GDR Model Weekly Insights for Mon 21 Nov 2022

GDR Model is now Bullish as we head into Seasonally Favorable Thanksgiving Week

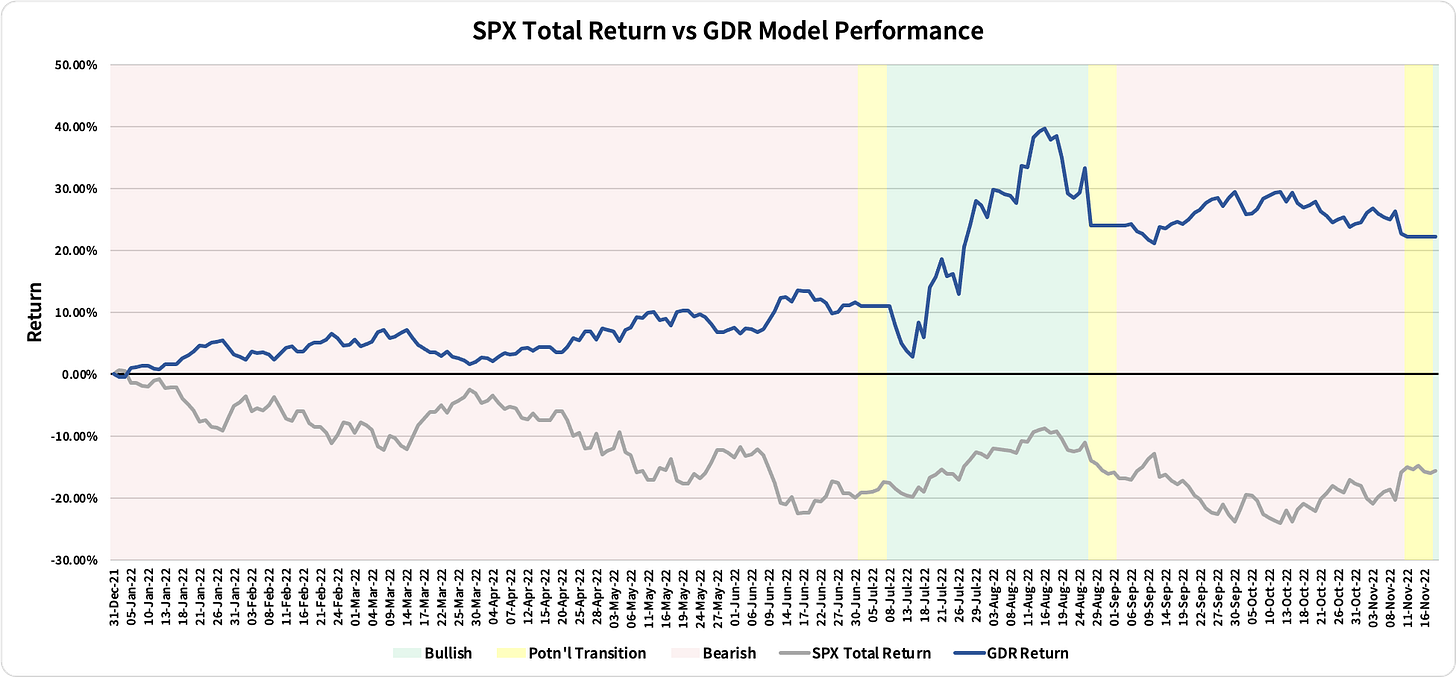

Review: 2022 Performance as of the close of 18 Nov 2022

GDR Model: +22.21%

S&P 500 Total Return: -15.60%

Information Ratio: 2.50

GDR Model Insights for the Week Ahead

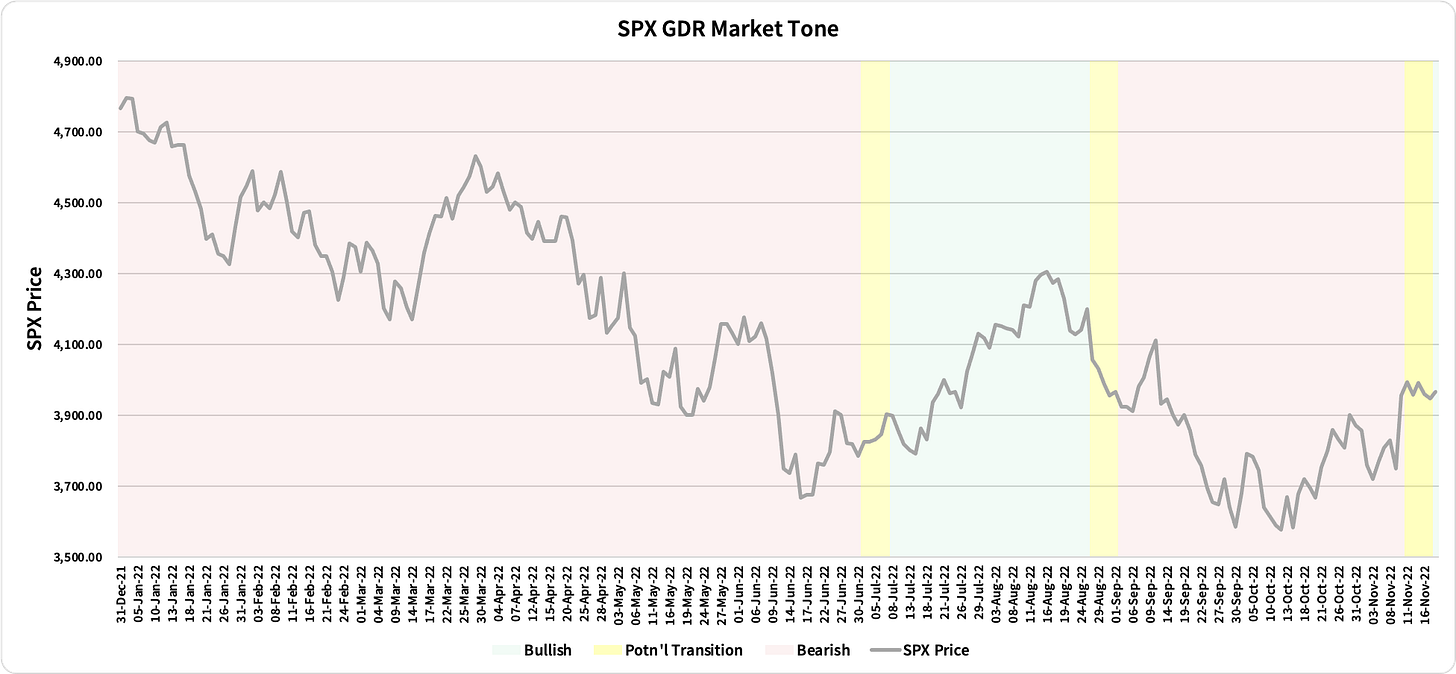

Market Tone: Bullish (previous week: Potential Transition to Bullish)

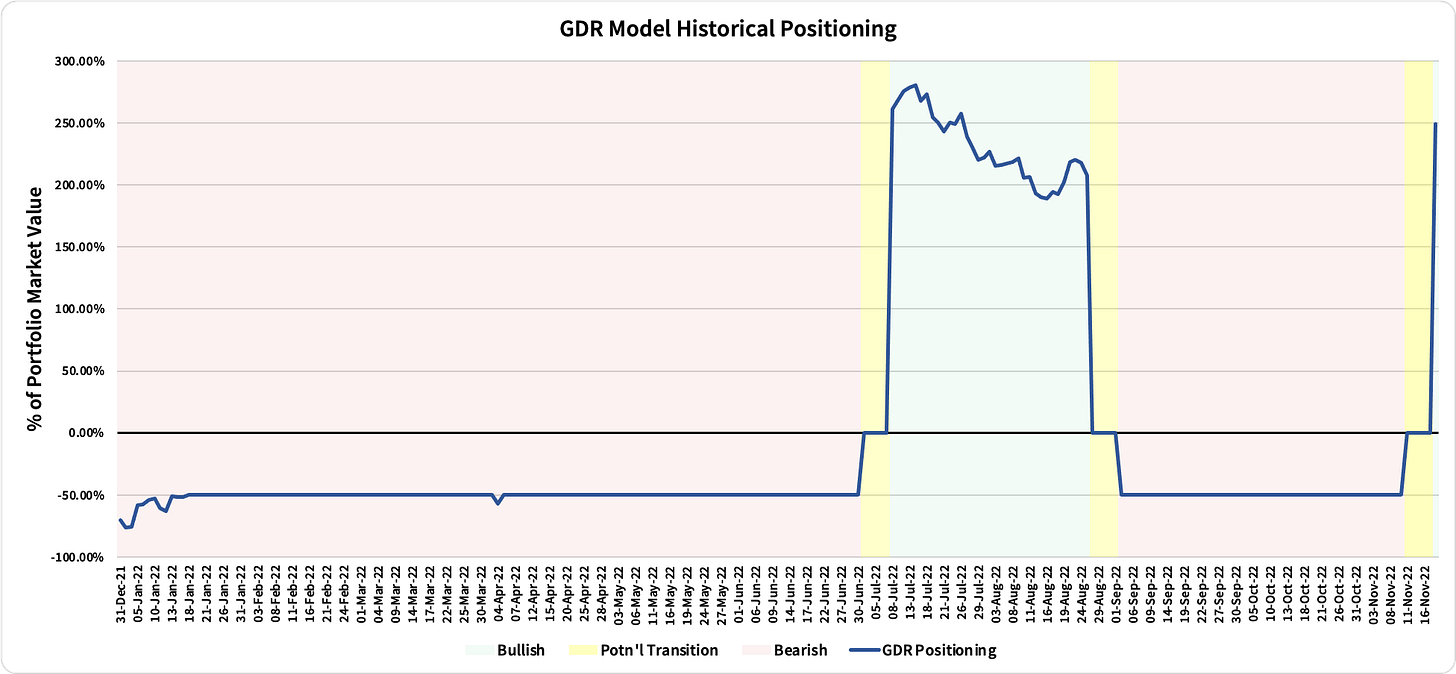

Positioning: +249.52% Long (previous day: 0.00% Flat)

Commentary: GDR Model has now completed its transition to Bullish. Typically Bullish signals have tended to last for at least 12 months, but the length of the most recent Bullish period from this summer shows that that doesn’t have to be the case so I’ll take this one week by week. If you are following GDR’s Positioning but are uncomfortable with leverage then going 100% Long is a perfectly reasonable alternative.

ES Market Structure Insights for Tomorrow

The first key aspect of next week to point out is that, due to the Thanksgiving holiday, it is a shortened trading week (no trading Thursday all day and Friday afternoon) and liquidity will be low. Nonetheless, a lack of liquidity does not imply rangebound trading, much on the contrary, trending moves often happen in thin markets. Moreover, seasonality has empirically favored positive returns during Thanksigiving week, although they tend to have vanished by the following week.

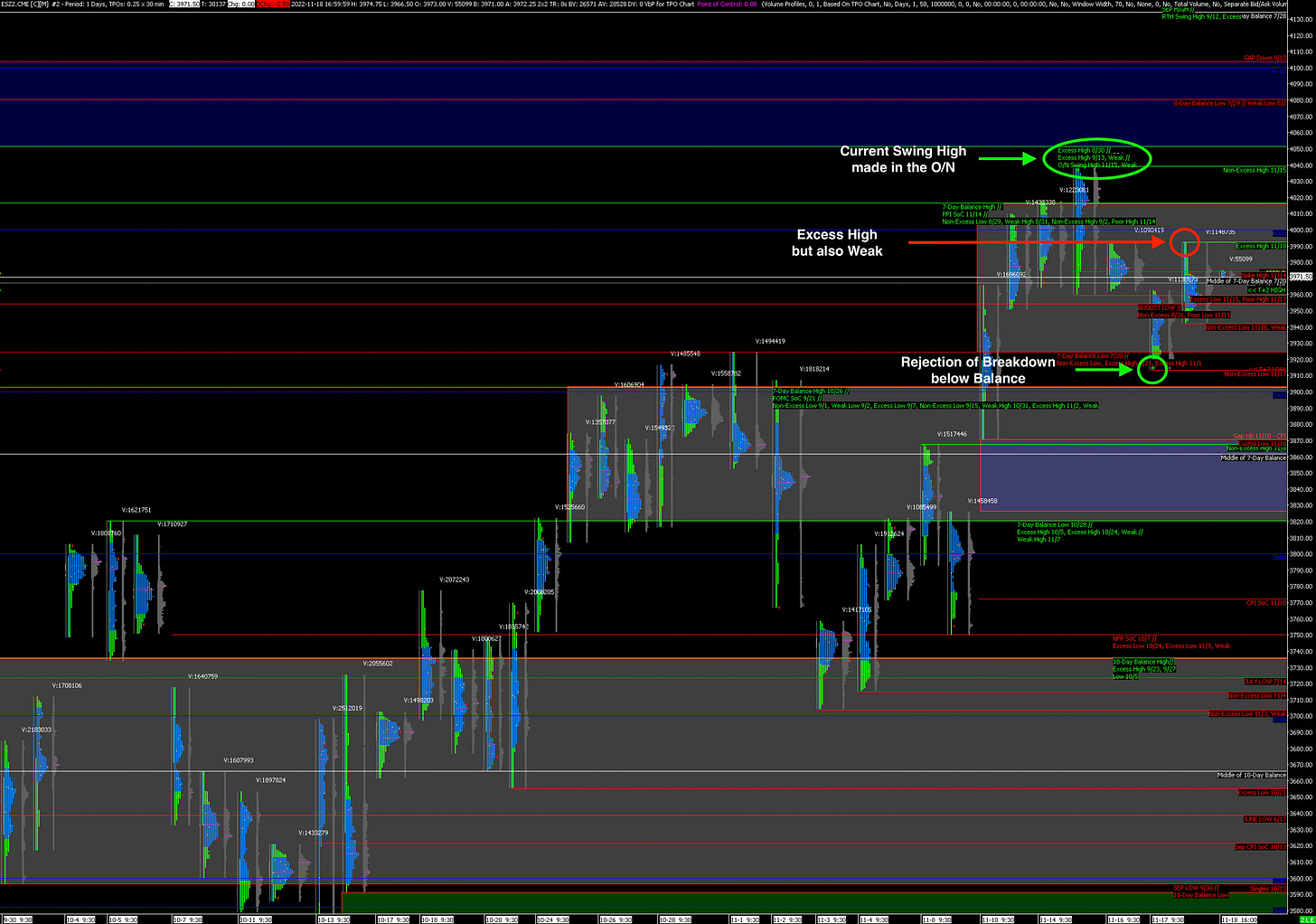

In terms of structure there are a few key markers to point out:

The most recent Swing High was made in the Overnight session of 15 Nov. When made during Globex, key swing highs/lows rarely last long without being re-visited during the US day session

On 17 Nov the ES rejected a break below the current Balance Zone (marked above in grey). This is a clear rejection of the Bearish idea

While the 11/18 High has Excess, typically implying it’s secure, it is also Weak as it matches the 11/16 almost to the tick, so don’t take the Excess for granted

For what it’s worth, the 11/18 Low is also Weak as it matches the 11/17 POC to the tick

Recent Lows (11/17 and 11/18) don’t have a lot of Excess

On balance, I would say structure continues to suggest further upside is the path of least resistance, but this isn’t exactly the most reassuring backdrop.

Potential Market-Moving Events

Monday - None

Later this Week: Initial Jobless Claims (Wed), FOMC Meeting Minutes (Wed), Thanksgiving - Markets Closed (Thu), Thanksgiving - Markets Close Early (Fri)