S&P 500 Daily Perspective for Tue 18 Jul 2023

Short-term balance, could go either way

GDR Model Insights for the S&P 500

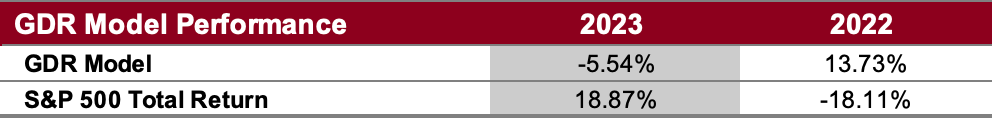

GDR Model Performance

This year has been challenging for the GDR Model’s style due to low confidence in the market.

GDR Model Outlook

The GDR Model is bullish.

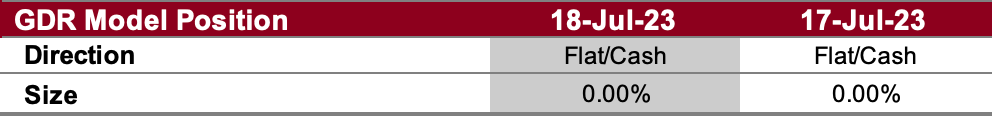

GDR Model Position

Even though the GDR Model remains bullish, it deteced more weakness than prices suggest towards the end of last week. In response, the model has pre-emptively closed its long position. If strength resumes, it would likely reopen the long position.

S&P 500 Futures Market Profile Analysis

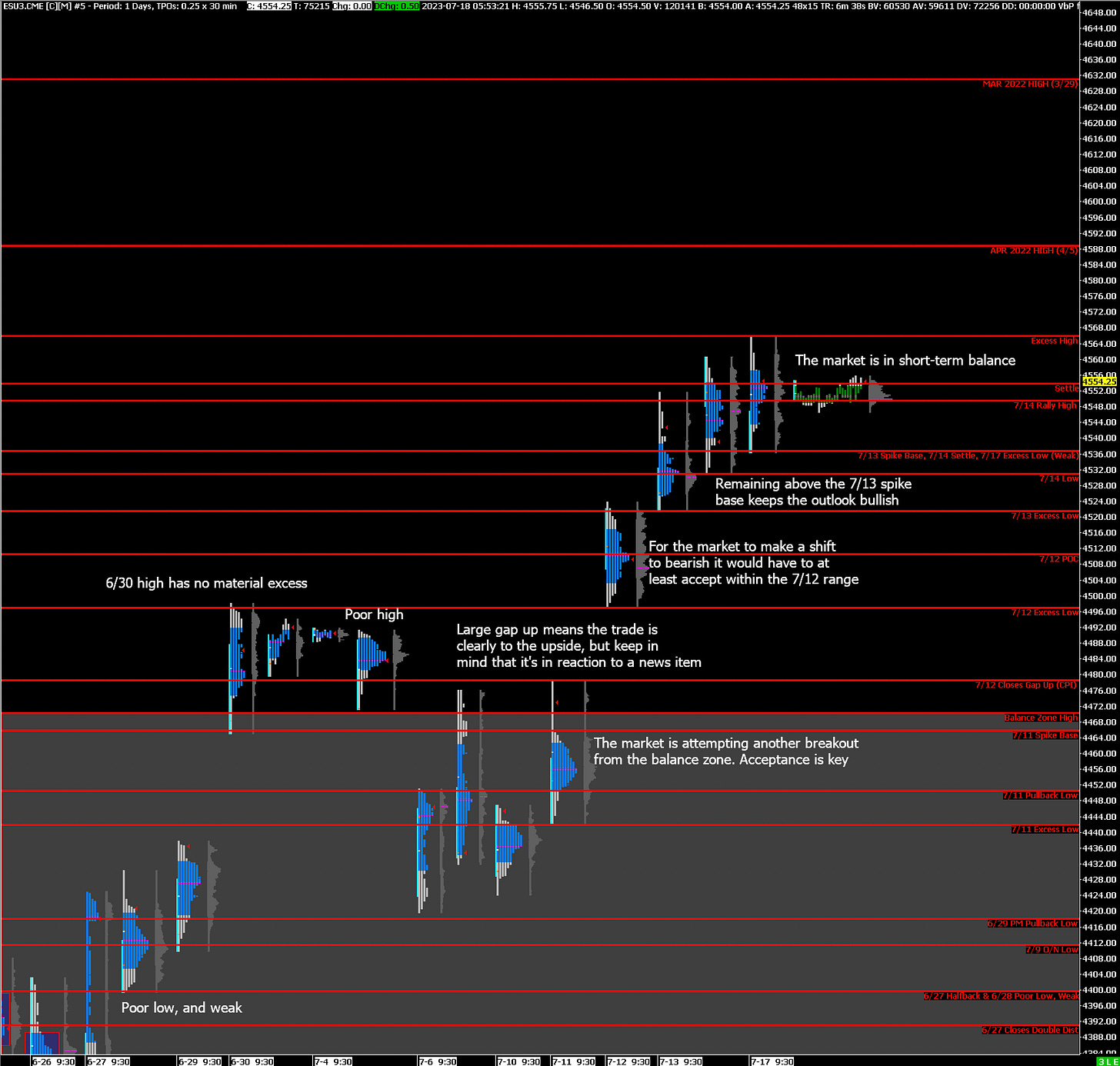

Near-Term Outlook: short-term balance, could go either way

Alternate Outlook: N/A

Key Levels

Bullish: 4550 (Rally High), 4566 (Excess High), 4589 (April 2022 High)

Bearish: 4531 (7/14 Low), 4522 (7/13 Excess Low), 4497 (7/12 Excess Low)

Market Narrative

Yesterday the market had a trend up day led almost entirely by weak-hands momentum traders as mechanical trading was prevalent. This is further corroborated by the liquidation observed in the last 30 minutes of trading. The market is now in short-term balance, with edges at yesterday’s Excess High and the 7/14 Low. Heading into today, it’s reasonable to apply balance trading guidelines. Do note that yesterday’s low is weak despite the excess.

Economic Calendar

8:30am - Retail Sales

9:15am - Industrial Production

10:00am - Business Inventories, FOMC Member Barr Speaks

Later this Week: TSLA 1.50%↑ earnings (Wed)