GDR Model Weekly Insights for Mon 6 Mar 2023

Short-Covering Rally, pressure on trapped shorts

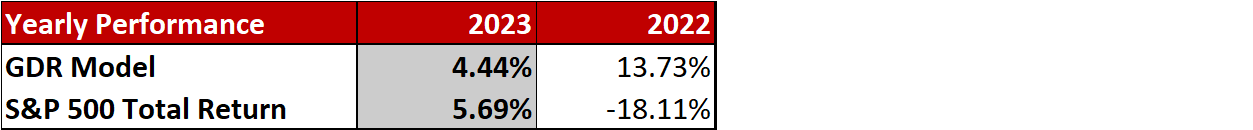

Review: Performance as of the close of 3 Mar 2023

GDR Model Insights for the Week Ahead

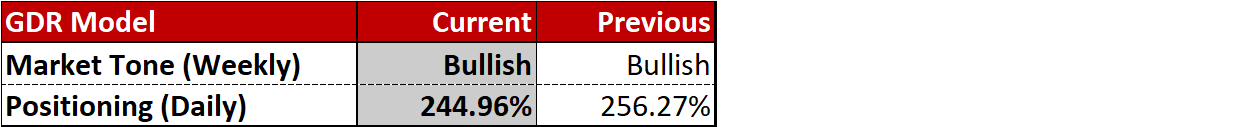

Commentary: GDR Model is back in firmly Bullish mode for now

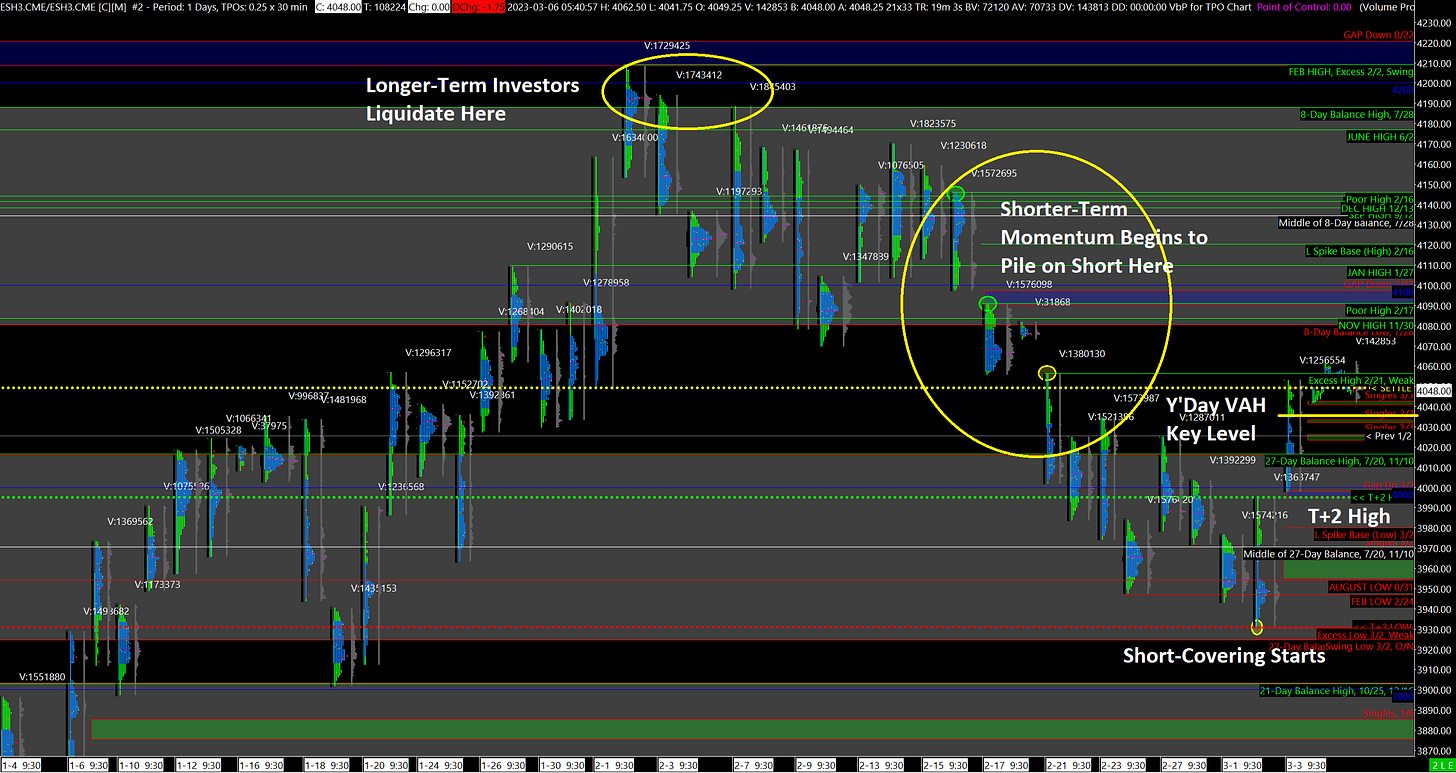

S&P 500 Futures Market Profile Insights for Today

Near-Term Outlook: Pressure on Trapped Shorts

Last Wednesday I began mentioning the possibility of a short-covering rally as short-term trader inventories were starting to look too stretched on the short side. This is where we are to start the week. In today’s chart, I’m highlighting a slightly longer-term perspective of what has happened so far. Note that longer-term investors liquidated at around the 4200 level in early February. Then halfway through the month, short-term traders began piling on to the short-trade. This makes sense as over the last few rallies over the last year or so the opposite has happened: the market hit a level where longer-term investors liquidated and following that, short-term traders tried to buy the dip. Tired of getting burned, they decided to go the opposite way this time.

The ES is trading well above the T+2 (Settlement) High, which is just under 4000. This will likely continue to put pressure on trapped shorts to continue the short-covering rally. Remember though: short-covering can often weaken a market, so don’t be fooled and don’t overstay your welcome. The ES touched 3930 just last Thursday and attracted no interest from long-term investors. It’s very unlikely that that will happen now at higher prices.

Potential Market-Moving Events

Today 10:00am - Factory Orders

Later this Week: Fed Chair Powell Testifies (Tue, Wed), ADP Nonfarm Employment Change (Wed), JOLTs Job Openings (Wed), Nonfarm Payrolls (Fri)