GDR Model Weekly Insights for Mon 12 Dec 2022

Reaction to this week's CPI and Fed Rate may send GDR back into Transition Mode

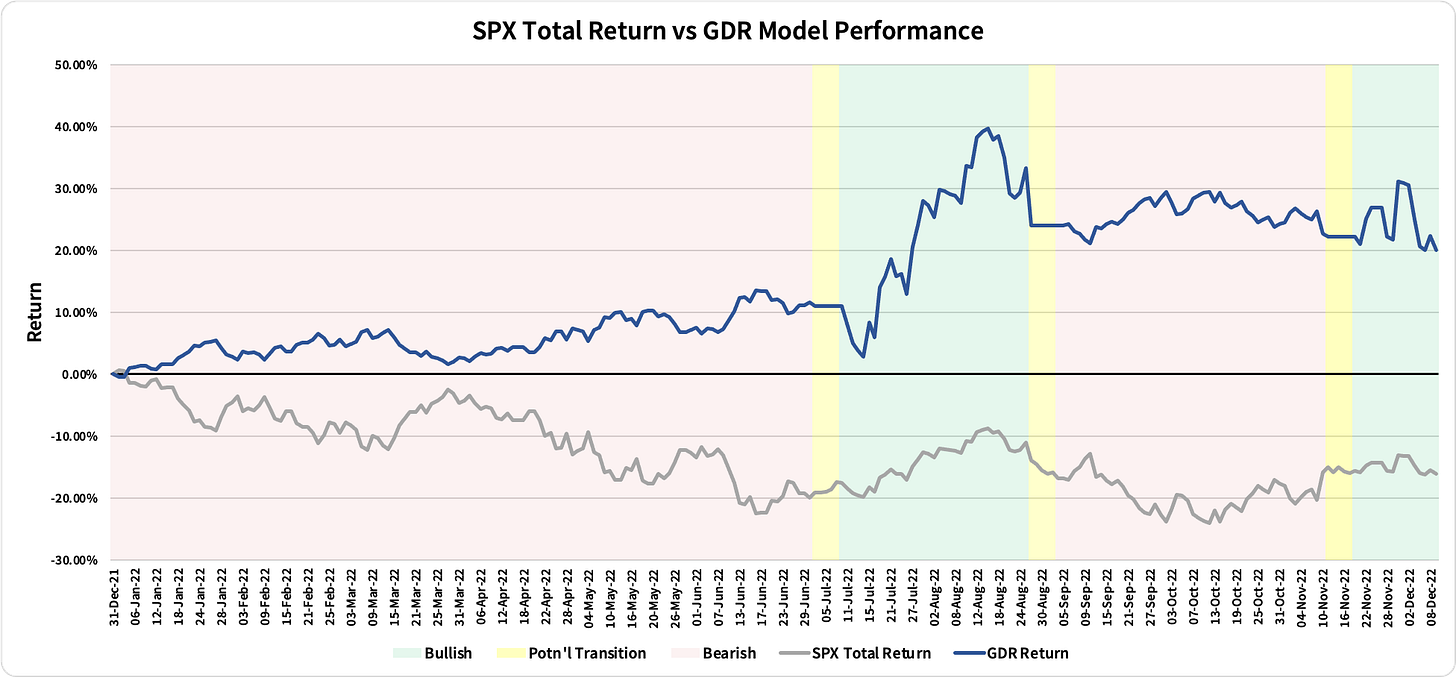

Review: 2022 Performance as of the close of 9 Dec 2022

GDR Model: +20.09%

S&P 500 Total Return: -16.17%

Information Ratio: 2.42

GDR Model Insights for the Week Ahead

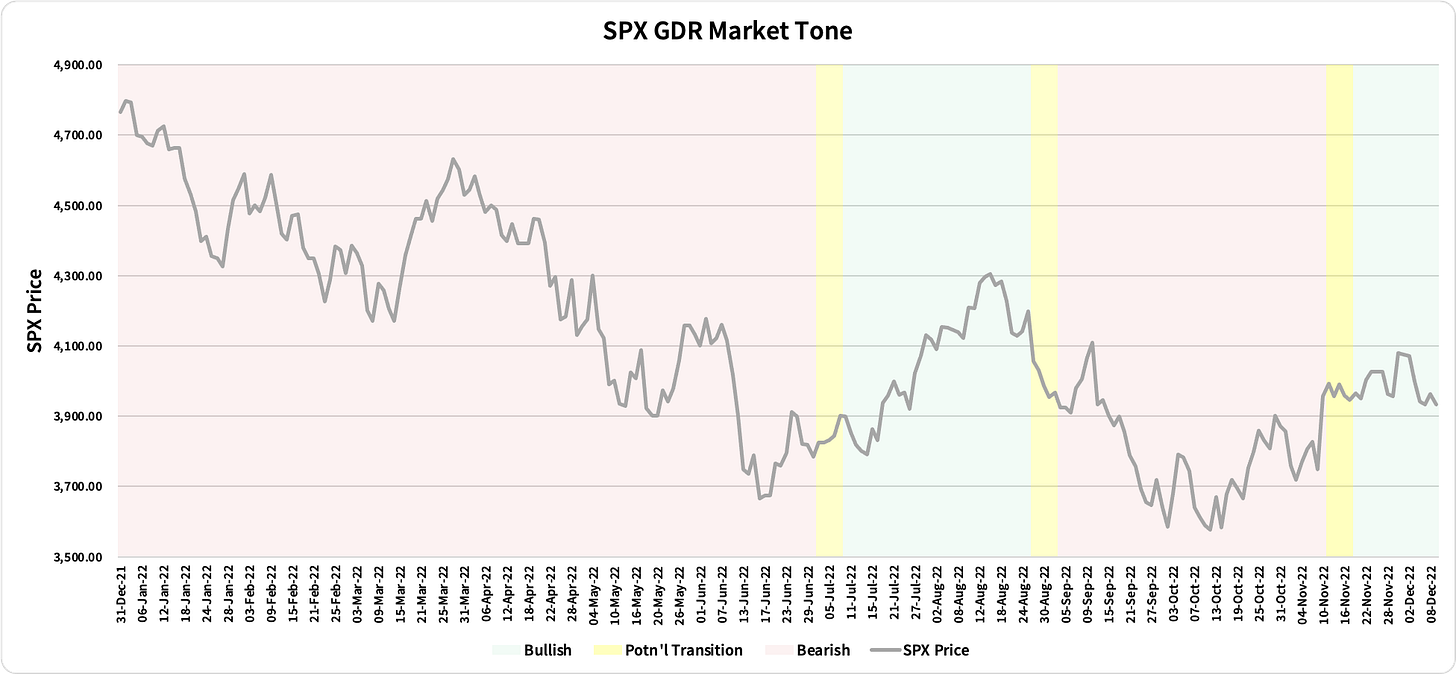

Market Tone: Bullish (previous week: Bullish)

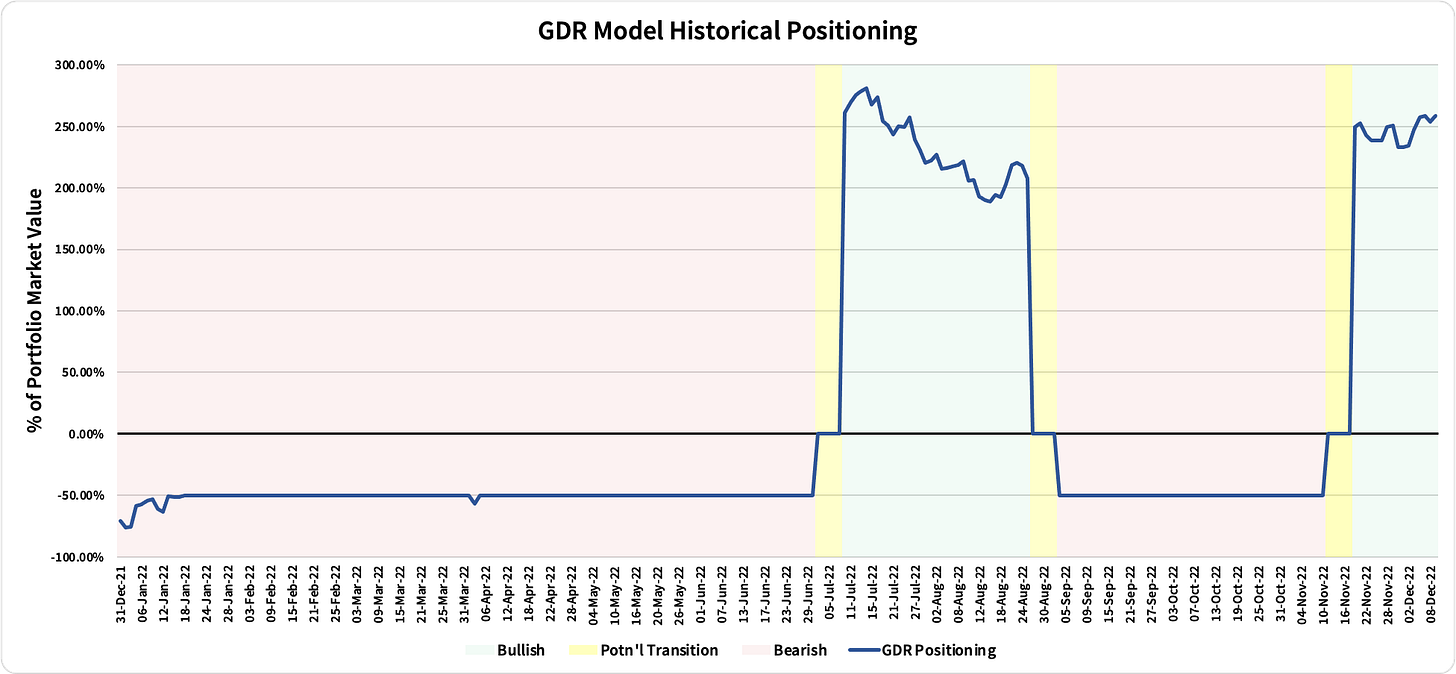

Positioning: +258.66% Long (previous day: +253.50% Long)

Commentary: GDR flagged some Bearishness at the end of last week. Reactions to CPI and FOMC this week will determine if the Bullish idea survives this latest test. Negative reactions to these data releases would likely send GDR back into Transition Mode by the end of the week.

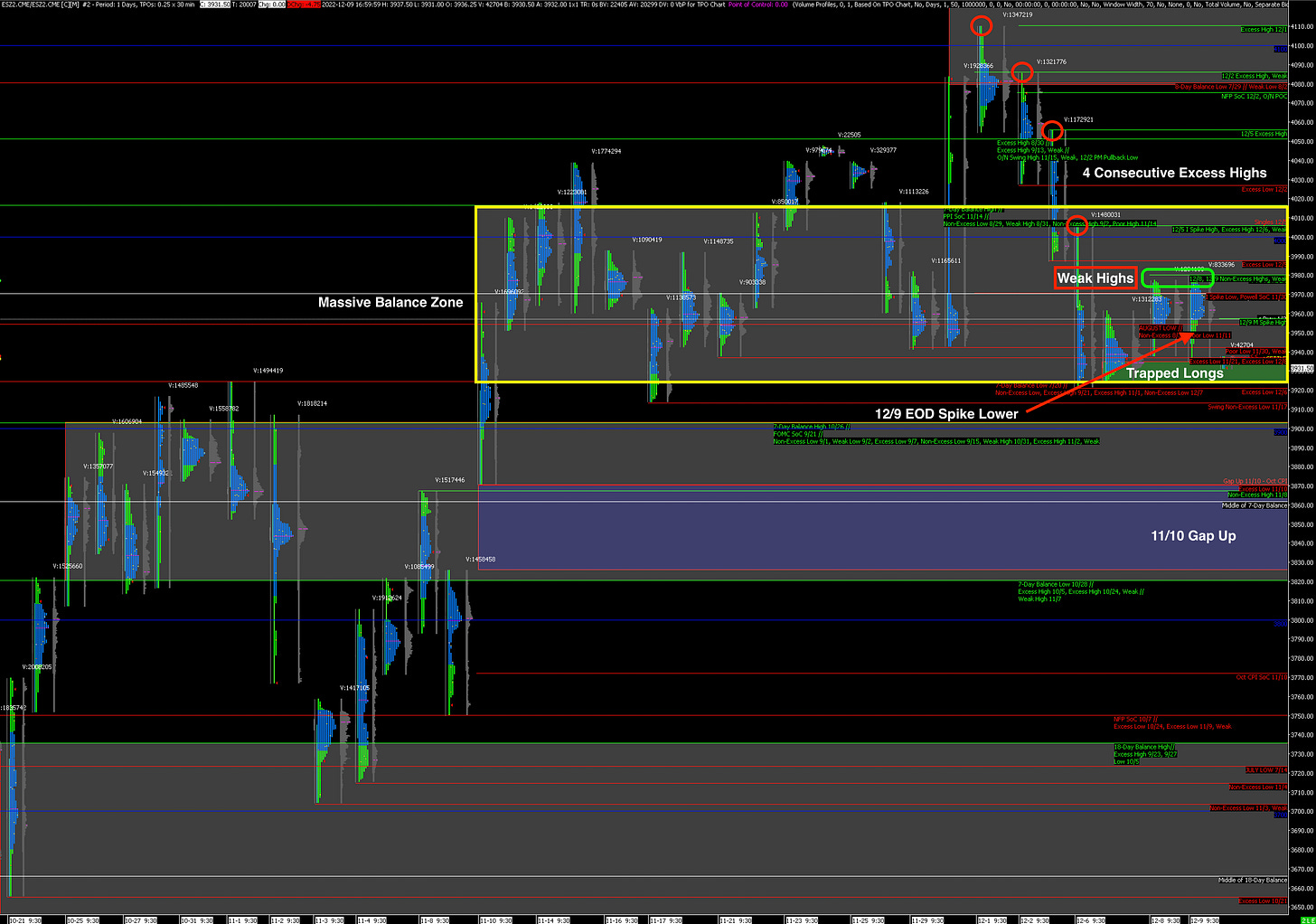

S&P 500 Futures Market Profile Insights for Tomorrow

The ES looks materially more Bearish after the end of last week. Friday’s spike lower at the end of the day was enough to convince me that the market’s near term agenda is most likely to at least clear out the Trapped Long Position below before having a chance at moving meaningfully higher. Breaking lower from the current Balance Zone has good odds of putting the 11/10 Gap Up back in play.

There are two key levels to keep in mind foe cues on where the market may be headed next:

Bullish: break and acceptance above the start of the Spike Lower at the end of Friday around 3958

Bearish: break and acceptance below the current Swing Low from 11/19 at around 3913

Consider that tomorrow has greater probability of being a narrow range, low volume day given that CPI comes out Tuesday morning, and Wednesday is a Fed day.

Potential Market-Moving Events

Monday - None

Later this Week: CPI (Tue), Fed Interest Rate Decision (Wed), FOMC Statement (Wed)