GDR Model Weekly Insights for Tue 27 Dec 2022

Market Profile suggests near-term upside, but pay attention to follow-through

Review: 2022 Performance as of the close of 16 Dec 2022

GDR Model: +13.73%

S&P 500 Total Return: -18.02%

Information Ratio: 2.15

GDR Model Insights for the Week Ahead

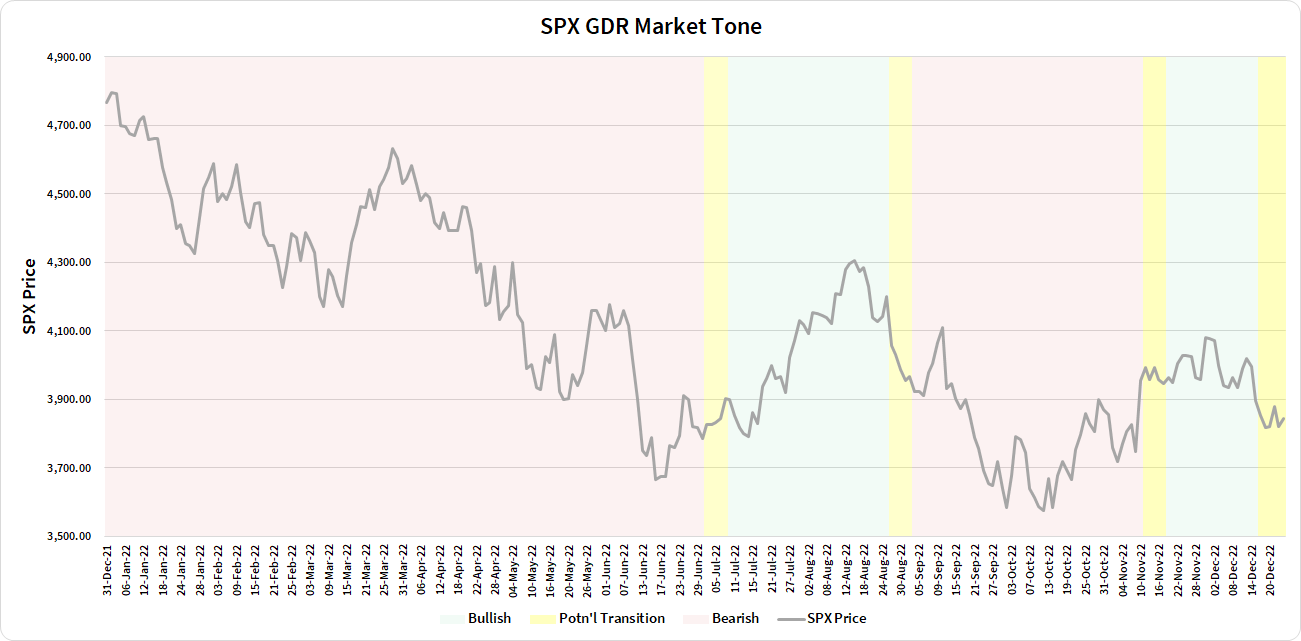

Market Tone: Transition (previous week: Potential Transition to Bearish)

Positioning: 0.00% Flat (previous day: 0.00% Flat)

Commentary: GDR is in Transition mode for the second week in a row. While this is rare, it’s definitely not unprecedented in the ~10 years or so of forward and backtesting this model has

S&P 500 Futures Market Profile Insights for Tomorrow

Near-Term Outlook: Bullish, careful of Balance High, Gap Rules

Friday’s market closed with a Poor High in need of Repair, following a second consecutive rejection of the current Balance Zone Low. Overnight trading so far suggests the ES will open on a Gap up. Seasonality also favors upside this week. This should all be treated as Bullish unless the market’s agenda proves to be otherwise. In other words, pay attention to follow-through regardless of whether you are Long or Short.

On a longer-term remark, I’m not entirely convinced that the ES is done selling off. The narrative seems to be shifting from inflation worries to economic slump concerns and while this year has been characterized by a lack of institutional participation, the times these big players have come into the market was to sell, not buy. Moreover, recent data from a Goldman Sachs report suggests that there is a widening gap between retail investors massively increasing their stock holdings while institutional investors continue to reduce equity exposure. The last time this type of divergence happened the market ended up having a ~20% sell-off in 3 months (Q4 2018).

Potential Market-Moving Events

Tuesday 08:30am - International Trade Balance, Retail Inventories

Tuesday 10:00am - S&P/Case-Shiller House Price Index

Later this Week: Pending Home Sales (Wed), Chicago PMI (Fri)