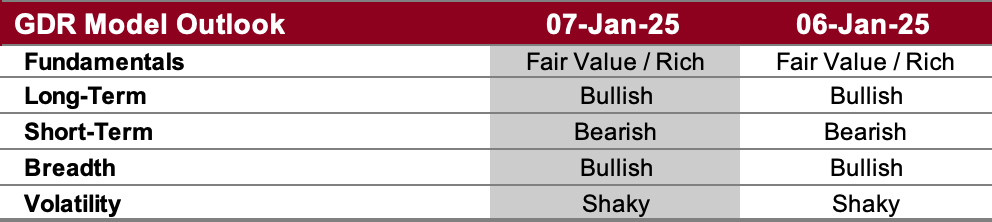

GDR Model Outlook

The GDR Model is neutral, however odds of a new leg up have increased.

Fundamentals Outlook (as of 17 Jun 2024): for the first time in a while the model showed stocks as being richly valued (i.e. overpriced). Note that this is just a barometer to help guide longer-term decision-making rather than short-term market timing.

Long-Term Outlook (as of 3 Jan 2025): the market found strength again last week. The probability of a significant long-term sell-off has materially decreased.

Short-Term Outlook (as of 6 Jan 2025): the market has resumed its ways of starting the day with strength but proving unable to hold onto it through the end of the day. There is a lot of indecision at this point.

Breadth Outlook (as of 6 Jan 2025): breadth is bullish, but without bullish Long and Short-Term Outlooks this provides no edge whatsoever.

Volatility Outlook (as of 6 Jan 2025): the Volatility Outlook was on track to show improvement at the start of the day, however it also deteriorated in the afternoon. No change for now.

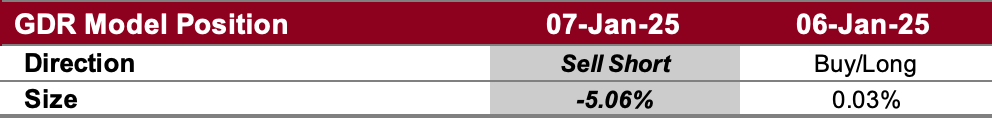

GDR Model Position

The GDR Model is effectively flat at this point as the market continues to show indecision on direction.