GDR Model Weekly Update - Mon 31 Oct 2022

Friday was dominated by overly emotional trading ahead of month-end - what's coming up next?

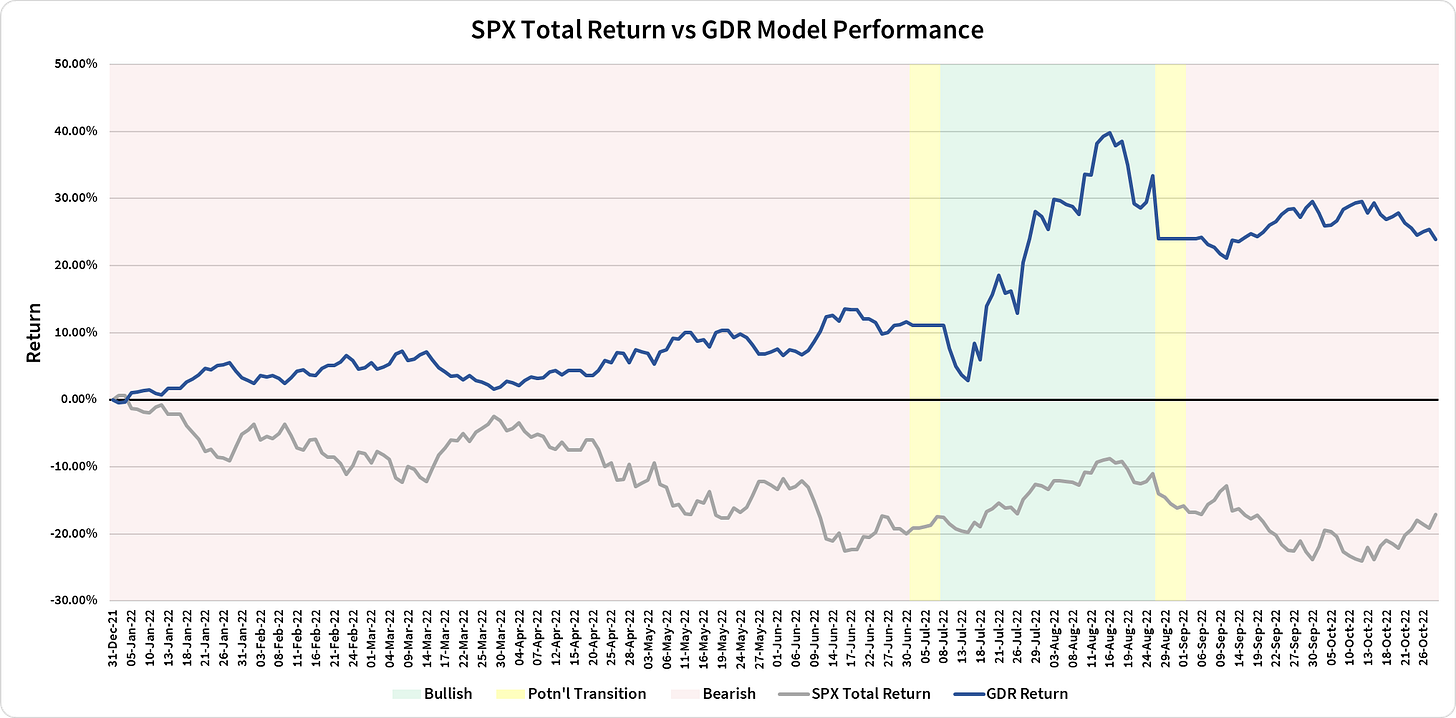

Review: 2022 Performance as of the close of 28 Oct 2022

GDR Model: +23.86%

S&P 500 Total Return: -17.09%

Information Ratio: 2.71

GDR Model Insights for the Week Ahead

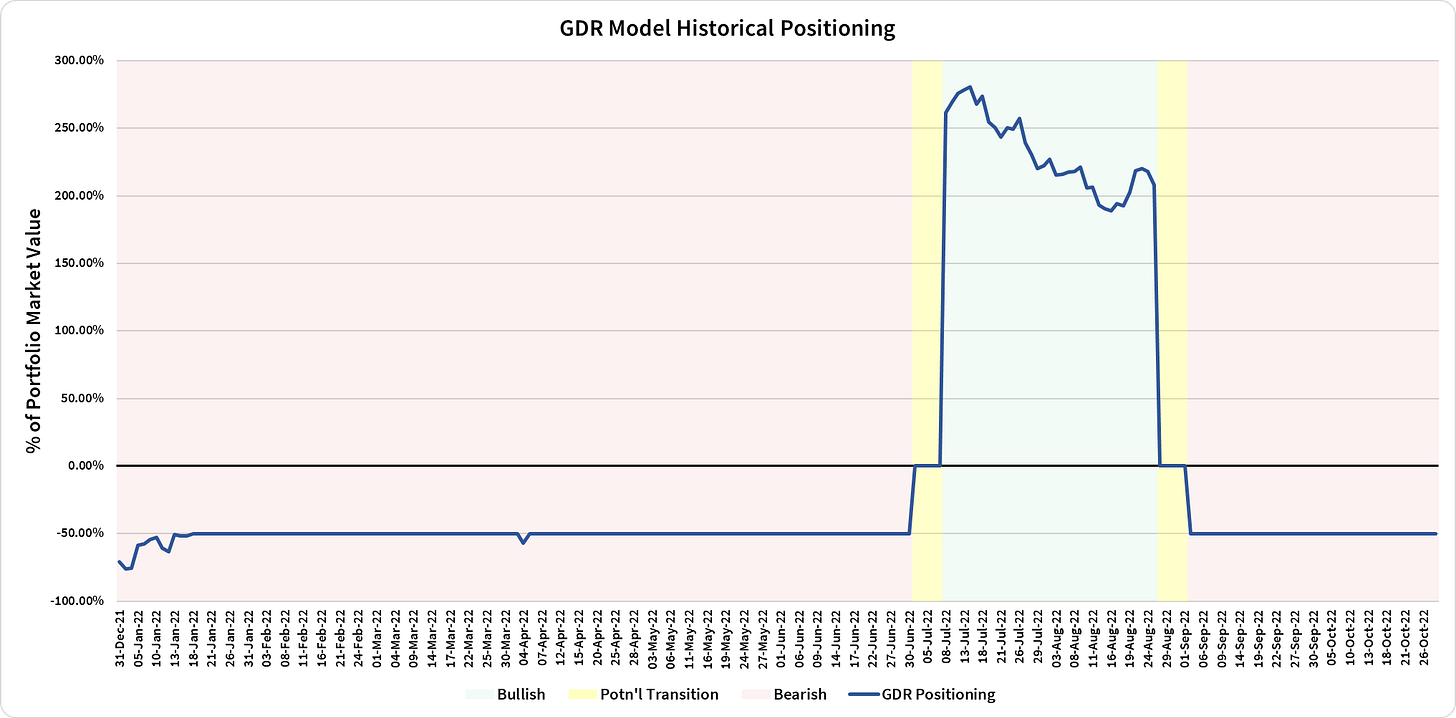

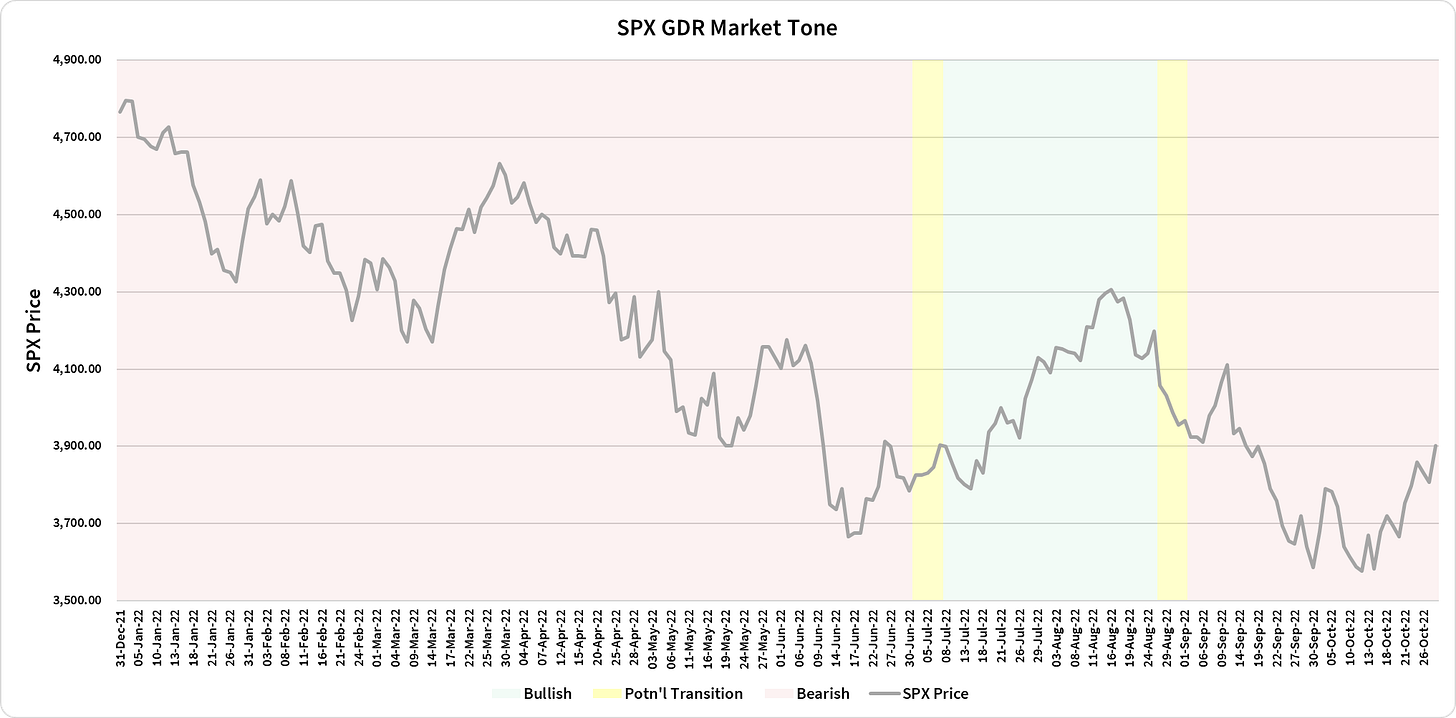

Market Tone: Bearish

Positioning: -50.00% Short (previous day: -50.00% Short)

Commentary: so far the GDR Model has not bought the rally from the lows that started 2 weeks ago. Typically this means that neither have the influential big money players. The coming week is critical - if the GDR’s Bearish Market Tone is to reassert itself, it will likely happen this week.

ES Market Structure Insights for Tomorrow

Ever since the 2022 low from 13 Oct, the market had put in decent structure while heading higher. However, Friday’s rally was predominantly overly emotional buying that is likely to have weakened the market. There are currently 5 trapped short positions holding up the ES and 4 of those were from Friday.

The logical next target before reaching some resistance is around the 3960 level, which coincides with the middle of a 7-Day Balance Zone from mid-July. This week requires extreme caution as the FOMC will announce its Fed Funds Rate decision on Wednesday at 2:00pm followed by the monthly Employment report on Friday at 8:30am.

Moreover, keep in mind that tomorrow is month-end - i.e. the last chance for active money managers to make returns on client monthly statements look as good as possible.

Potential Market-Moving Events Tomorrow

09:45am - Chicago PMI