GDR Model Weekly Insights for Mon 20 Mar 2023

Bearish Outlook, but key Fed week can easily cause a U-turn

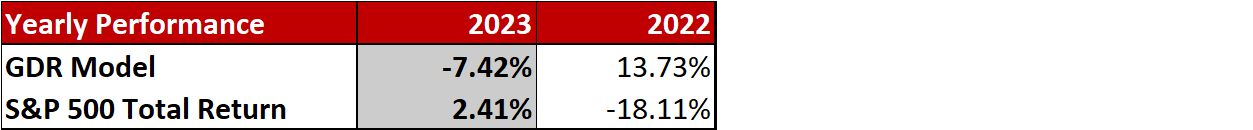

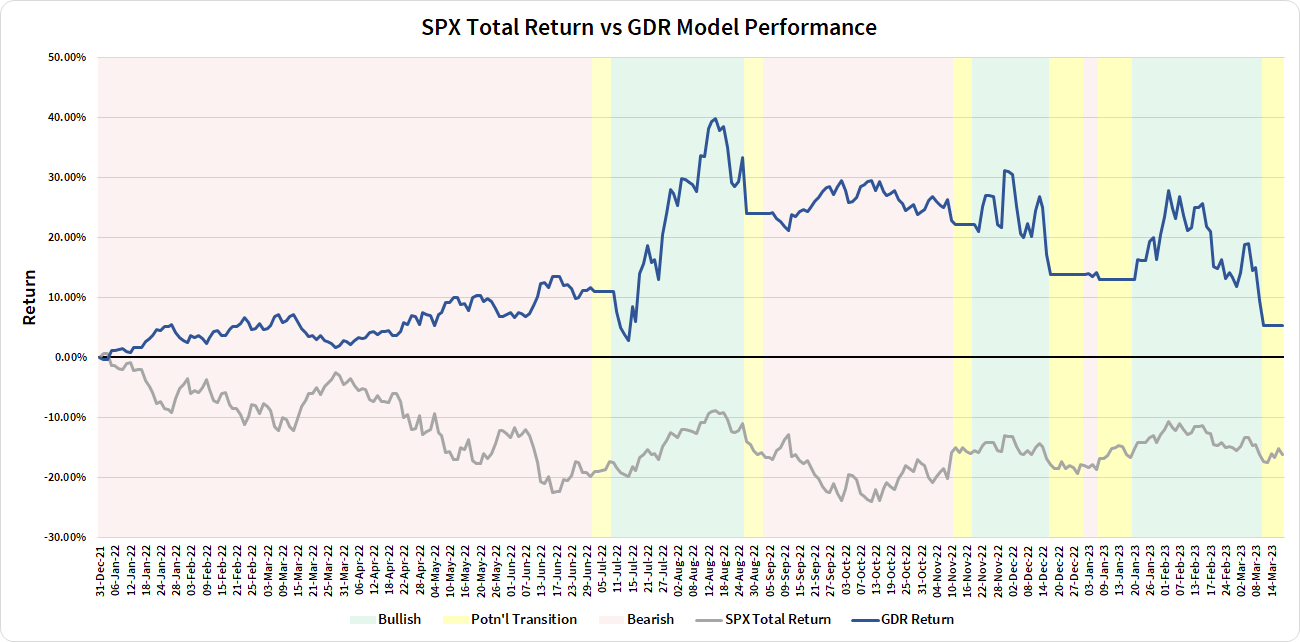

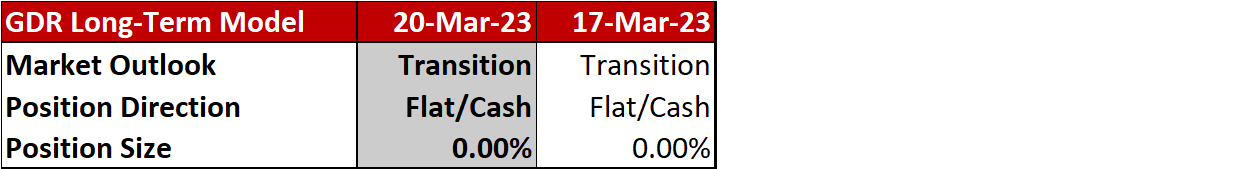

Review: Performance as of the close of 17 Mar 2023

GDR Model Insights for the Week Ahead

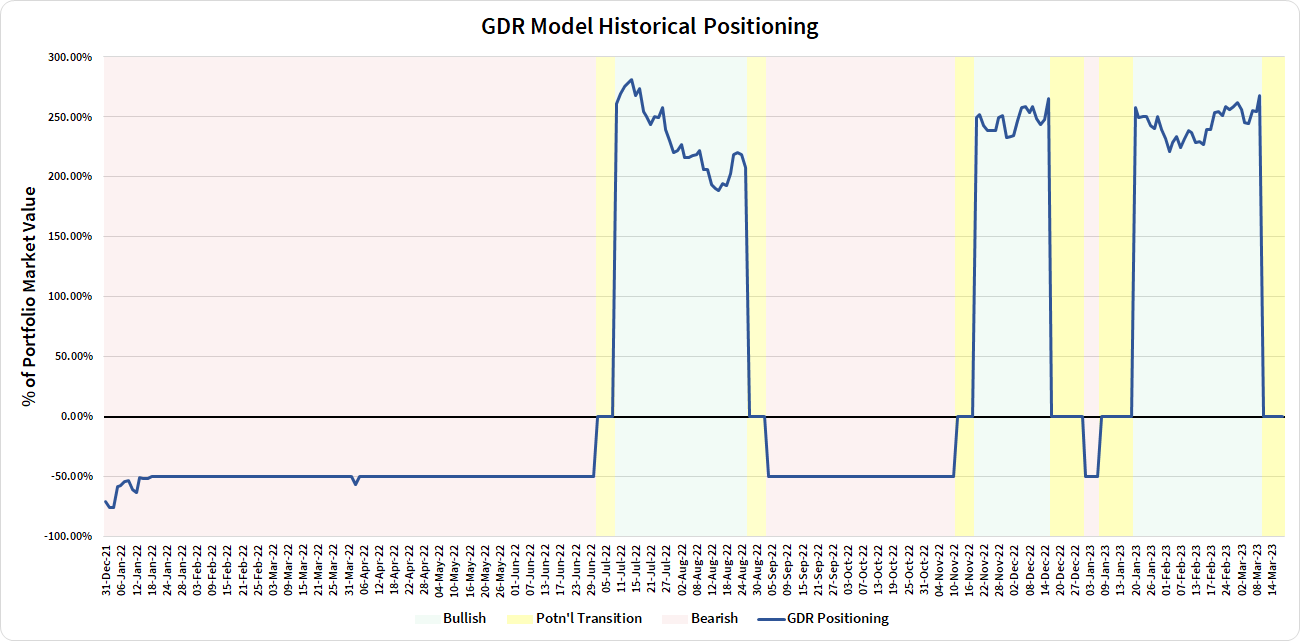

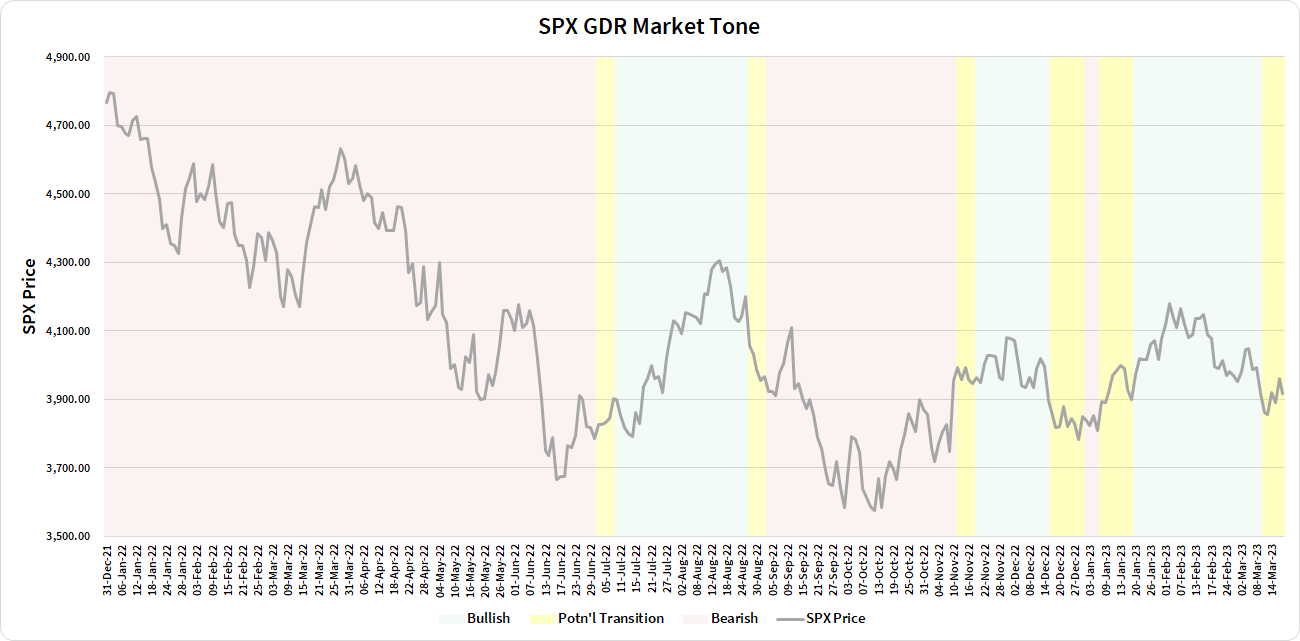

Commentary: GDR Model has remained steadily Bearish. This week will be key as the market looks to see how the FOMC will react to the recent struggles in the Financial Sector

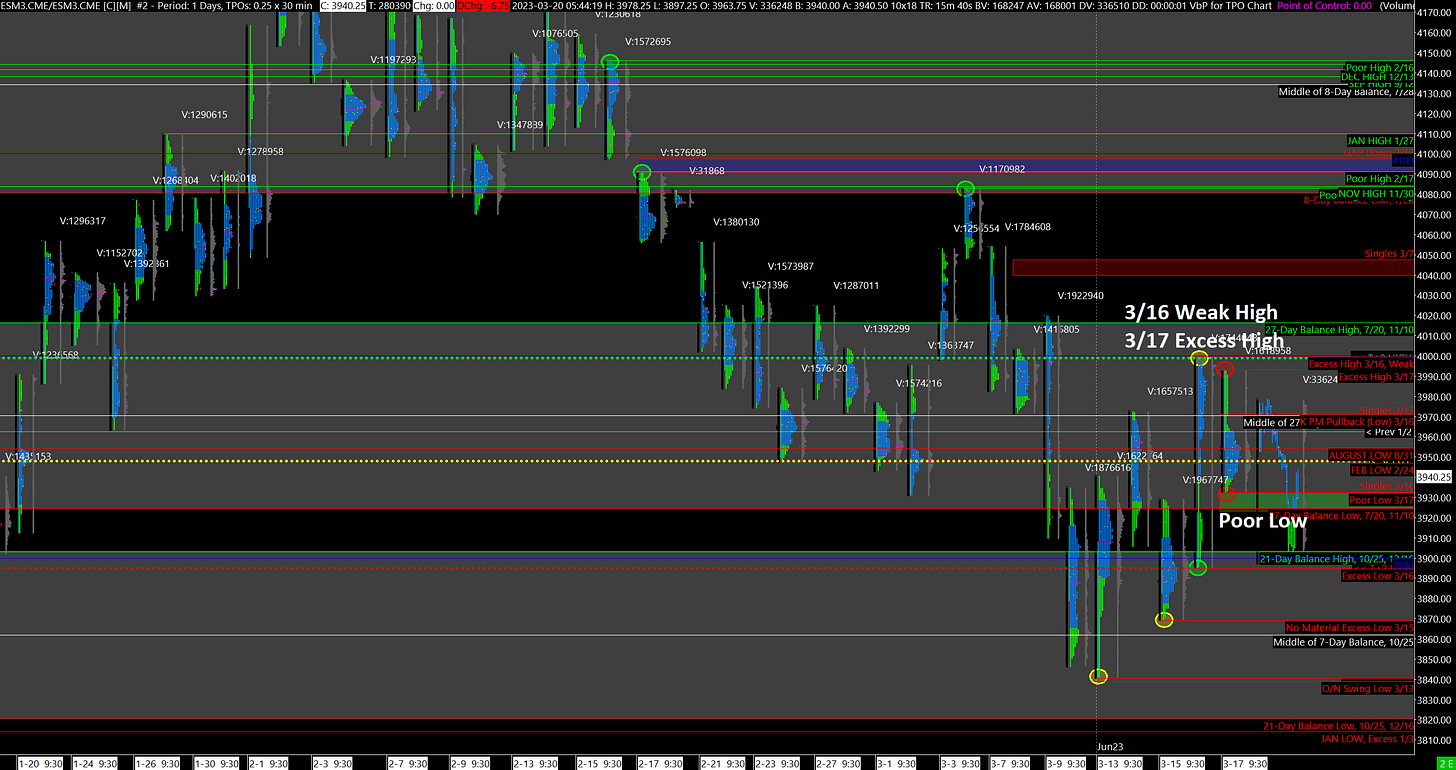

S&P 500 Futures Market Profile Insights for Today

Near-Term Outlook: Bearish and Volatile

Counterpoint: Rejection of the Balance Zone Low and Value Continues Higher

Friday’s counterpoint highlighted the potential for liquidation given that Thursday’s rally looked led by short-covering. The market left behind a Poor Low following Friday’s Liquidation, which increases the odds that it will be taken out. Moreover, today’s Overnight session has been unusually volatile with a wide range. This suggests the market is still trying to make sense of the SVB (parent SIVB 0.00%↑) and Credit Suisse (CS 0.00%↑) collapses and the potential impact these may have on this week's Fed Interest Rates Decision.

The most likely outcome for today is for the Poor Low to be repaired and for the market to test the Low of the Current Balance Zone. At that point it’s important to monitor for continuation. On the other hand, it’s important to note that Value is in a short-term trend higher. For any further downside to be sustained, Value needs to start to build Lower. Here are some key levels for today:

Bullish: 3971 (Trapped Long Position), 4000 (Weak High), 4016 (Top of Current Balance Zone)

Bearish: 3932 (Poor Low), 3924 (Bottom of Current Balance Zone, Trapped Short Position), 3903 (Top of Lower Balance Zone)

Potential Market-Moving Events Today

Today - None

Later this Week: Fed Interest Rate Decision (Wed)