S&P 500 Daily Perspective for Mon 12 Jun 2023

One-day balance, slight bullish edge

GDR Model Insights for the S&P 500

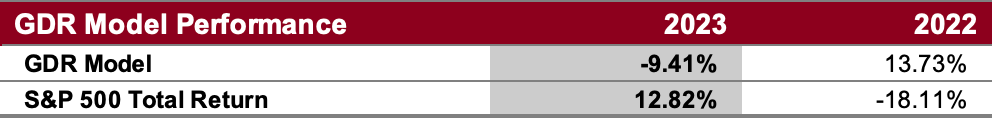

GDR Model Performance

This year has been challenging for the GDR Model’s style due to low confidence in the market.

GDR Model Outlook

The GDR Model is now bullish following the recent breakout from consolidation.

GDR Model Position

The GDR Model is currently holding a long position on the market’s strength.

S&P 500 Futures Market Profile Analysis

Near-Term Outlook: one-day balance, bullish edge

Alternate Outlook: N/A

Key Levels

Bullish: 4326 (Friday Poor High), 4328 (August 2022 High), 4378 (Bottom of Upper Balance Zone)

Bearish: 4294 (Poor Low), 4282 (Closes 6/9 Double Distribution), 4252 (Bottom of Lower/Current Balance Zone)

Market Narrative

Last Friday the market attempted another breakout from its balance zone and to a certain extent it succeeded. However, this can easily be reversed this week, especially with the Fed’s interest rate decision coming up on Wednesday. You can regard Friday’s trading as a one-day balance with edges on the poor low and poor high. Balance trading guidelines can be applied. There is a slight bullish edge.

Potentially equally important, the ES futures contract rolled from June to September expiry this weekend. As such, price levels may be a bit out of whack for the next couple of weeks. As of the rollover, September futures were trading approximately 44 handles higher than the June contracts.

Economic Calendar

Today - none notable

Later this Week: CPI (Tue), Fed Interest Rate Decision (Wed), FOMC Press Conference (Wed)