GDR Model Weekly Insights for Mon 9 Jan 2023

Spike Rules apply today with good potential for further upside

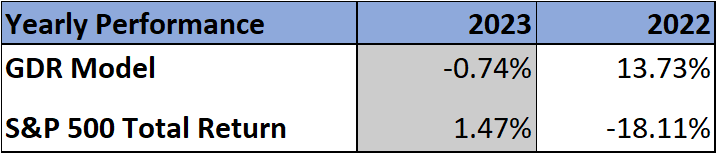

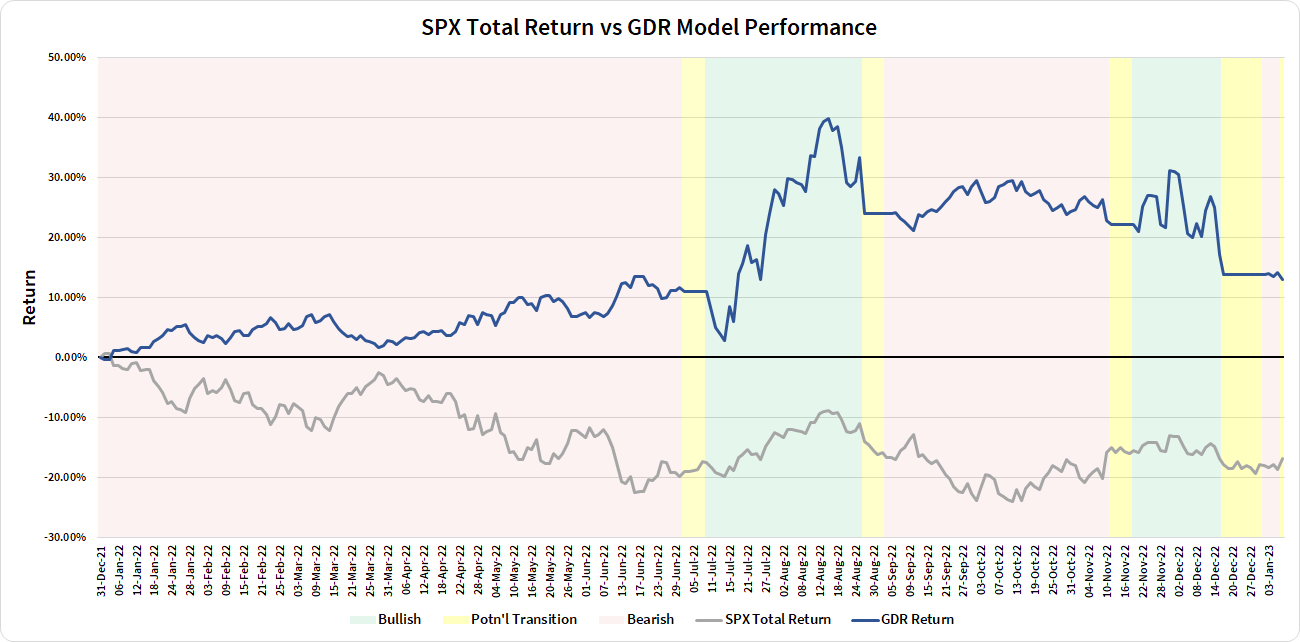

Review: Performance as of the close of 6 Jan 2023

GDR Model Insights for the Week Ahead

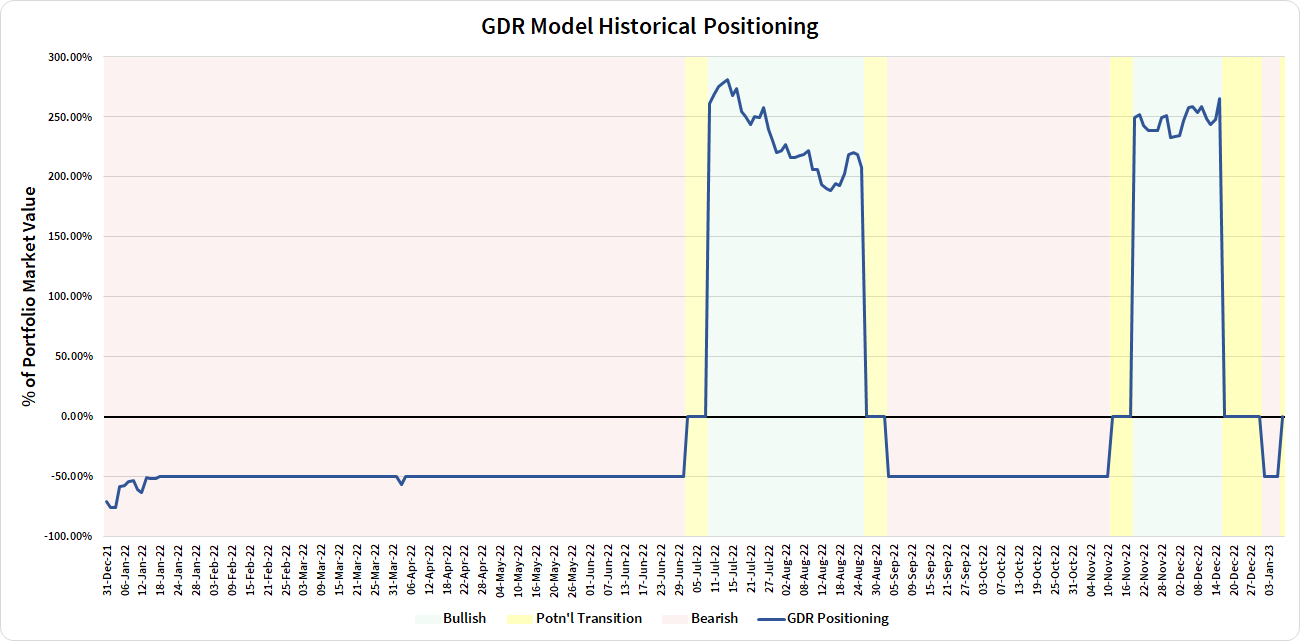

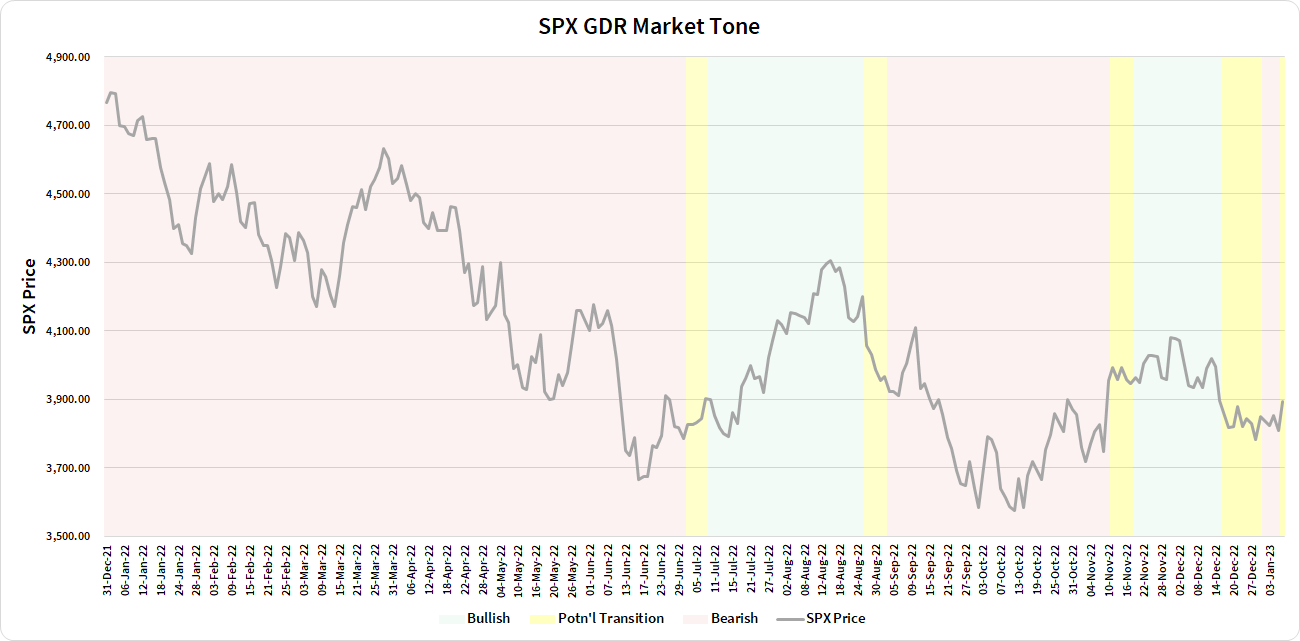

Market Tone: Transition (previous week: Bearish)

Positioning: 0.00% Flat (previous day: -50.00% Short)

Commentary: GDR has returned to Transition mode. Given the recent chop in the market, GDR will likely look for a trend to establish itself more firmly before shifting into Bullish or Bearish mode again

S&P 500 Futures Market Profile Insights for Today

Near-Term Outlook: Spike Rules, potential for further upside

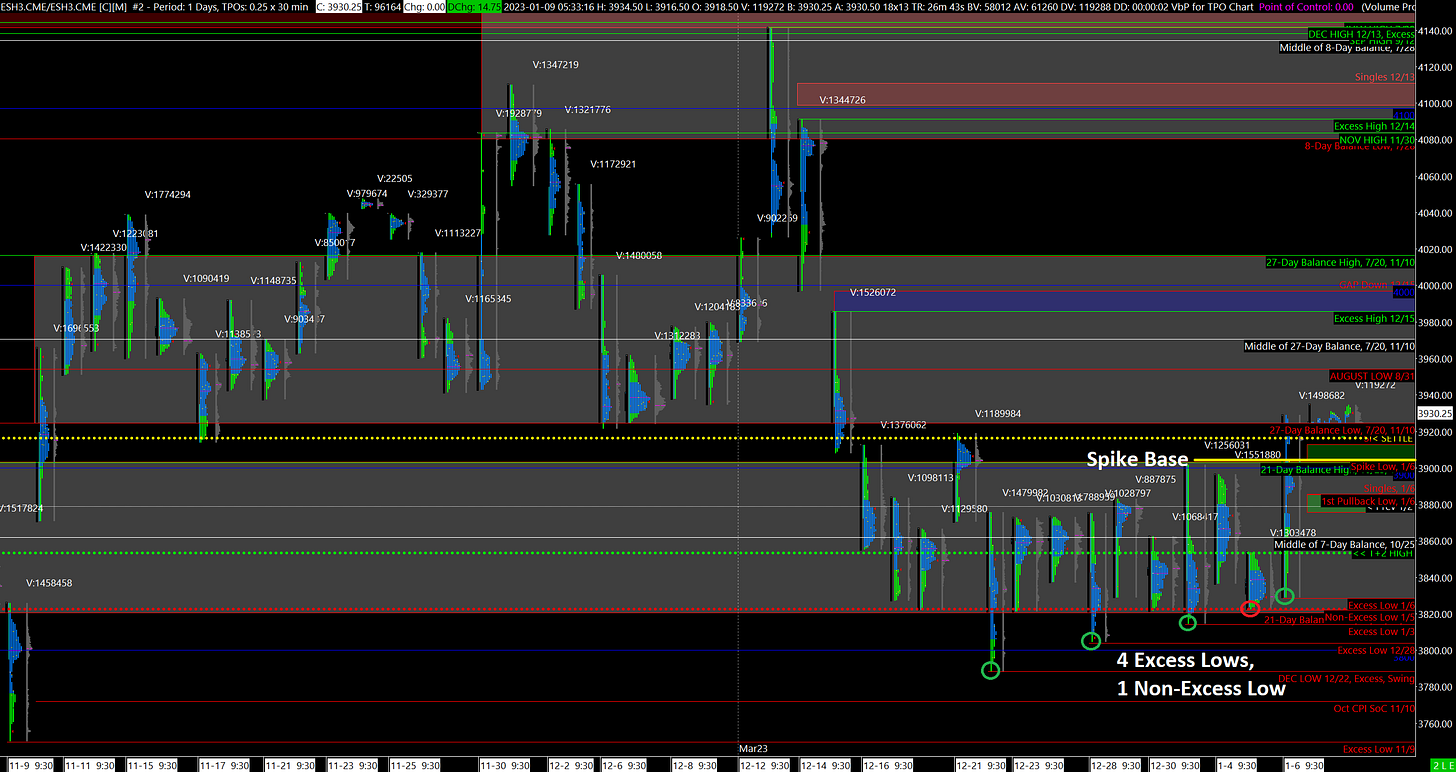

Following the release of Employment Data last Friday, the market had a Trend Day Up and ended the day on a Spike Up. The Spike Base is just above the recent Balance Zone (~3905) - it is now a key reference to keep in mind. Should the ES remain above it then we are likely to continue on a Bullish trend. If the market breaks down below it then we are more likely to be stuck in the recent Balance Zone for a bit longer.

It is also worth keeping in mind that Friday’s rally shows Poor Structure with 2 Trapped Short positions left behind. This doesn’t necessarily make the market more Bearish imminently, but it’s definitely something to carry forward. Keep in mind Powell will speak tomorrow at 9am and that CPI will be released on Thursday.

Potential Market-Moving Events

Today - None

Later this Week: Fed Chair Powell Speaks (Tue), CPI (Thu)