GDR Model Weekly Insights for Mon 14 Nov 2022

GDR Model has shifted to Transition Mode, but beware of poor structure building up below

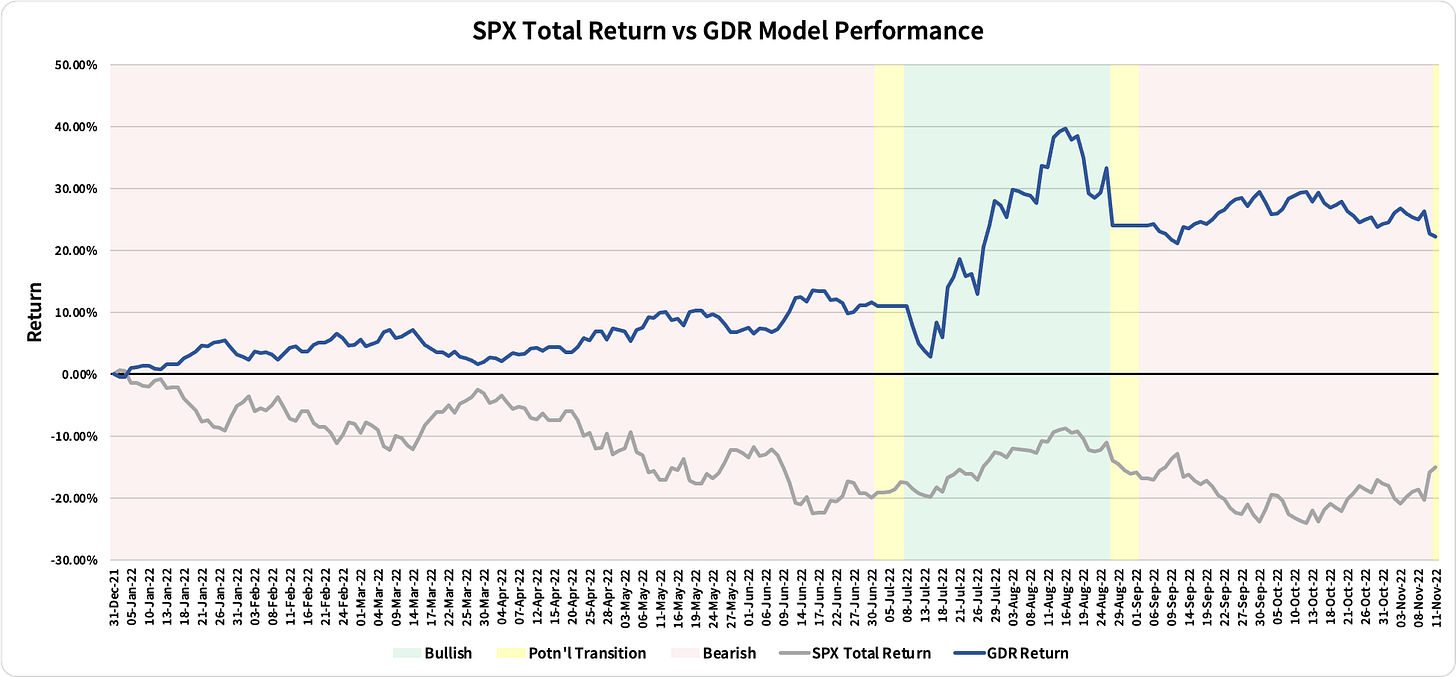

Review: 2022 Performance as of the close of 4 Nov 2022

GDR Model: +22.21%

S&P 500 Total Return: -15.08%

Information Ratio: 2.45

GDR Model Insights for the Week Ahead

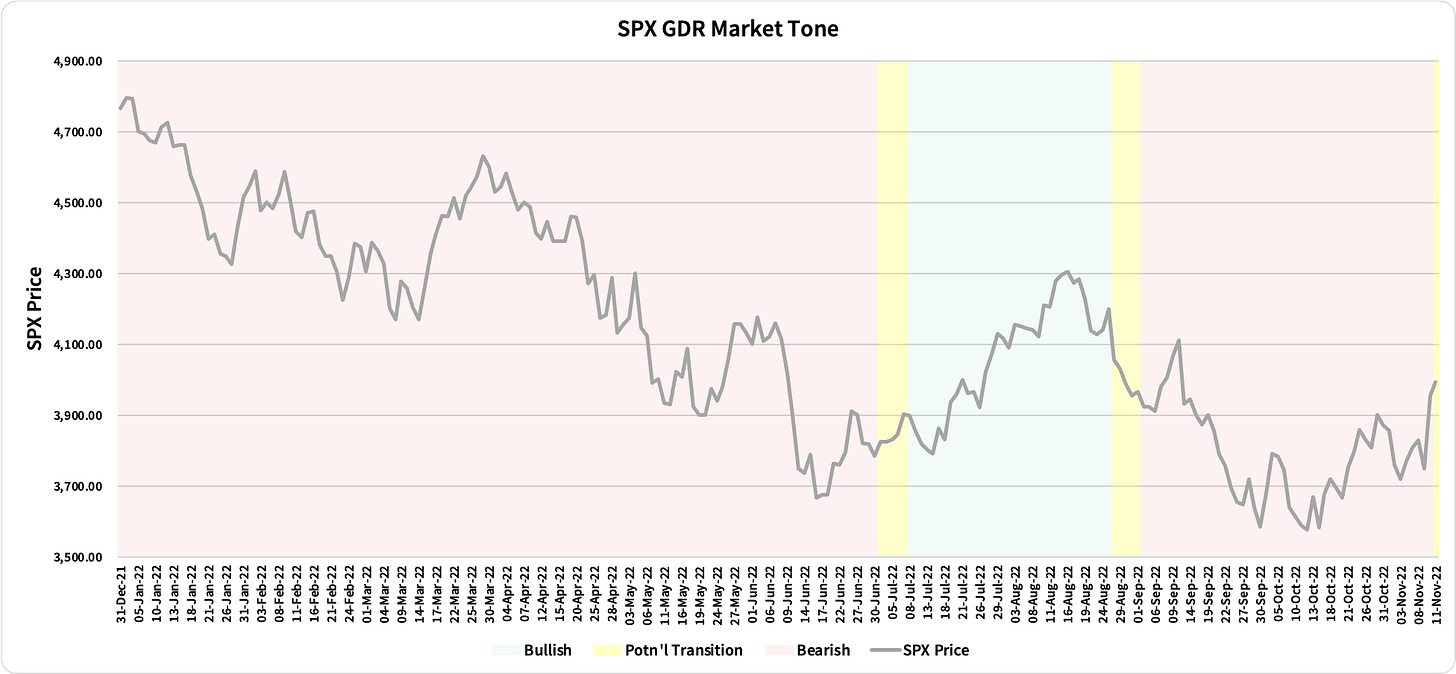

Market Tone: Potential Transition to Bullish (previous week: Bearish)

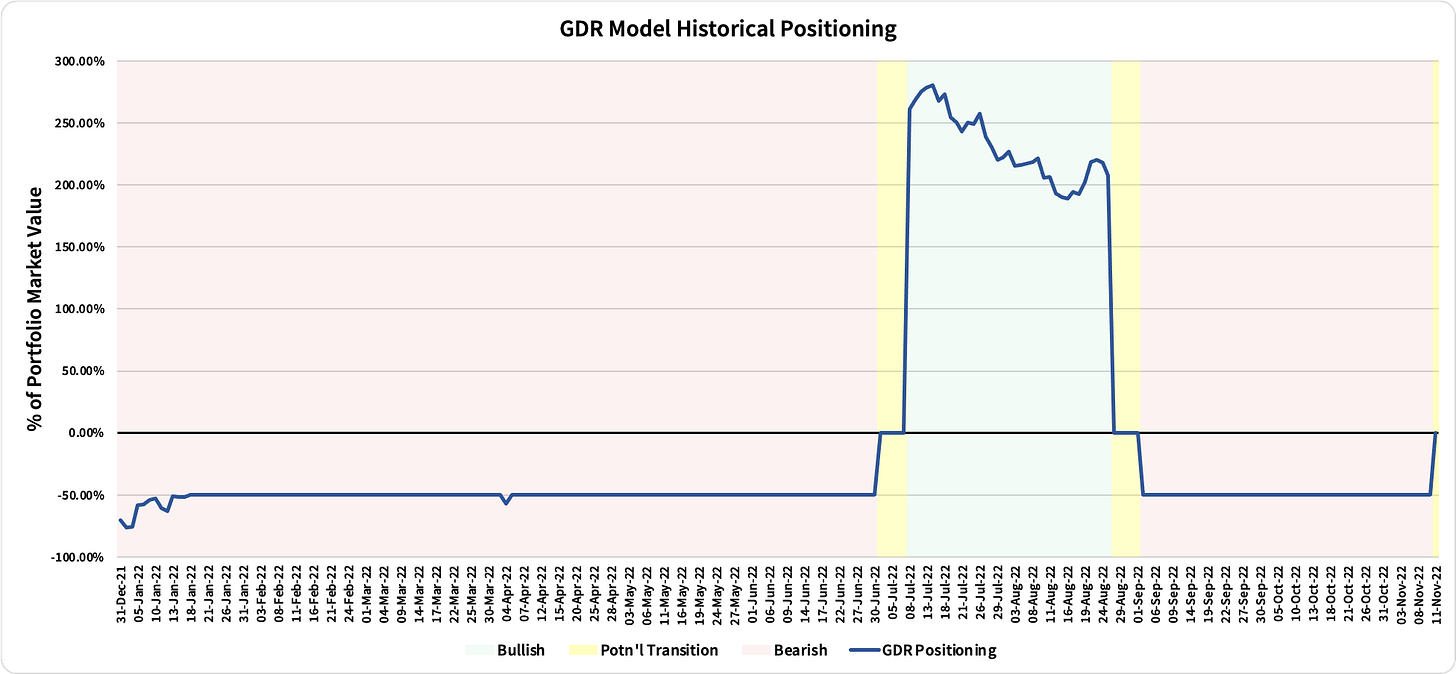

Positioning: 0.00% (previous day: -50.00% Short)

Commentary: at the start of last week we highlighted that the reaction to CPI would be key for GDR Model near-term and that’s exactly what happened: GDR is now in Transition mode. Sustained Bullishness this week will complete the model’s transition to Bullish. In the meantime, seasoned investors and traders who are confident in the market’s underlying strength may initiate starter long positions during this week.

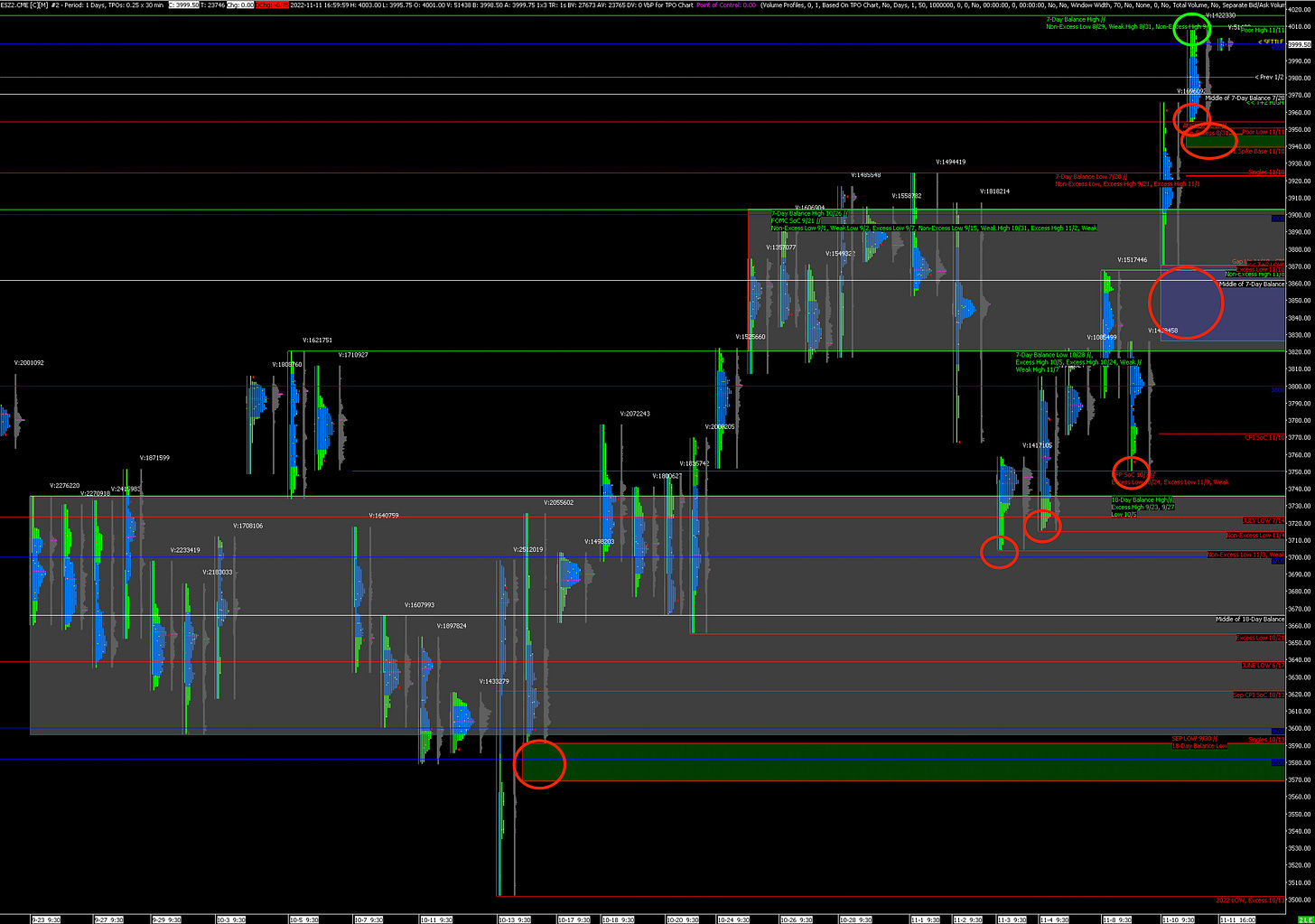

ES Market Structure Insights for Tomorrow

The ES has built the most recent rally on relatively poor structure, which makes me skeptical that this is the start of a long and sustained rally. In the chart above, the red/green circles highlight poor structure below/above. While there is some additional poor structure around the 4080, 4160 and 4210 levels above not visible in the chart, they start to be overwhelmed by the bad structure below. Poor market structure tends to (eventually) act like a magnet for price and is helpeful in determining directional probabilities as well as targets.

Probably, the most bullish thing the market could do at this point would be to test lower prices and be bought up again as it would allow an opportunity to correct the poor structure. Continuing up from here would probably be more indicative of further short covering, which would ultimately weaken the market. If the ES is headed higher, the 4140 level is the next logical spot for resistance.

Coming off of two consecutive weeks with critical data releases (FOMC, CPI, etc) it is easy to underestimate this week’s releases. Nonetheless, PPI and Retail Sales especially can bring some additional volatility. An astute read of ES trader inventories heading into those releases has the potential to payoff nicely.

Potential Market-Moving Events

Monday 06:30pm - FOMC Member Williams Speaks

Later this Week: PPI (Tue), Retail Sales (Wed), Industrial Production (Wed), Initial Jobless Claims (Thu)