S&P 500 Daily Perspective for Tue 11 Jul 2023

Lean bullish on likely gap up opening

GDR Model Insights for the S&P 500

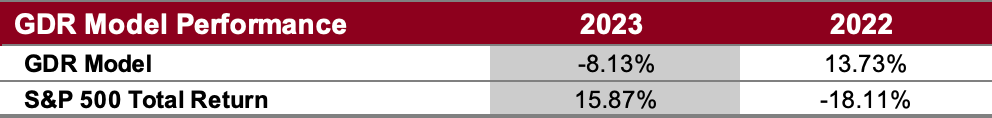

GDR Model Performance

This year has been challenging for the GDR Model’s style due to low confidence in the market.

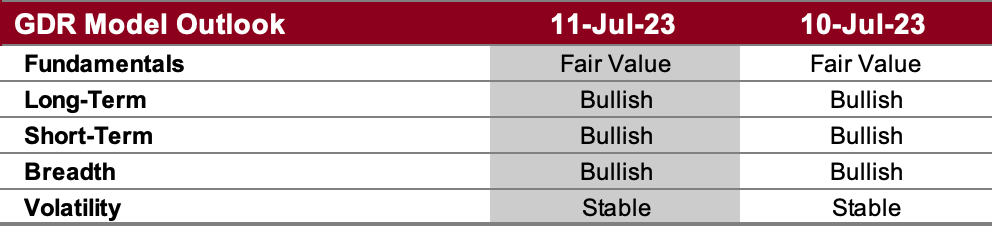

GDR Model Outlook

The GDR Model is bullish.

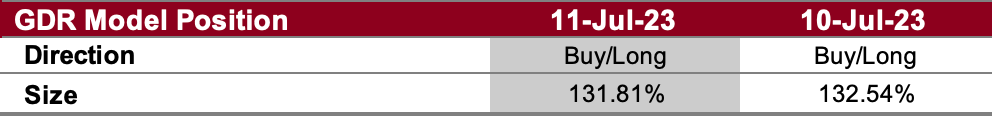

GDR Model Position

The GDR Model has re-opened its long position. However, position size is reduced compared to earlier in the year due to deteriorating fundamentals.

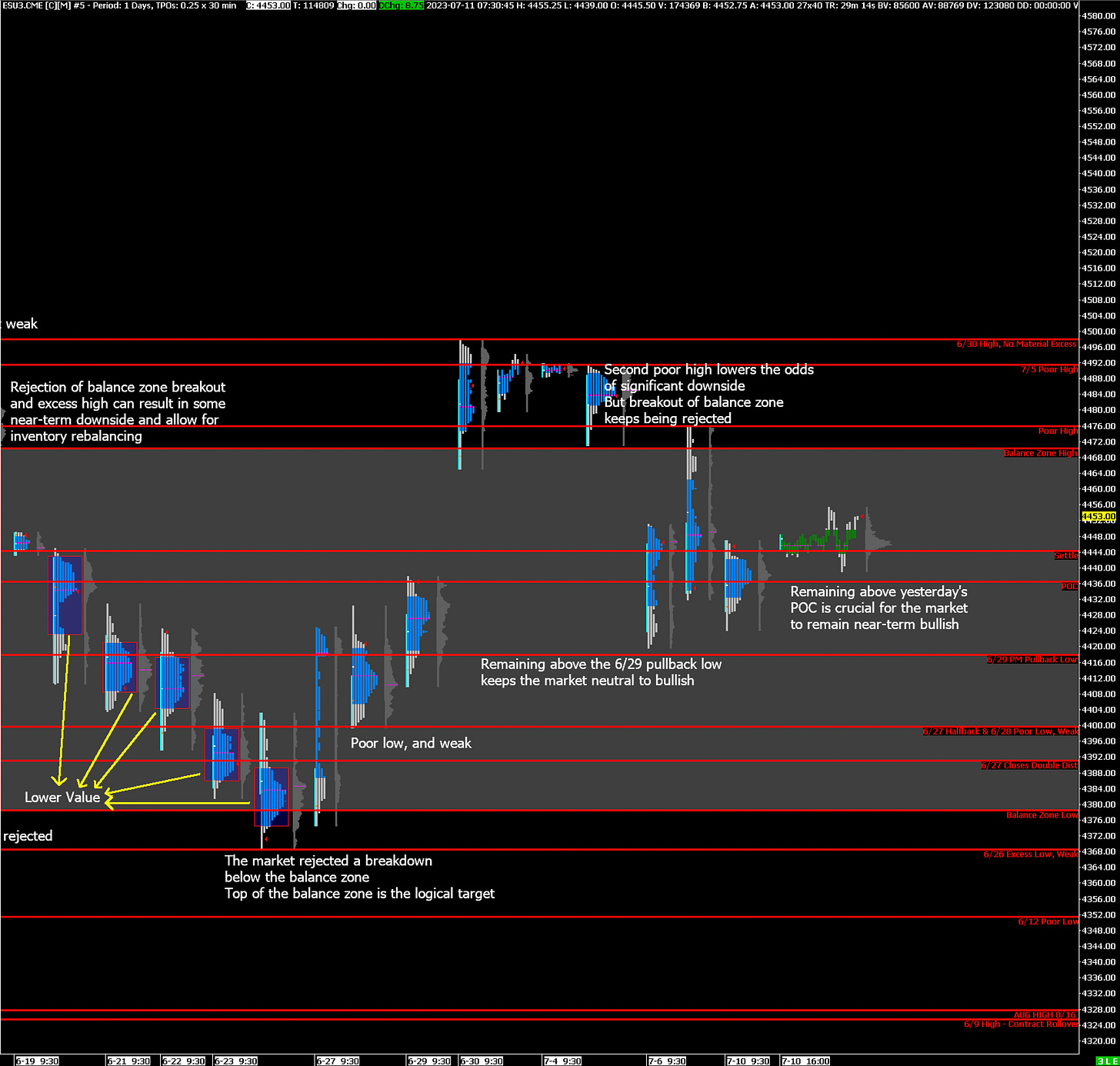

S&P 500 Futures Market Profile Analysis

Near-Term Outlook: lean bullish on potential gap up opening

Alternate Outlook: retest of balance zone low following third rejected breakdown

Key Levels

Bullish: 4470 (Top of Current Balance Zone), 4476 (Poor High), 4492 (7/5 Poor High)

Bearish: 4436 (POC), 4418 (6/29 Pullback Low), 4400 (Poor Low, Weak Low)

Market Narrative

Yesterday was a balanced trading day with rotation around a small 3-day balance. This morning, the market looks set to open on a gap up, which is bullish and thus gap trading guidelines apply. Closing the gap (if ultimately there is one) does not necessarily invalidate the bullish outlook. Rather trading and accepting below yesterday’s POC at around 4436 would likely make the market start to lean bearish.

Economic Calendar

Today - none notable

Later this Week: CPI (Wed), PPI (Thu)