S&P 500 Daily Perspective for Fri 30 Jun 2023

Bullish with value building higher

GDR Model Insights for the S&P 500

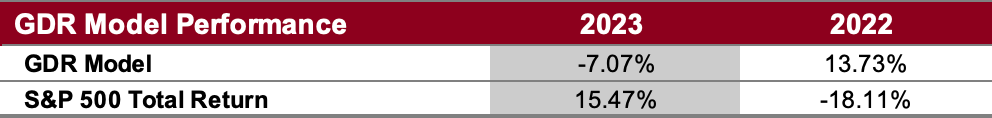

GDR Model Performance

This year has been challenging for the GDR Model’s style due to low confidence in the market.

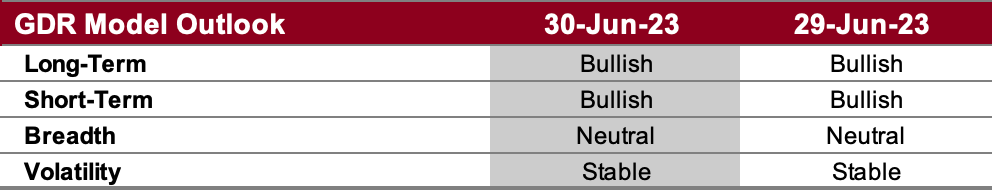

GDR Model Outlook

The GDR Model is now back to bullish following some recent stabilization.

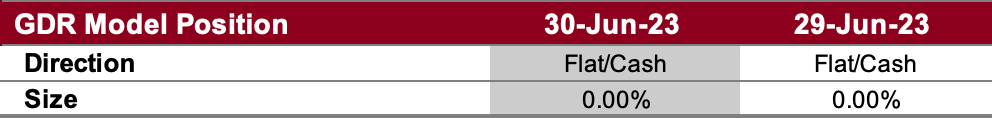

GDR Model Position

The GDR Model is in cash, but a re-entry into a long position is becoming more likely.

S&P 500 Futures Market Profile Analysis

Near-Term Outlook: bullish as value is building higher, top of balance zone target

Alternate Outlook: liquidation to repair poor structure below

Key Levels

Bullish: 4445 (6/20 Excess High), 4451 (Closes 6/20 Gap Down), 4470 (Top of Current Balance Zone)

Bearish: 4418 (PM Pullback Low), 4400 (Poor Low, Weak Low), 4378 (Bottom of Current Balance Zone)

Market Narrative

Yesterday was a trend day up with a distinct pullback low in the afternoon. More importantly, note that value is now back to building higher. The near-term outlook is bullish as long as the market stays above today’s pullback low (4418), despite the poor structure below.

Beware of the possibility for more challenging trading conditions tomorrow as it’s the last trading day for Q2 and next week there will only be three trading days due to Independence Day.

Economic Calendar

8:30am - PCE

9:45am - Chicago PMI

10:00am - Michigan Consumer Sentiment

Next Week: Independence Day - Early Close (Mon), Markets Closed (Tue), Nonfarm Payrolls (Fri)