GDR Model Weekly Insights for Mon 5 Dec 2022

Characteristically Bullish week by GDR's standards, although Market Structure has deteriorated

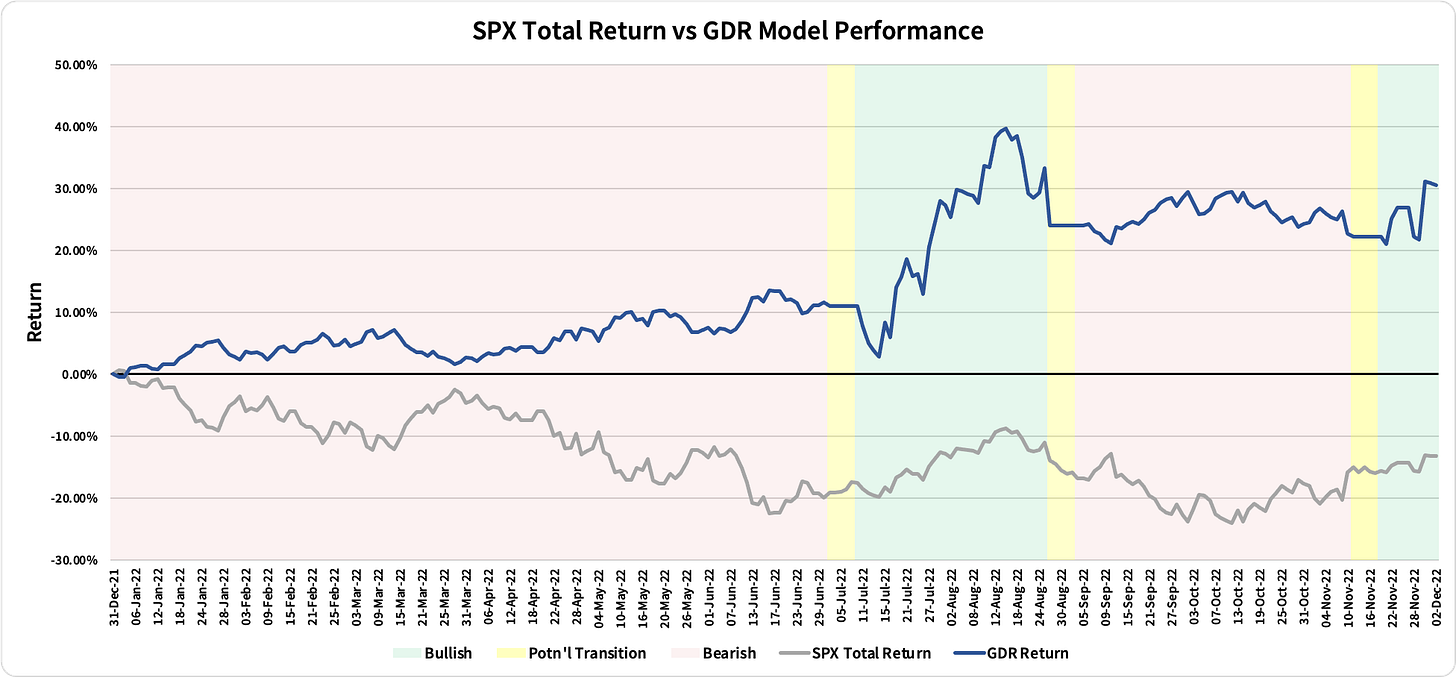

Review: 2022 Performance as of the close of 2 Dec 2022

GDR Model: +30.54%

S&P 500 Total Return: -13.26%

Information Ratio: 2.90

GDR Model Insights for the Week Ahead

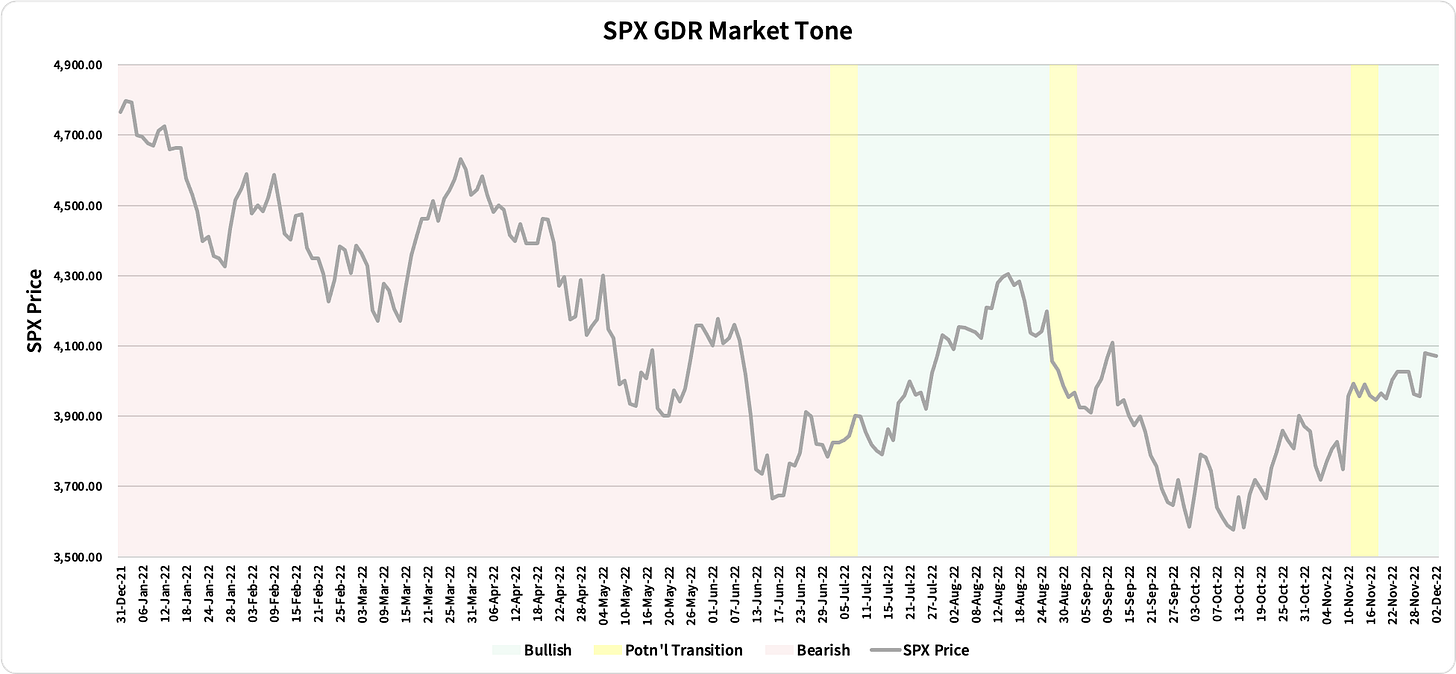

Market Tone: Bullish (previous week: Bullish)

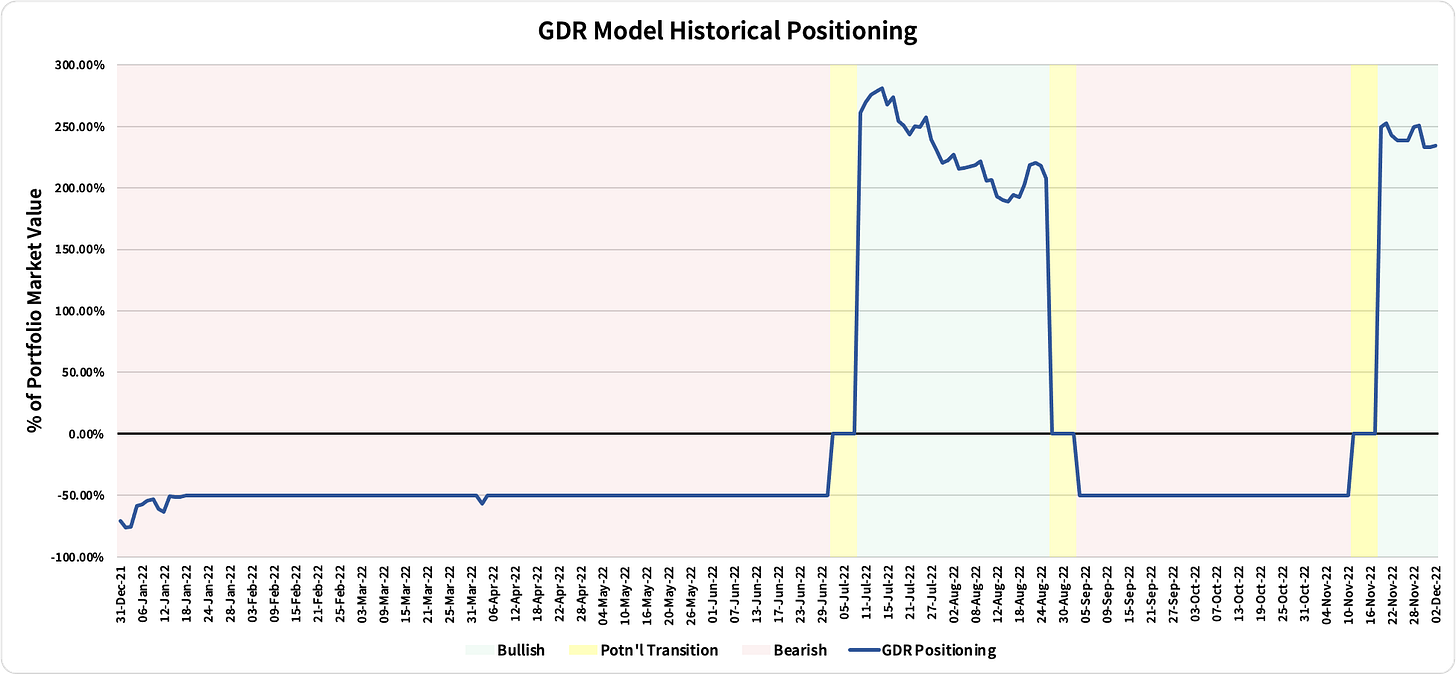

Positioning: +234.28% Long (previous day: +233.43% Long)

Commentary: Typically when GDR is definitively in Bullish mode, adverse news events aren’t able to make any difference to the uptrend. The fact that the ES was unable to follow through lower on Friday is something to carry forward in your market narrative

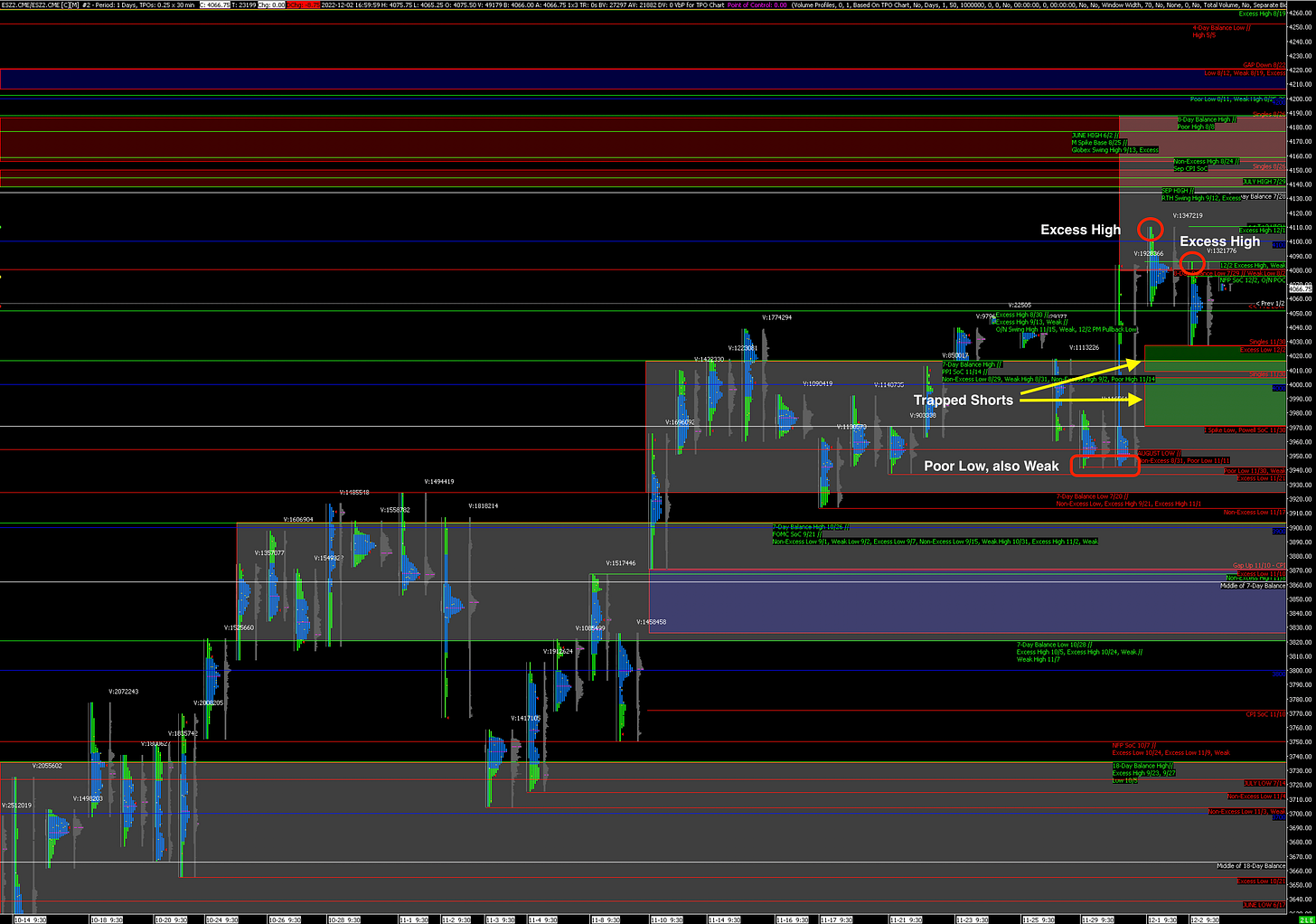

S&P 500 Futures Market Profile Insights for Tomorrow

Currently ES futures are attempting to re-enter a Balance Zone above from early August, however while Friday technically counts as a Balance Day with a Strong Close, it’s important to notice the increasing number of Bearish markers:

The rally following Powell’s speech last week left behind a Poor Low that is also Weak and in need of repair

There are still two large Trapped Short positions below

The market has now left behind two consecutive Excess Highs

There is no question that the prevalent trend on the market is up, but things are definitely starting to look more Bearish. Do keep in mind that correcting the poor structure below does not necessarily have to kill the current uptrend, although it’s definitely something to keep in mind, especially if you day trade.

Potential Market-Moving Events

Monday 09:45am - S&P Global Composite PMI, Services PMI

Monday 10:00am - ISM Non-Manufacturing PMI, ISM Non-Manufacturing Employment, Factory Orders

Later this Week: PPI (Fri)