S&P 500 Daily Perspective for Fri 17 Jan 2025

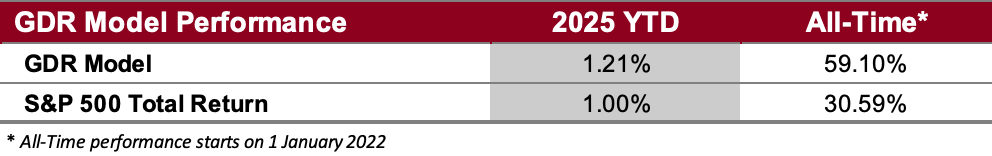

GDR Model Performance

Please see the Performance page for more detailed performance numbers, how they’re calculated and a chart.

GDR Model Outlook

The GDR Model is neutral. The recent indecision in the market seems to be dissipating and it looks to be leaning bullish at this point.

Fundamentals Outlook (as of 17 Jun 2024): for the first time in a while the model is showing stocks as being richly valued (i.e. overpriced). Note that this is just a barometer to help guide longer-term decision-making rather than short-term market timing.

Long-Term Outlook (as of 10 Jan 2025): after recovering a bit last week, the market closed weak again this week. The Long-Term Outlook has been downgraded to neutral and If this weakness is sustained, the odds of a significant sell-off will increase significantly.

Short-Term Outlook (as of 16 Jan 2025): the market has now shown strength for three days in a row on the short-term timeframe. This timeframe’s outlook is upgraded to bullish.

Breadth Outlook (as of 16 Jan 2025): breadth has been downgraded back to neutral. However, as mentioned yesterday, this portion of the model is the most prone to noise, so it’s easy to see it go back and forth between different ratings at times.

Volatility Outlook (as of 16 Jan 2025): the Volatility Outlook is within striking distance of an upgrade to Stable. If sustained, this could usher in a calmer market regime where price mostly goes up.

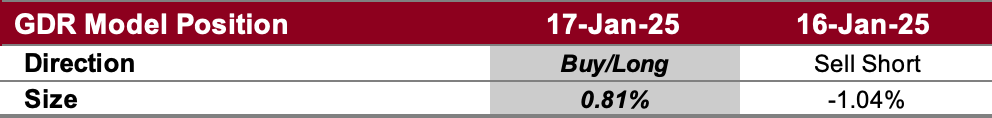

GDR Model Position

The GDR Model is essentially flat. However, it won’t be long before it opens a long position should the market continue to show consistent strength as it has over the past few days.