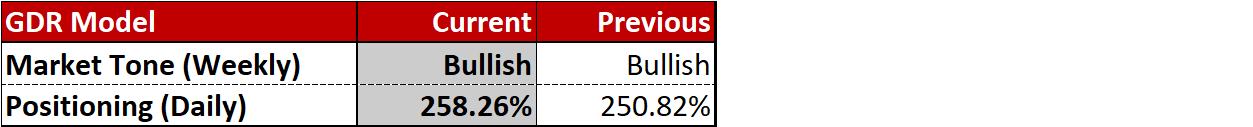

GDR Model Weekly Insights for Mon 27 Feb 2023

Momentum Short Sellers in Control; questionable Structure above

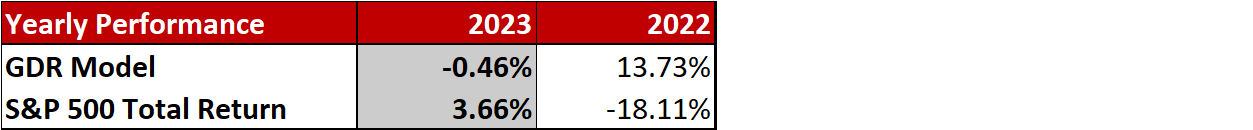

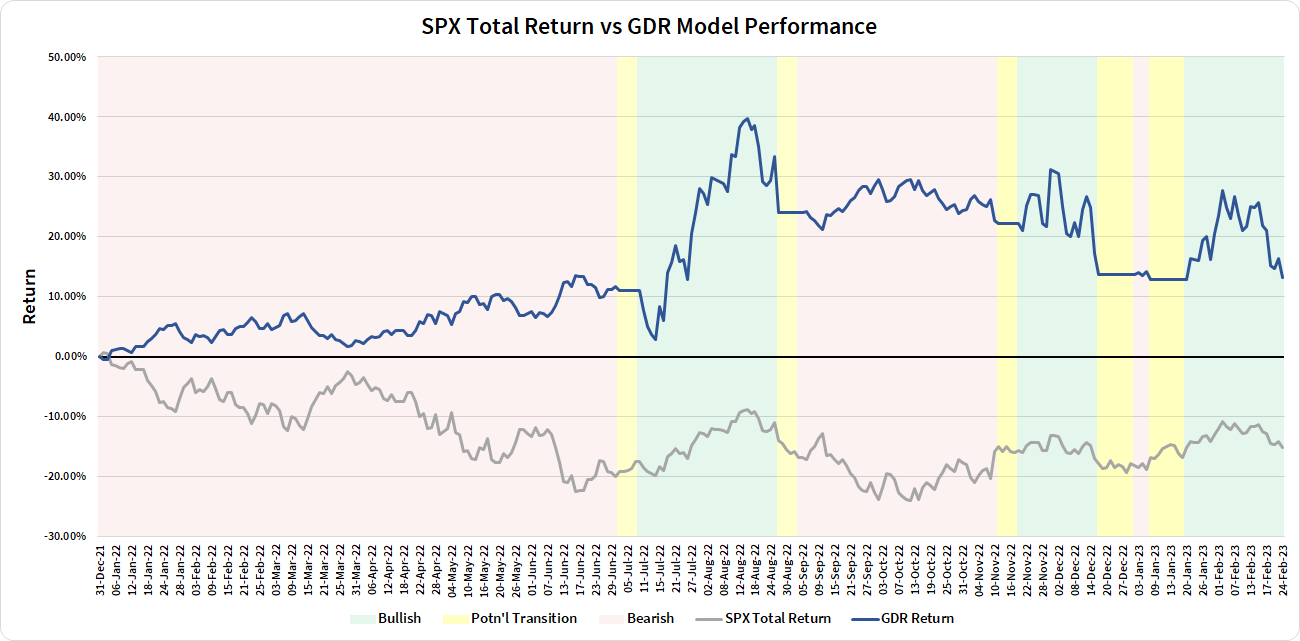

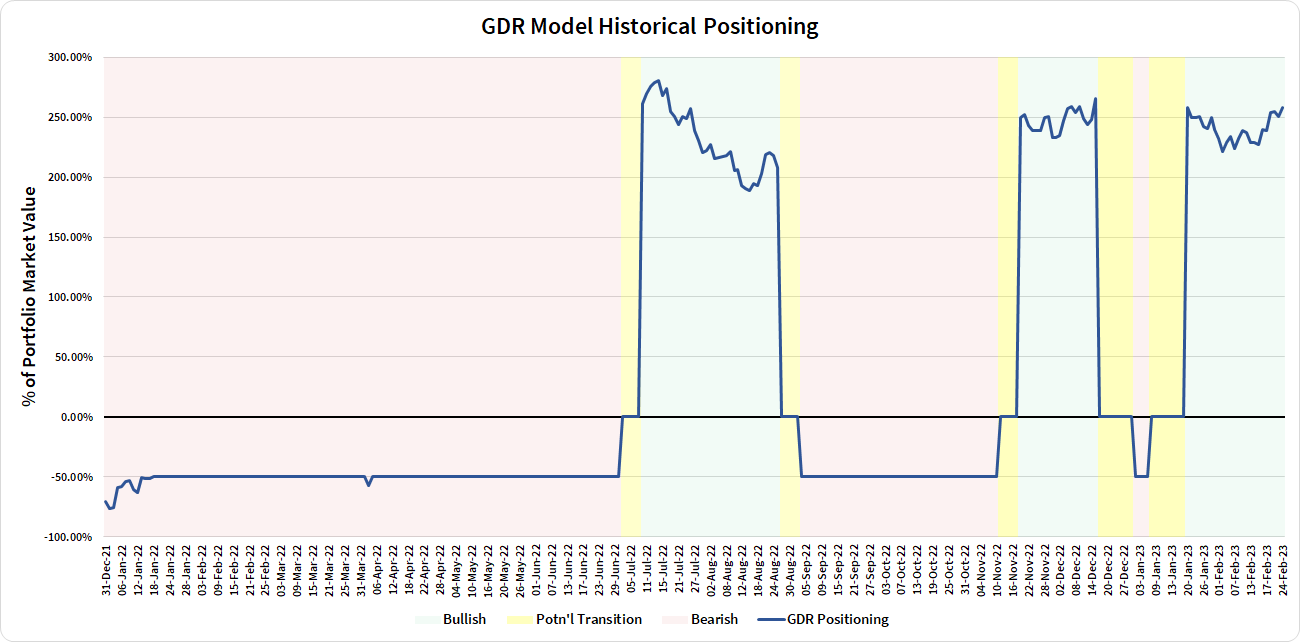

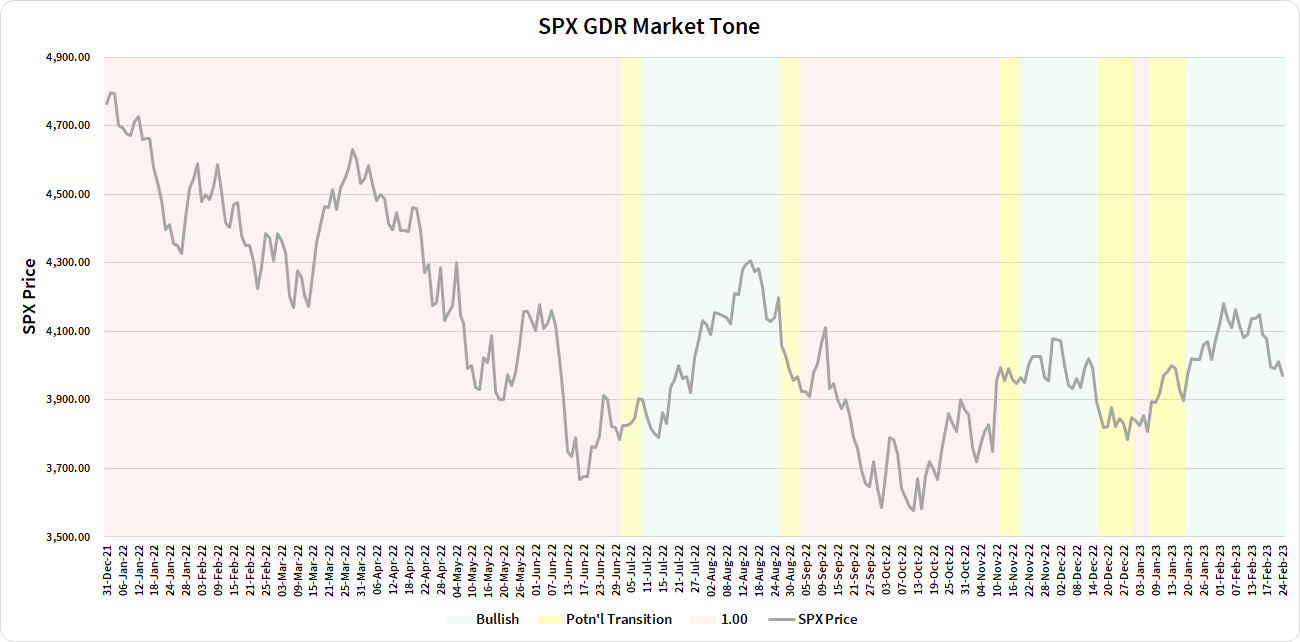

Review: Performance as of the close of 24 Feb 2023

GDR Model Insights for the Week Ahead

Commentary: at this point, GDR Model is likely to close its long position at the end of this week. Of course this could change between now and Friday, but market conditions have deteriorated quite a bit lately

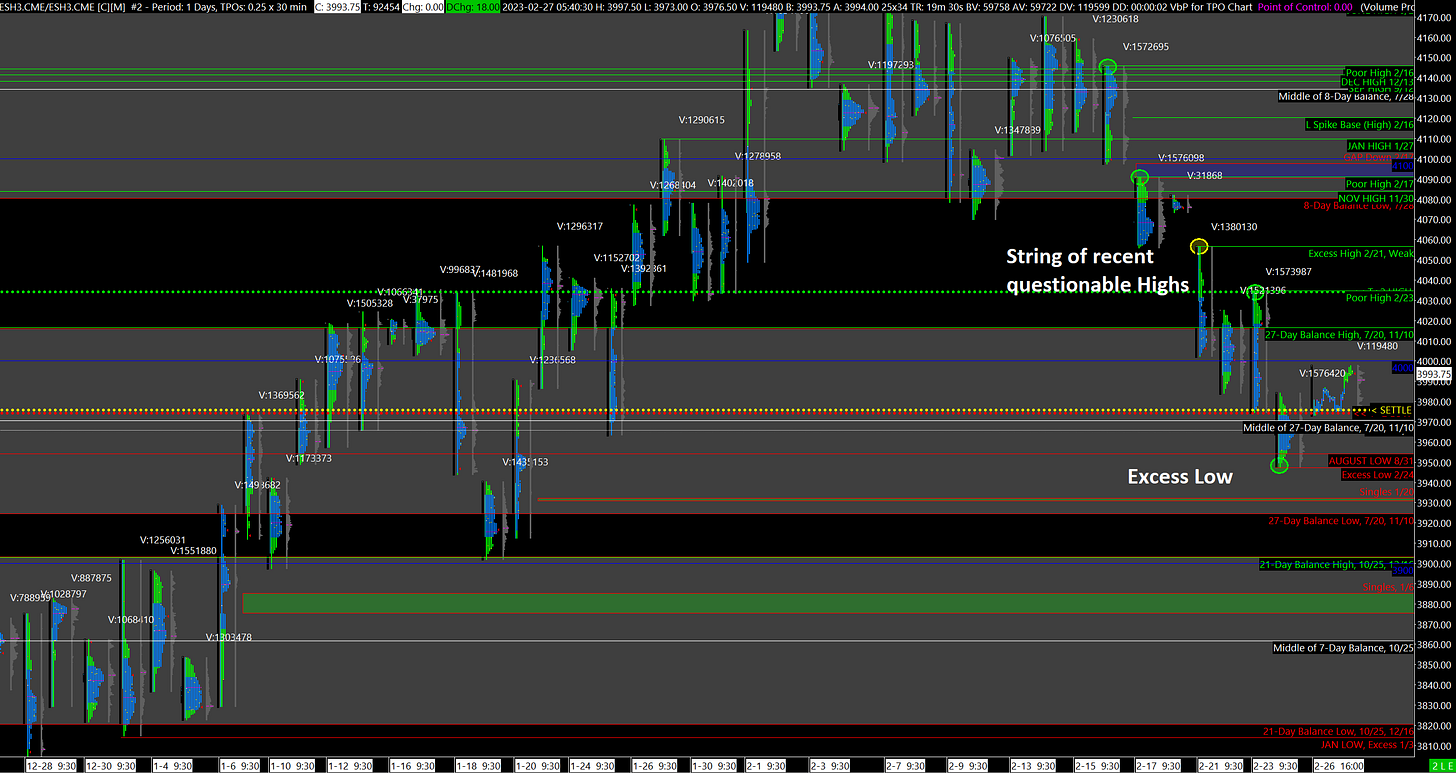

S&P 500 Futures Market Profile Insights for Today

Near-Term Outlook: Momentum Short-Sellers in Control with Questionable Recent Highs

The current Market Profile analysis is relatively straightforward: several recent Highs are Questionable but short-term Short-Sellers remain in control. This will continue to dominate until longer-term players step in so don’t take the Market Profile read at face value and blindly go long. Poor Structure can stay in need of Repair for a long time.

Friday’s Low, while it has Excess, it is also Weak because it coincides almost exactly with the 200 DMA. Large investment funds don’t buy (or sell) at Exacting Levels such as this. The presence of longer-term players will likely be evidenced by a string of Excess Lows at seemingly random levels. This group determines when prices stop falling so wait for them to step in. Remember: it’s better to be a little late to a move than a little early.

Potential Market-Moving Events

Today 08:30am - Durable Goods Orders

Today 10:00am - Pending Home Sales

Later this Week: CB Consumer Confidence (Tue)