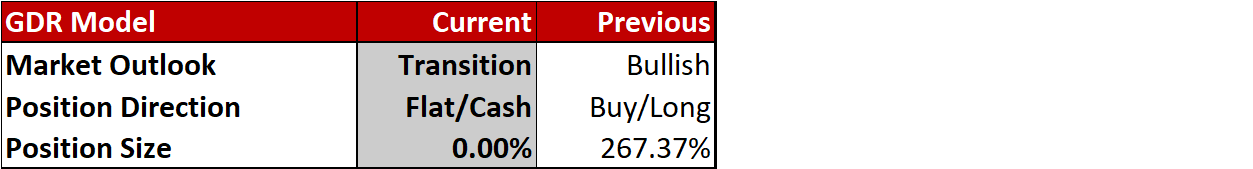

GDR Model Weekly Insights for Mon 13 Mar 2023

Potential Longer-Term Investor Liquidation spurred by SVB collapse

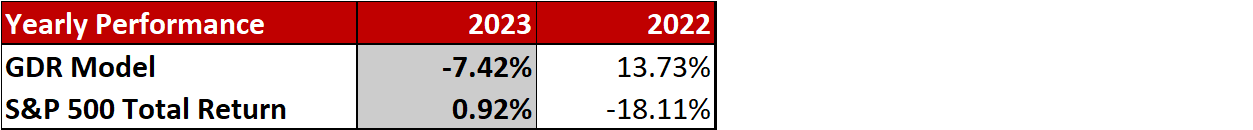

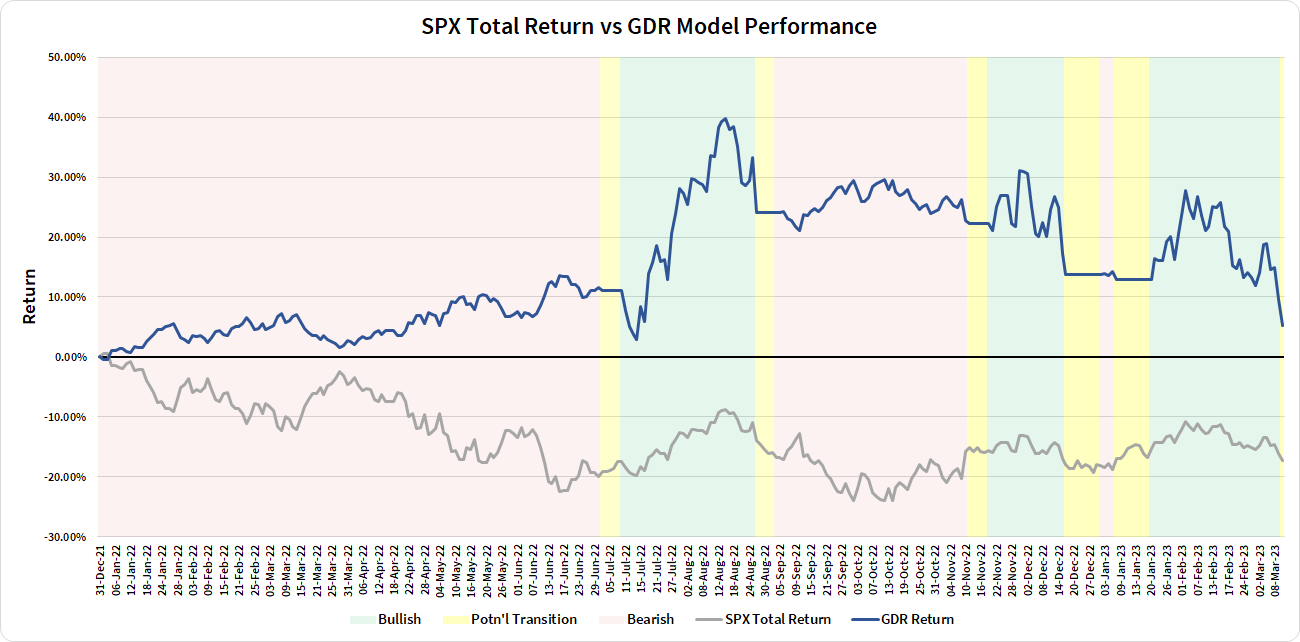

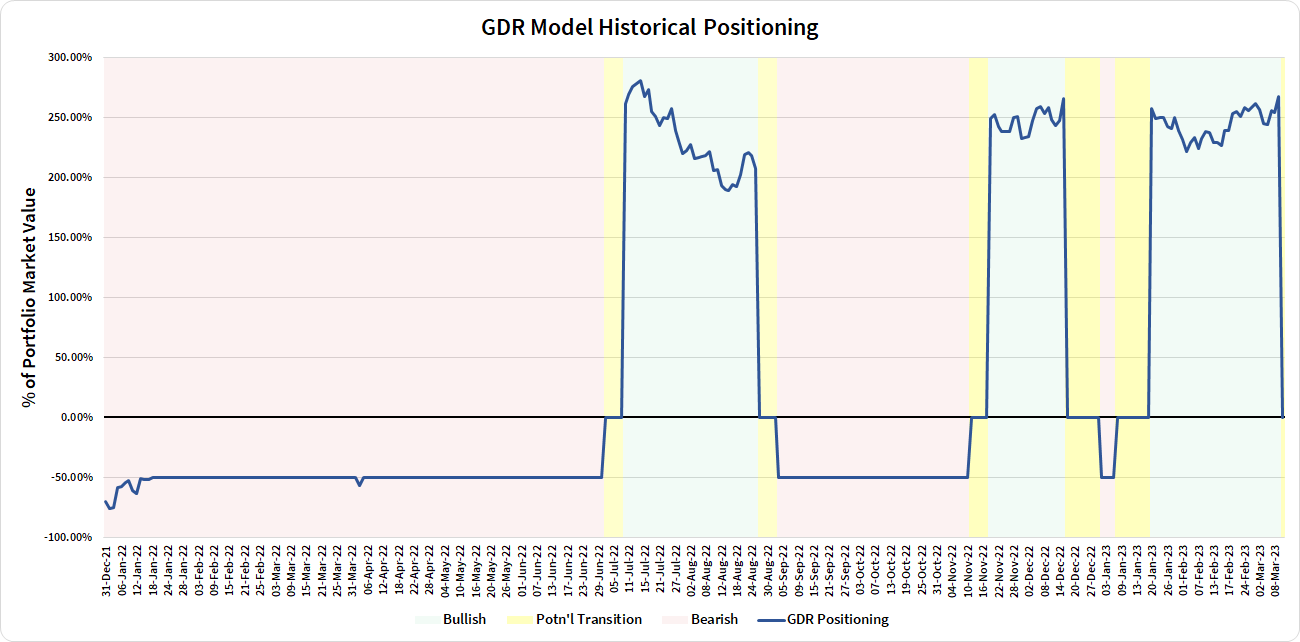

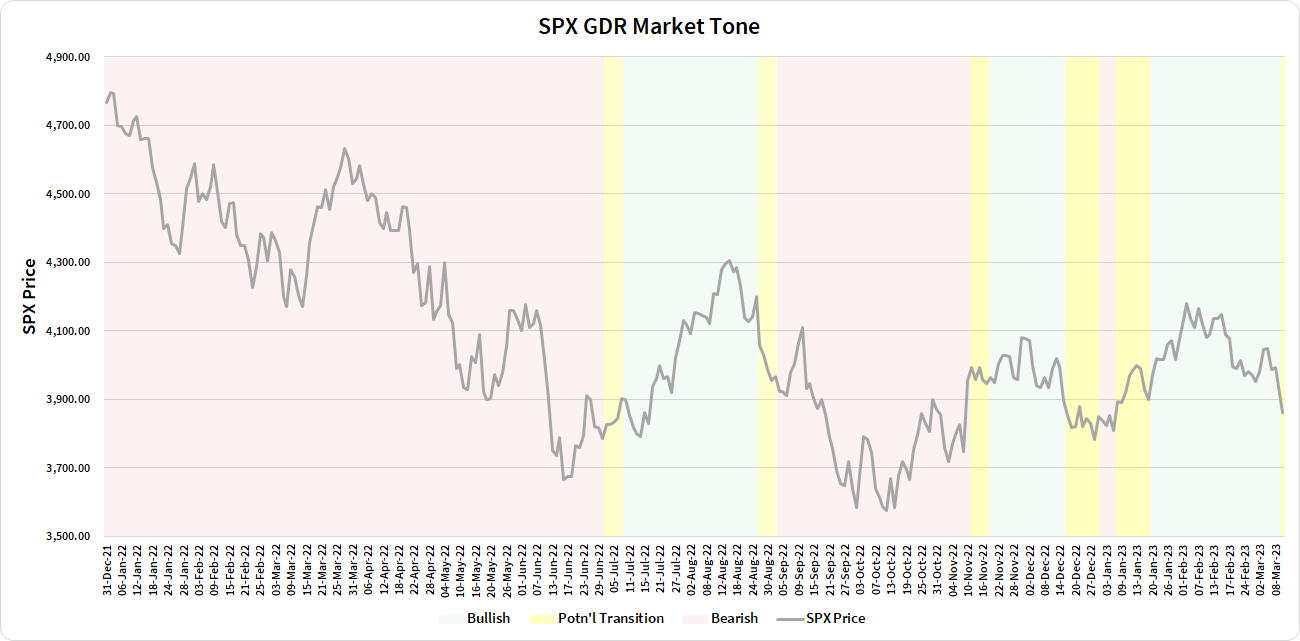

Review: Performance as of the close of 10 Mar 2023

GDR Model Insights for the Week Ahead

Commentary: news of the SVB collapse (parent: SIVB 0.00%↑) led to a broad-based sell-off in equity markets and GDR Model is now, unsurprisingly, fully in cash. Either the market shurgs this off relatively quickly and traders buy the dip or this could be a sign of something brewing this year… Either way, this is the kind of occurrences that GDR Model has a tough time guarding against. It’s a good thing they don’t happen all too often…

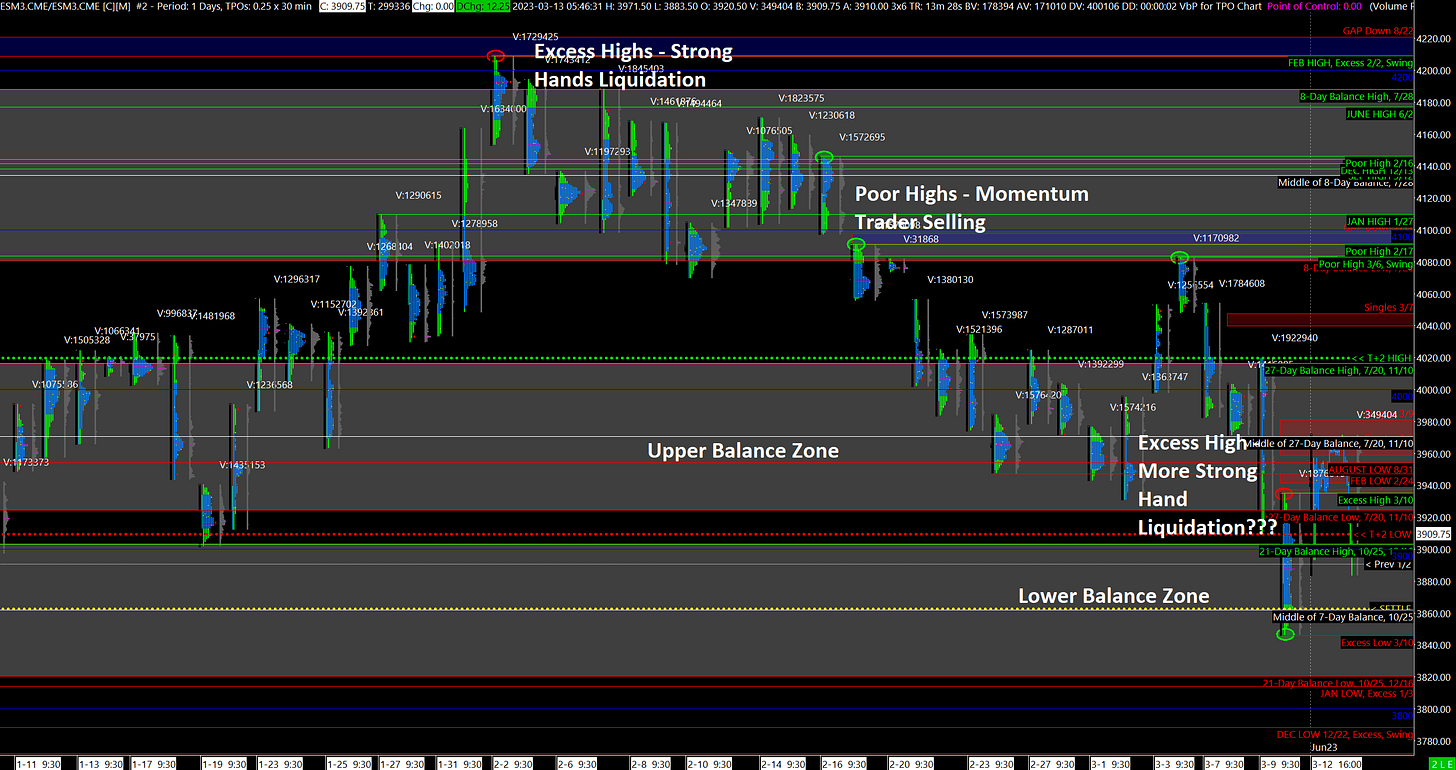

S&P 500 Futures Market Profile Insights for Today

Near-Term Outlook: Potential Longer-Term Investor Liquidation following Major Event

The last two days of last week were dominated by the collapse of SVB, one of the biggest bank collapses in US history and the most significant since the 2008 Financial Crisis. SVB is a subsidiary of SIVB 0.00%↑, which is an S&P 500 component, but more importantly, the collapse quickly fired up speculation that the US financial sector may be in poor health, which sent the financial sector tumbling (XLF 0.00%↑) in a broad sell-off that impacted nearly the entire market.

Last night, the market opened to a violent short-covering rally, but most of that has already been given back by the market (remember, short-covering often weakens a market). Currently the ES is in no man’s land, in between 2 major Balance Zones - whichever one is accepted will likely guide where the market will go next:

Bearish: the lower Balance Zone is accepted and the reasonable target becomes its lower end at around 3820

Neutral/Bullish: the upper Balance Zone is accepted. In that case, it will be more important to monitor for continuation as for a truly Bullish outlook the market will have to chew threw the Trapped Long positions above (the 3 red boxes on the chart)

Potential Market-Moving Events

Today - None

Later this Week: CPI (Tue), PPI (Wed)