GDR Model Weekly Insights for Mon 19 Dec 2022

GDR is now in Transition Mode. Market Profile suggests odds are for further downside early this week

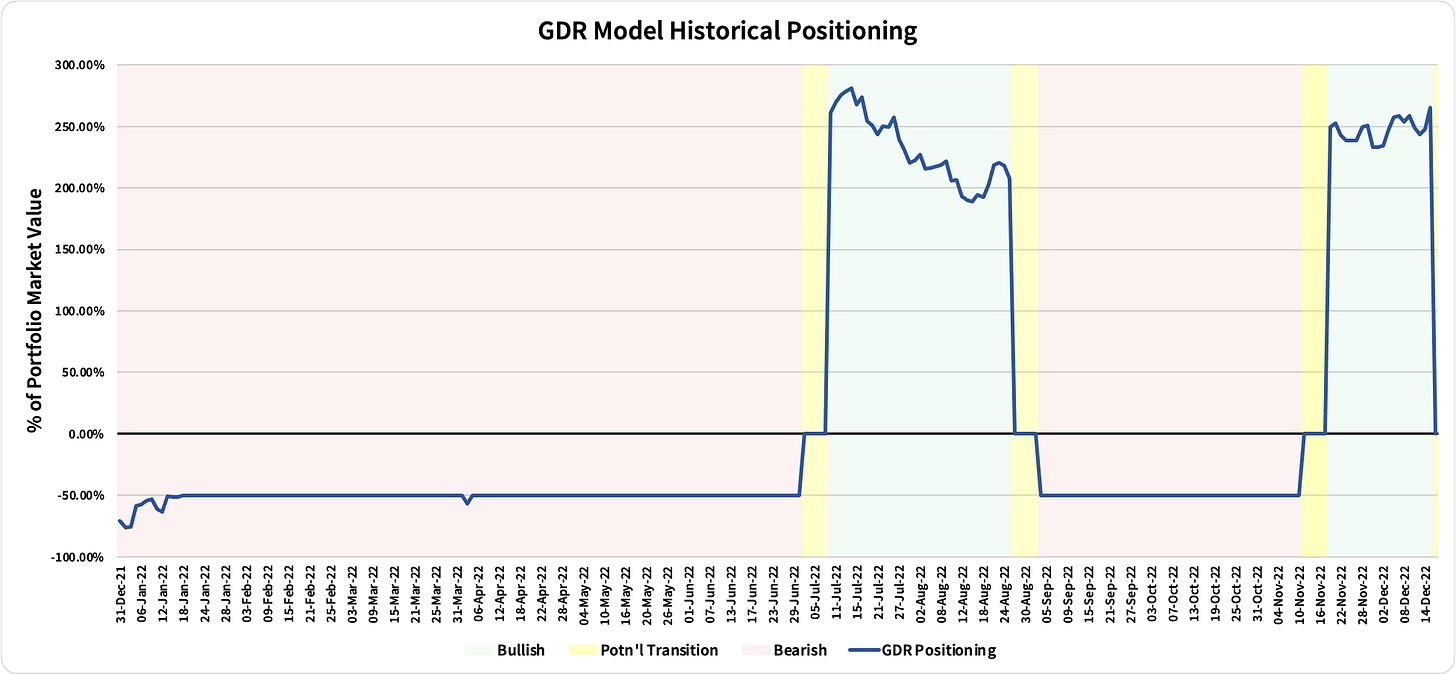

Review: 2022 Performance as of the close of 16 Dec 2022

GDR Model: +13.73%

S&P 500 Total Return: -17.88%

Information Ratio: 2.12

GDR Model Insights for the Week Ahead

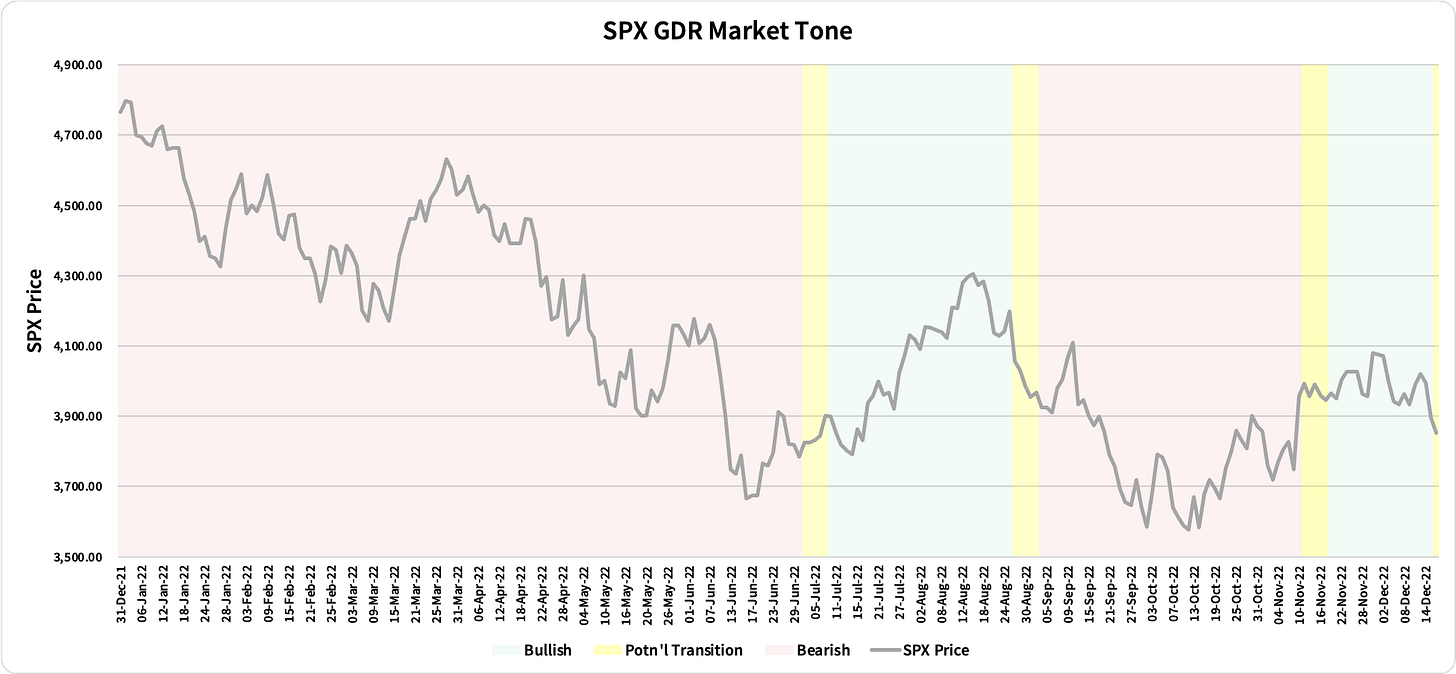

Market Tone: Potential Transition to Bearish (previous week: Bullish)

Positioning: 0.00% Flat (previous day: +265.52% Long)

Commentary: GDR’s Market Tone is now Potential Transition to Bearish. While in Transition states the Model goes Flat for the duration, it is reasonable for traders/investors who are confident in the potential for Bearishness to start building a Short position this week

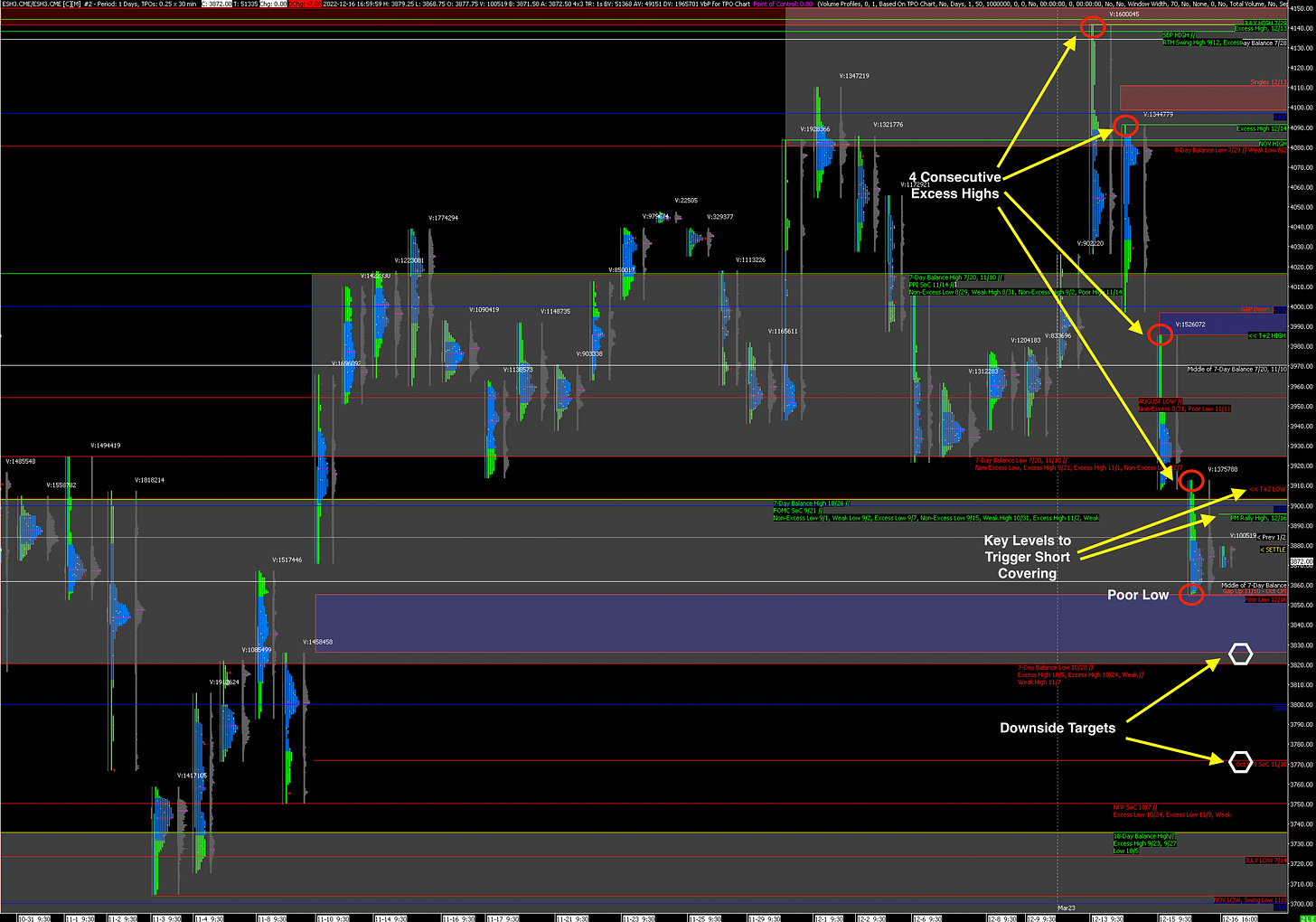

S&P 500 Futures Market Profile Insights for Tomorrow

For the second consecutive day the ES closed with a Poor Low that is in need of repair, therefore there are greater odds that there is yet more downside to come early this week. The logical targets below are around 3826, i.e. closing the Gap Up from the CPI release in November, and then around 3772, which is where the rally that created the Gap Up started.

There is a chance that inventories may be too short. The key levels that serve as a tip off would be the Afternoon Rally High from Friday at around 3896, and the T+2 (Settlement) Low just below 3910. Accepting above these levels would raise the odds of a near-term short-covering rally that would postpone repair of the Poor Low.

On a sidenote, it seems like the market’s narrative has just about shifted from focusing on Inflation to Economic Slowdown/Recession fears.

Potential Market-Moving Events

Monday - None

Later this Week: GDP (Thu), PCE (Fri), Personal Spending (Fri)