GDR Model Weekly Insights for Mon 3 Apr 2023

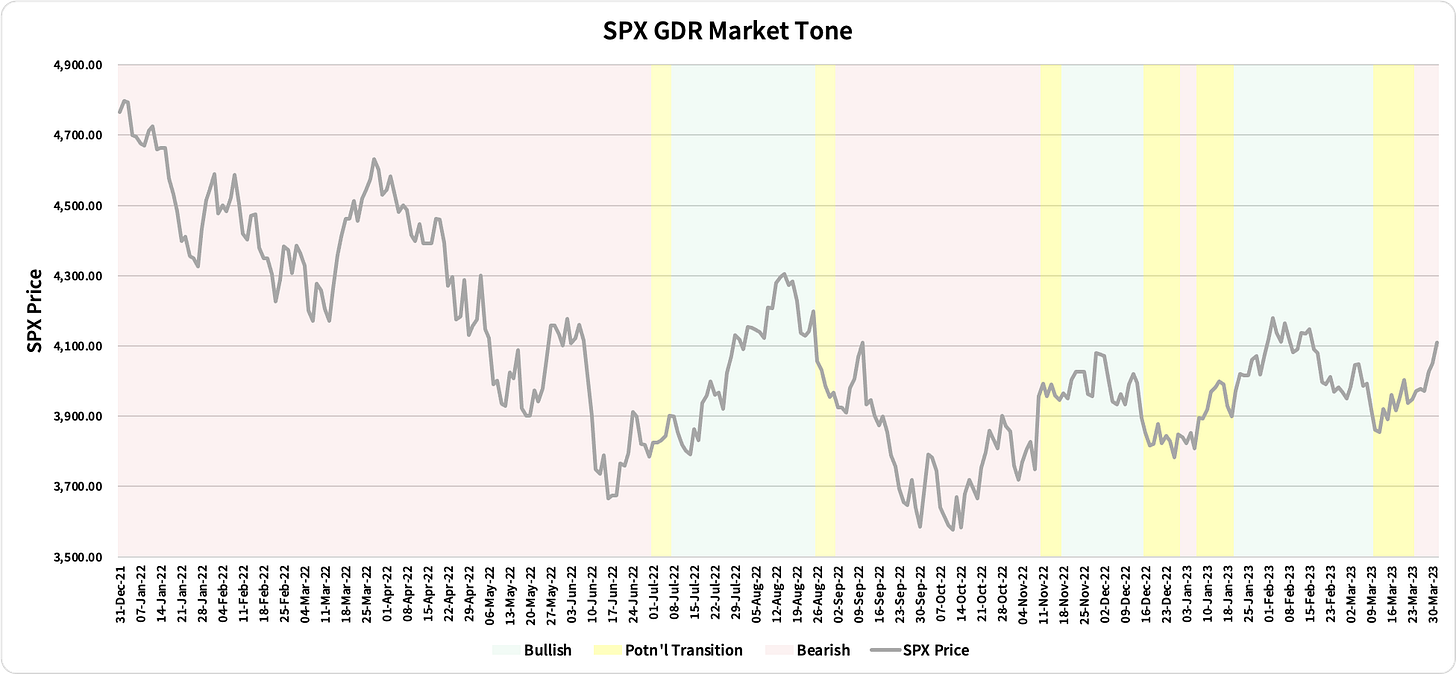

The market is Bullish but Inventories have relentlessly gotten continuously longer and may be overdue for a correction

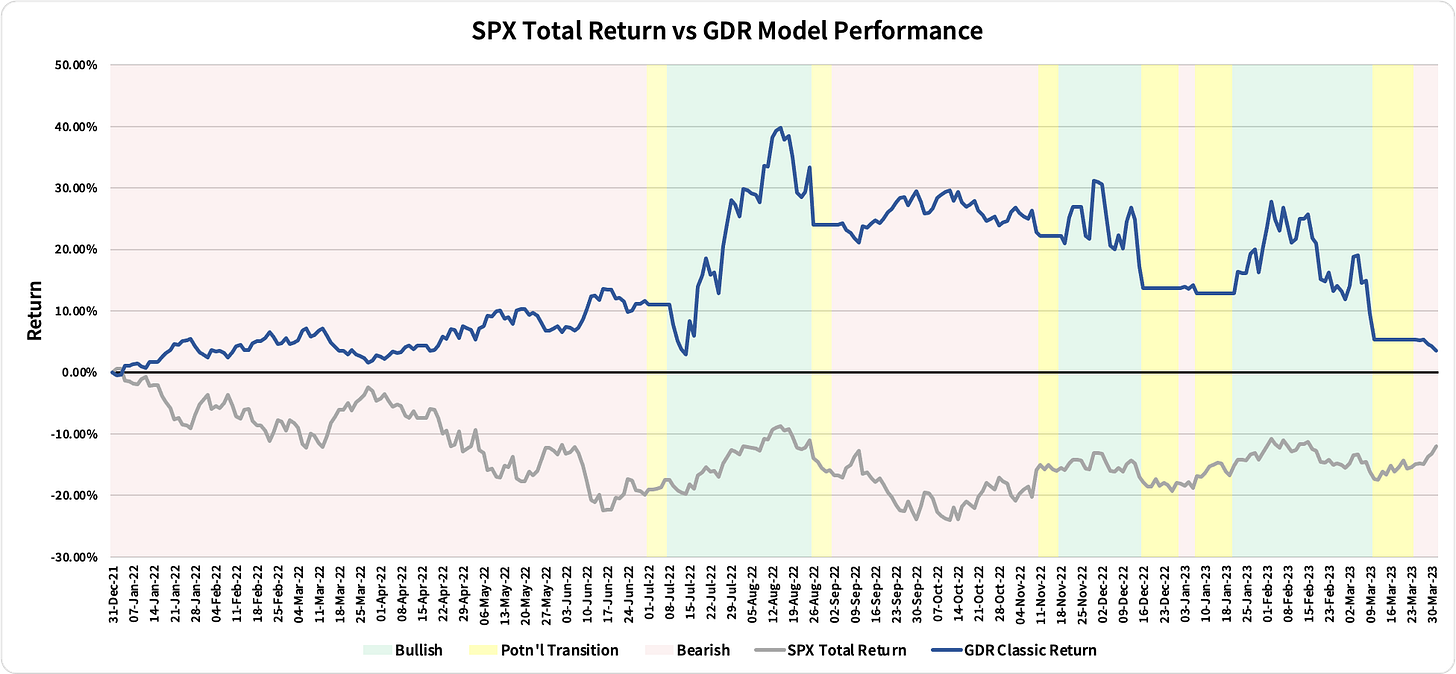

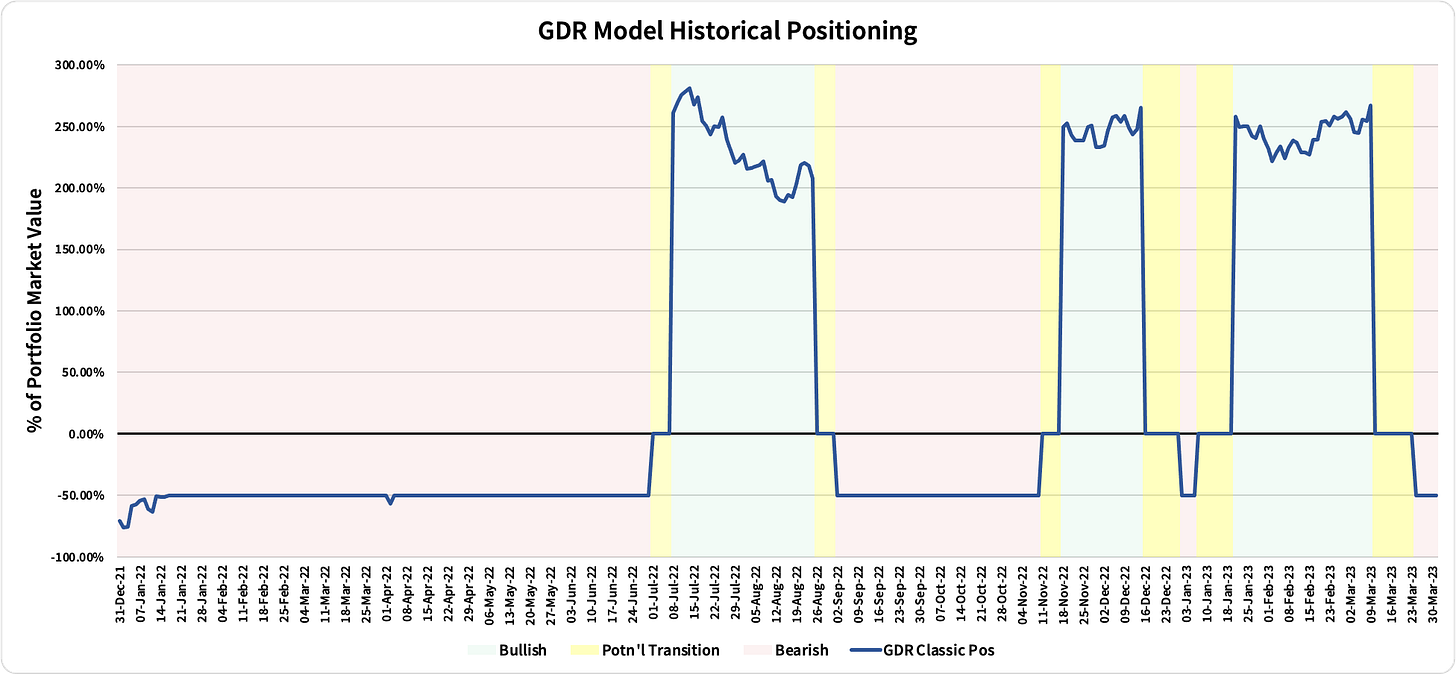

Review: Performance as of the close of 31 Mar 2023

GDR Model Insights for the Week Ahead

Commentary: the GDR Model has tentatively gone to neutral. It’s not a super convincing shift in the model, but process is process…

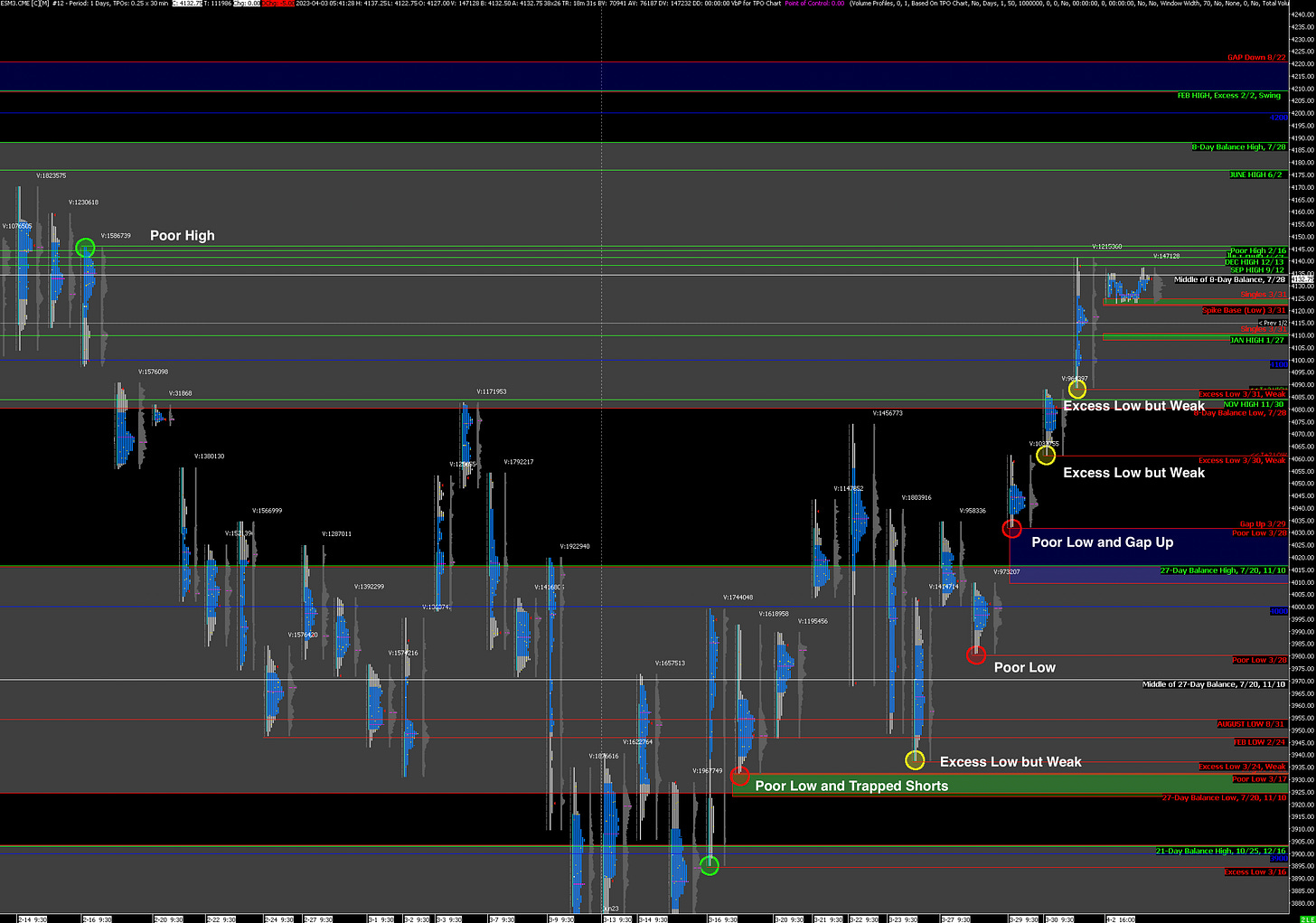

S&P 500 Futures Market Profile Insights for Today

Near-Term Outlook: Bullish as Market Targets Remaining Poor Structure Above

Counterpoint: Overly Long Inventories keep increasing the odds of at least a Liquidation Break

Key Levels for Today:

Bullish: 4146 (Poor High), 4188 (Balance Zone High), 4221 (Closes Gap Down)

Bearish: 4122 (Friday Spike Base), 4088 (Friday Weak Low), 4061 (Weak Low)

Friday was a textbook Trend Day that ended on a Spike Higher - Spike Trading Guidelines apply. Notably, even though Friday’s Low has proper Excess, it coincides exactly with Thursday’s High and therefore it is Weak. The number of Weak references and Poor Structure holding up the current market is remarkable and certainly increasing the odds of at least a Liquidation Break if not worse.

It’s not uncommon for money managers to bid up the market going into the end of a tough month or quarter to make the statements clients receive look better so watch out for higher chances of a sell-off now that Q2 has started. Finally, keep in mind that this week is shorter as markets are closed for Good Friday. A reminder that the point of this analysis isn’t to blindly enter a short on open today, but rather so that you are ready and not surprised when/if a sell-off begins.

Potential Market-Moving Events Today

Today at 9:45am - Markit Manufacturing PMI

Today at 10:00am - ISM Manufacturing PMI

Later this Week: Nonfarm Payrolls (Fri - Markets Closed for Good Friday)