S&P 500 Daily Perspective for Fri 11 Oct 2024

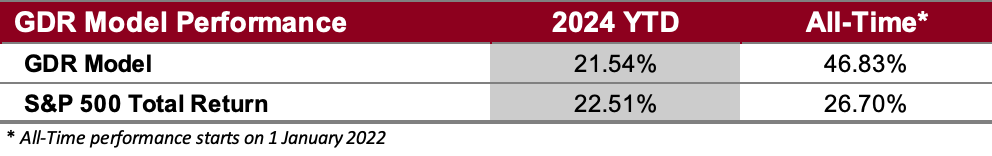

GDR Model Performance

Please see the Performance page for more detailed performance numbers, how they’re calculated and a chart.

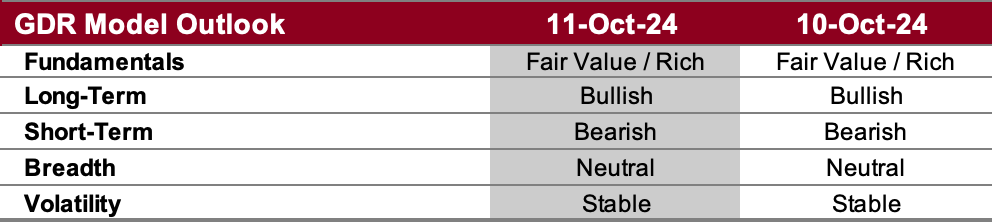

GDR Model Outlook

The GDR Model is bullish to neutral, and weakening. Despite this week’s rally, the model continues to peg the market as weak. Remember, this model is (mostly) price-blind and focuses almost exclusively on the market’s underlying strength or weakness.

Note on the Fundamentals Outlook (as of 17 June 2024):

for the first time in a while the model is showing stocks as being richly valued (i.e. overpriced). Note that this is just a barometer to help guide longer-term decision-making.

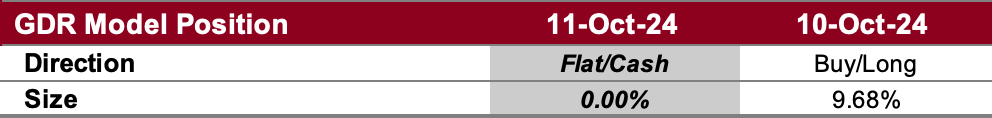

GDR Model Position

As mentioned above, the GDR Model is not priced based, and the last two days were a perfect example of that; in terms of price, this recent rally looks strong, however, the model deemed it to be weak mostly due to deteriorating breadth and breadth momentum. As such, the model is now flat.

There is still one more major data release tomorrow, so whether the market remains weak or strengthens can change in a flash.