S&P 500 Daily Perspective for Wed 26 April 2023

Bearish after breakdown from 3-day Balance

GDR Model Insights for the S&P 500

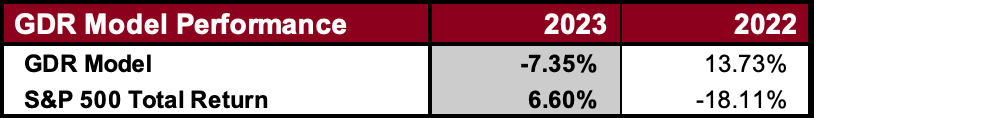

GDR Model Performance

This year has been challenging for the Model’s style due to low confidence in the market.

GDR Model Outlook

The overall Model is Neutral, but it picked up on some weakness towards the end of last week. Breadth is now back to Bearish while the increased potential for Volatility the model identified several days back seems to now be playing out.

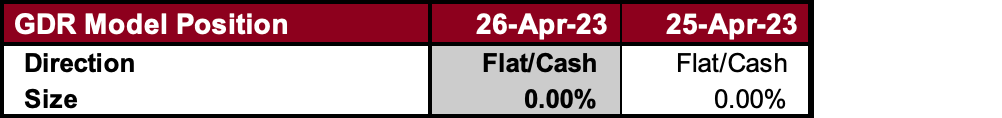

GDR Model Position

Despite the slight deterioration at the end of last week, the model is still not committing to a position as there is not enough conviction.

S&P 500 Futures Market Profile Analysis

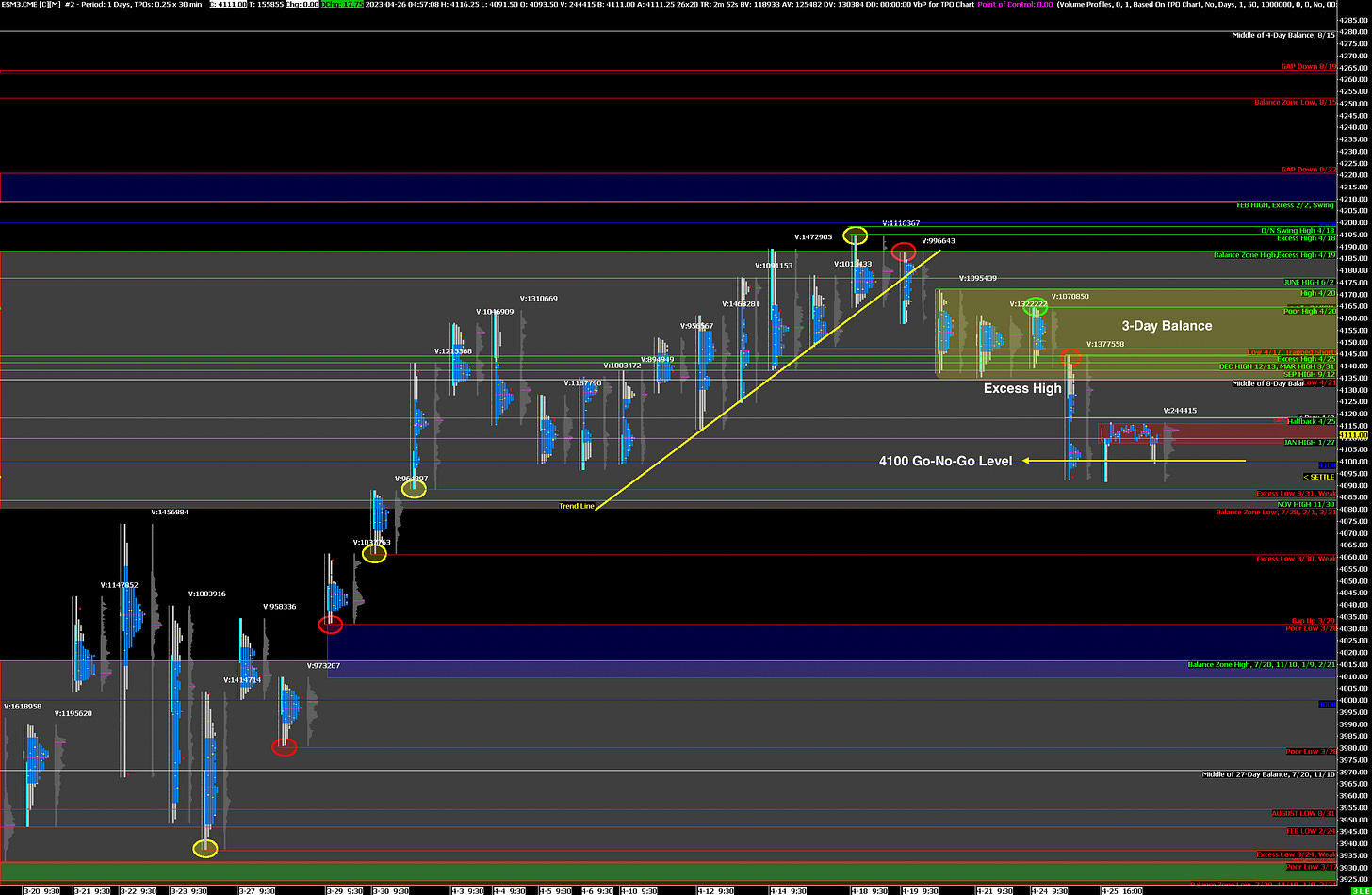

Near-Term Outlook: Break from 3-Day Balance, Bearish

Alternate Outlook: Rejection below Go-No-Go Level

Key Levels for Today

Bullish: 4118 (Y’day Halfback), 4136 (Short-Term Balance Low), 4172 (Short-Term Balance High)

Bearish: 4100 (Go-No-Go Level), 4080 (Bottom of Current Balance Zone), 4061 (Weak Low)

Market Narrative

Yesterday the market broke lower from a 3-Day Balance and traded all the way below 4100. It then recovered slightly higher after hours on the back of MSFT 0.00%↑ and GOOGL 0.00%↑ earnings. The logical downside target would be the Low of the greater Balance Zone at 4080, but the market currently finds itself at a Go-No-Go Level around 4100.

For the ES to avoid a bigger sell-off it needs to trade and accept at least above yesterday’s Halfback (4118). However, if it fails and then accepts below 4100, the chance for a panic sell-off materially increases as short-term Inventories have gotten too long between 4100 and 4200.

Economic Calendar

Today at 8:30am - Durable Goods Orders

Earnigs After the Close: META 0.00%↑

Later this Week: GDP (Thu), AMZN -0.14%↓ (Thu), PCE (Fri), XOM 0.00 (Fri)