GDR Model Weekly Insights for Mon 27 Mar 2023

Low Volatility Rally on Friday was Most Likely Short-Covering. Can the Fed's Liquidity Injection Continue Driving Stocks Higher?

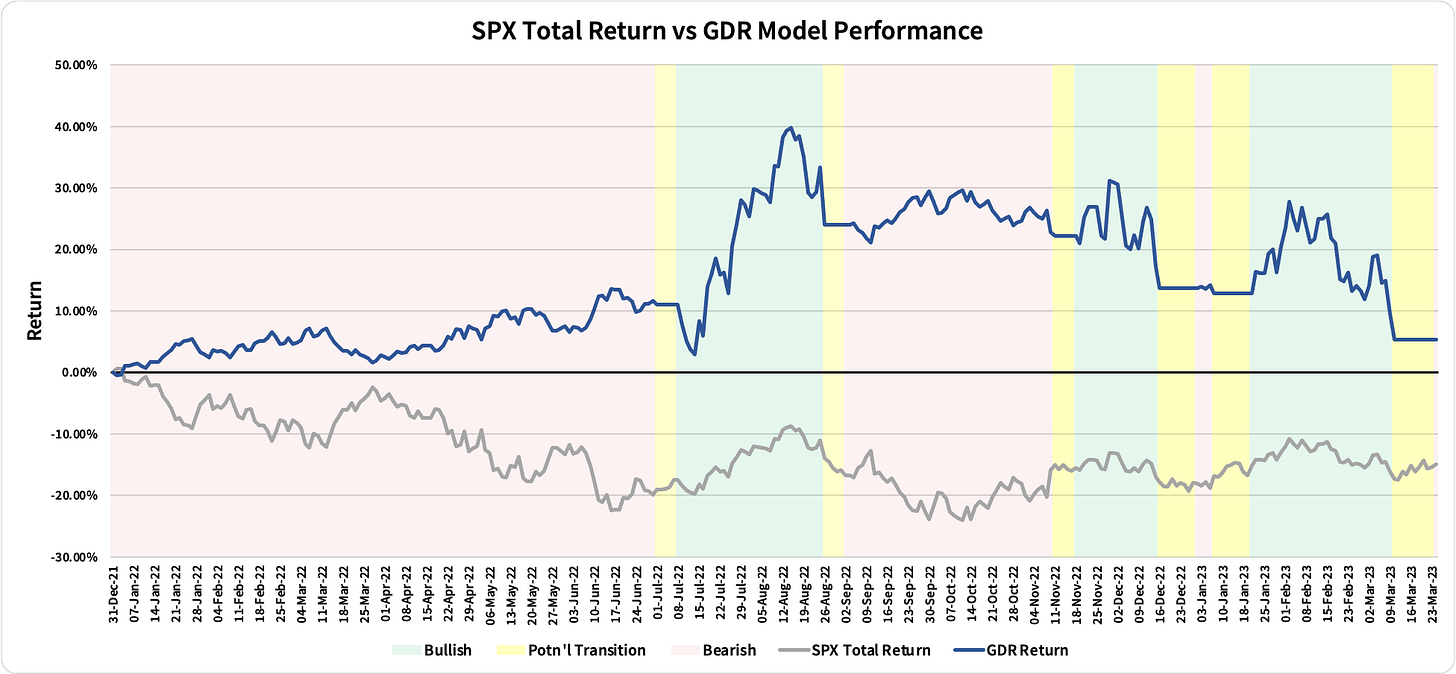

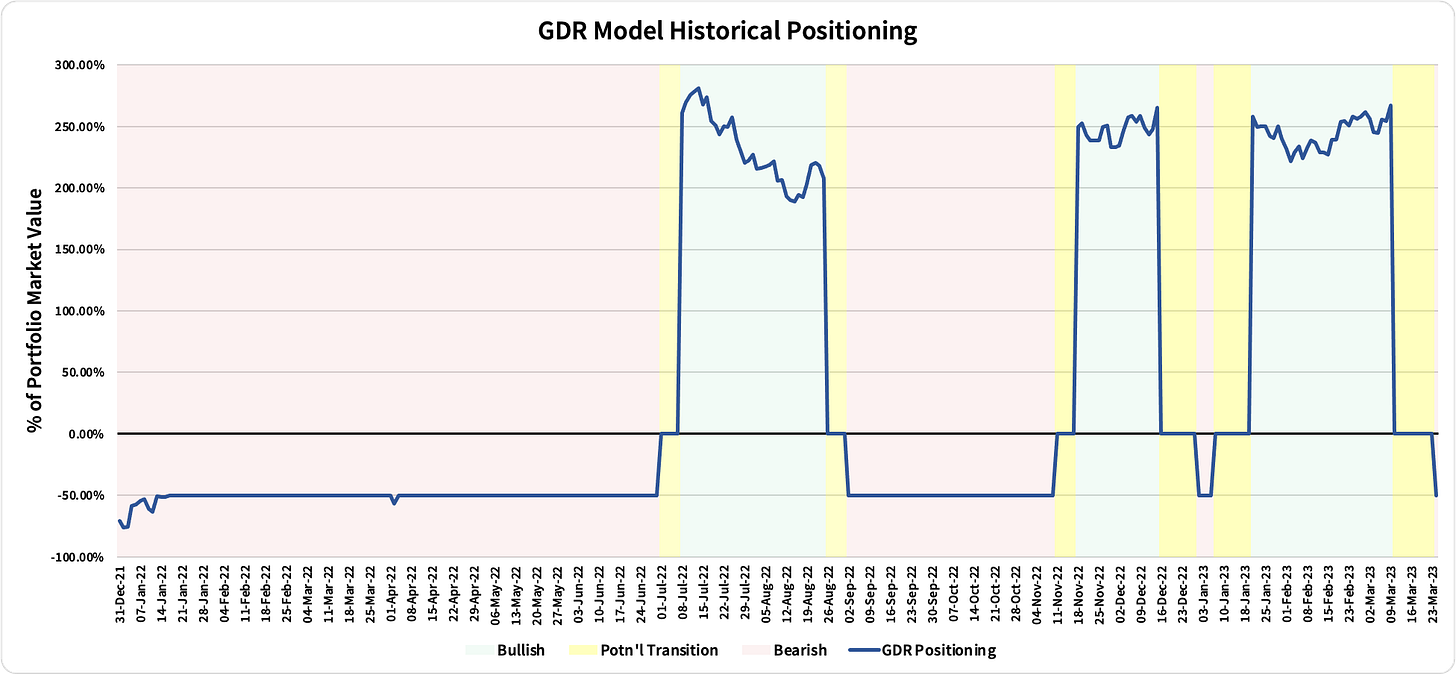

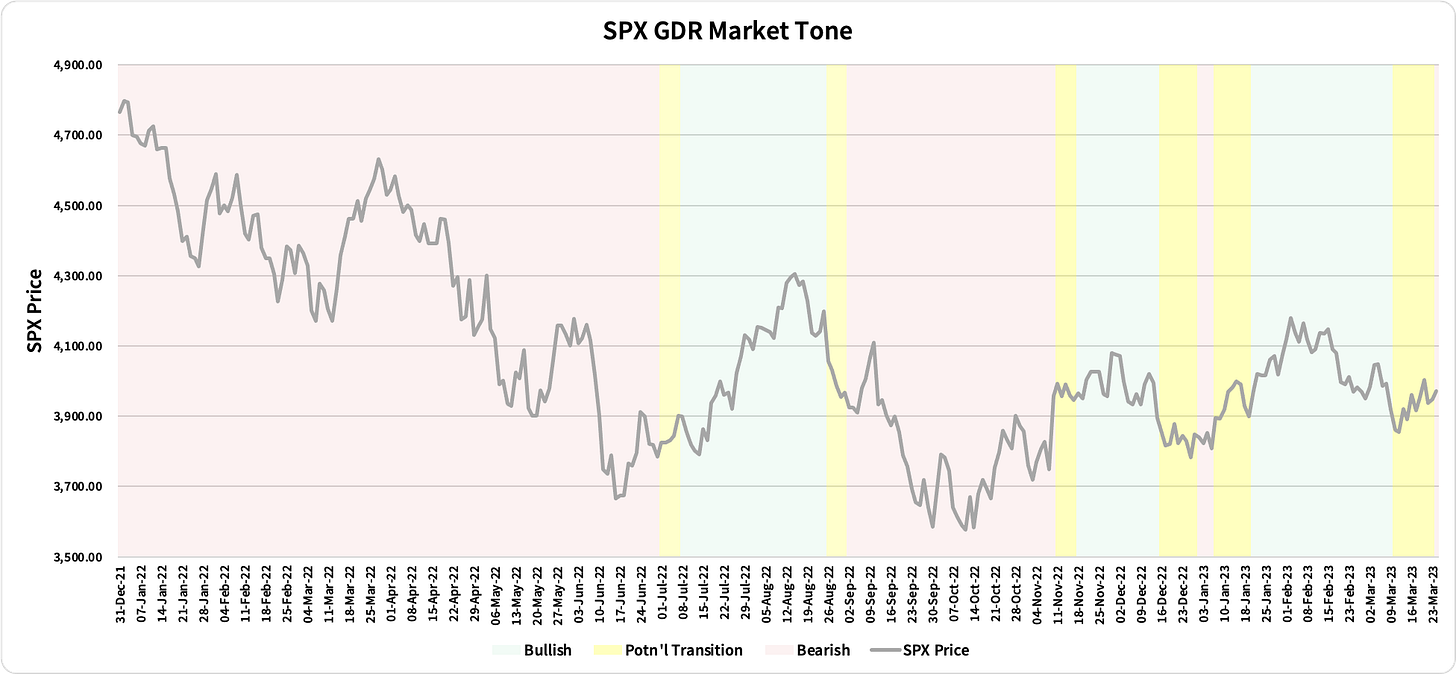

Review: Performance as of the close of 24 Mar 2023

GDR Model Insights for the Week Ahead

Commentary: despite the rally on Friday, GDR has not budged in its outlook and has entered into a short position to start this week.

S&P 500 Futures Market Profile Insights for Today

Near-Term Outlook: Market Rejects Top of Balance Zone

Counterpoint: Fresh Liquidity from Fed Continues Driving Market Higher

Key Levels for Today:

Bullish: 4016 (Current Balance Zone High), 4080 (Upper Balance Zone Low), 4098 (Closes Gap Down)

Bearish: 4003 (Prev High), 3937 (Prev Low, Weak), 3924 (Current Balance Zone Low / Trapped Short Position)

Last Friday was a steady trend day up with the market one-time framing higher from 11am onward. While the shape of the profile is generally Bullish, my take is that odds are it was mostly short-covering driving the market higher. The Low for the day, even though it has proper Excess, it is Weak because it matches the Overnight Low exactly - this suggests weak-hands momentum traders. In addition, Value did not follow price higher and there was no afternoon inventory adjustment or liquidation of long day trader positions. The only scenario I can think of where daytraders don’t liquidate long positions before market close, especially before a weekend, is when they were actually covering short positions and therefore there are no long positions to liquidate.

Regardless, we must still respect the fact that the Fed has injected $300 billion in liquidity and this can have a real impact in driving equity prices up. Focusing on Friday’s High (4003) and the Top of the Current Balance Zone (4016) today will be key.

Potential Market-Moving Events Today

Today - None

Later this Week: CB Consumer Confidence (Tue), GDP Q4 Revision (Thu), PCE (Fri)