S&P 500 Daily Perspective for Fri 21 April 2023

Short-Term Balance going into Monthly Options Expiration

GDR Model Insights for the S&P 500

GDR Model Performance

This year has been challenging for the Model’s style due to low confidence in the market.

GDR Model Outlook

The overall Model is Neutral. Breadth is more solidly in the Neutral camp now, but the Short-Term Outlook is starting to be challenged. Beware of the potential for increased Volatility today due to monthly options expiration.

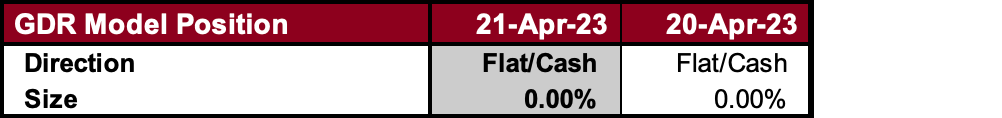

GDR Model Position

In line with the fragility of the current rally, the Model remains 100% in cash.

S&P 500 Futures Market Profile Analysis

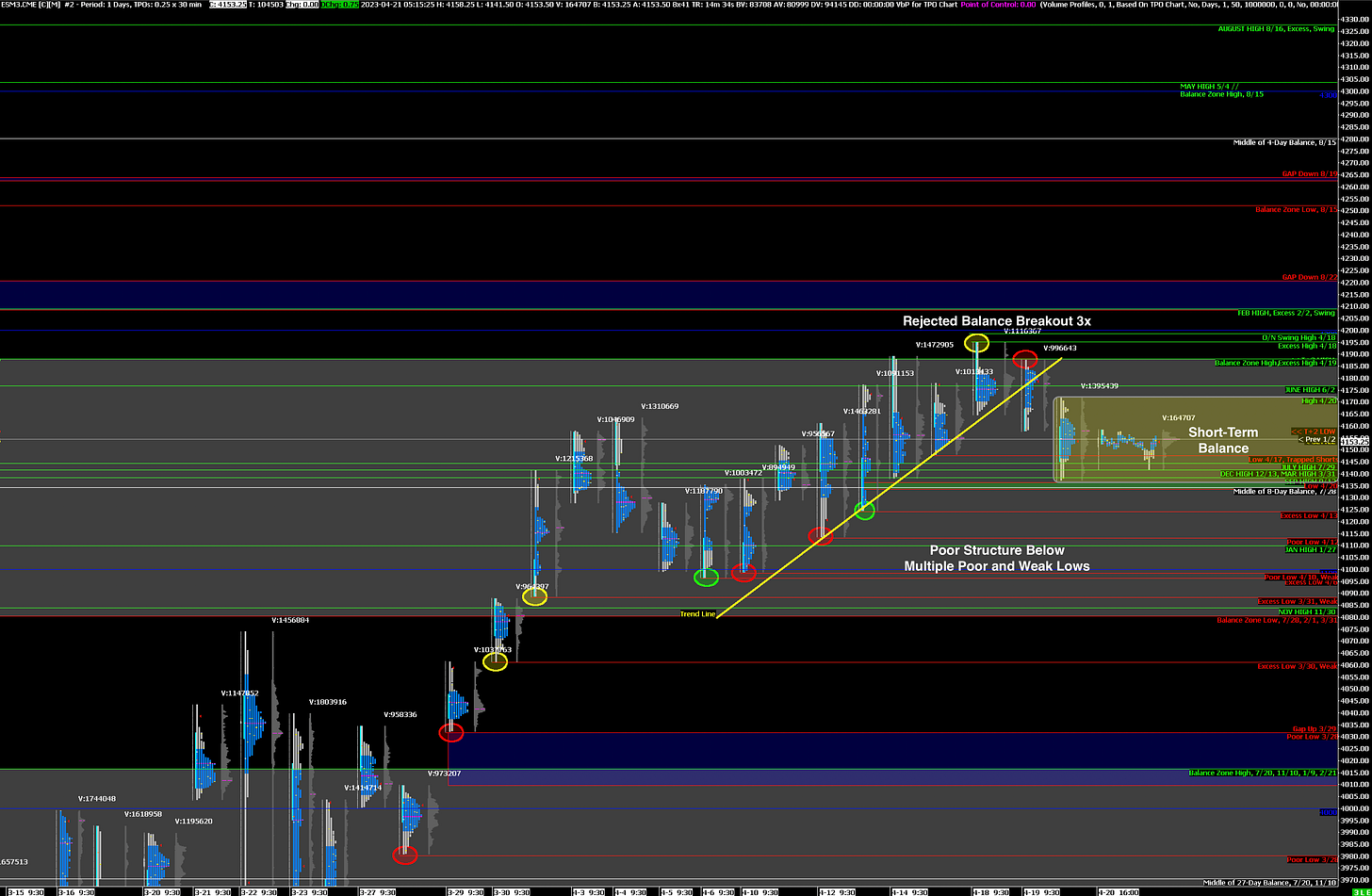

Near-Term Outlook: Short-Term Balance, could go either way

Alternate Outlook: N/A

Key Levels for Today

Bullish: 4172 (Y’day High), 4188 (Top of Current Balance Zone), 4221 (Closes Gap Down)

Market Narrative

Yesterday the market opened on a Gap Down that was quickly filled. However, in line with Gap Trading Guidelines, the market broke later in the day as Value did not manage to get up to unchanged. While the recent trend line is clearly broken, yesterday was a Balanced day. Assuming nothing changes materially until the RTH Open, I will approach the day as a short-term Balance using Balance Trading Guidelines. The edges are yesterday’s High (4172) and Low (4136).

Today is monthly options expiration (OpEx). Occasionally this can add additional Volatility to the market.

Economic Calendar

9:45am - Manufacturing PMI