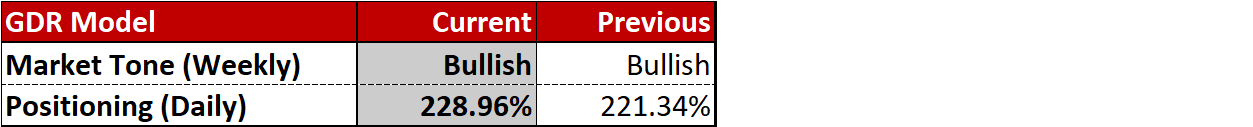

GDR Model Weekly Insights for Mon 6 Feb 2023

ES is having a Liquidation Break... Could it turn into more serious Bearishness?

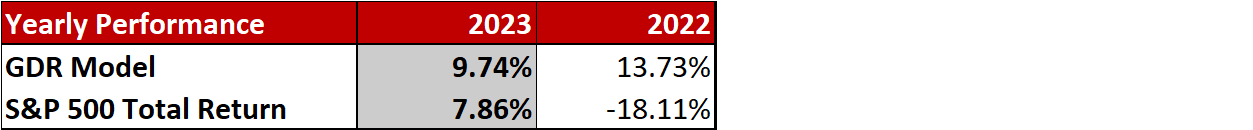

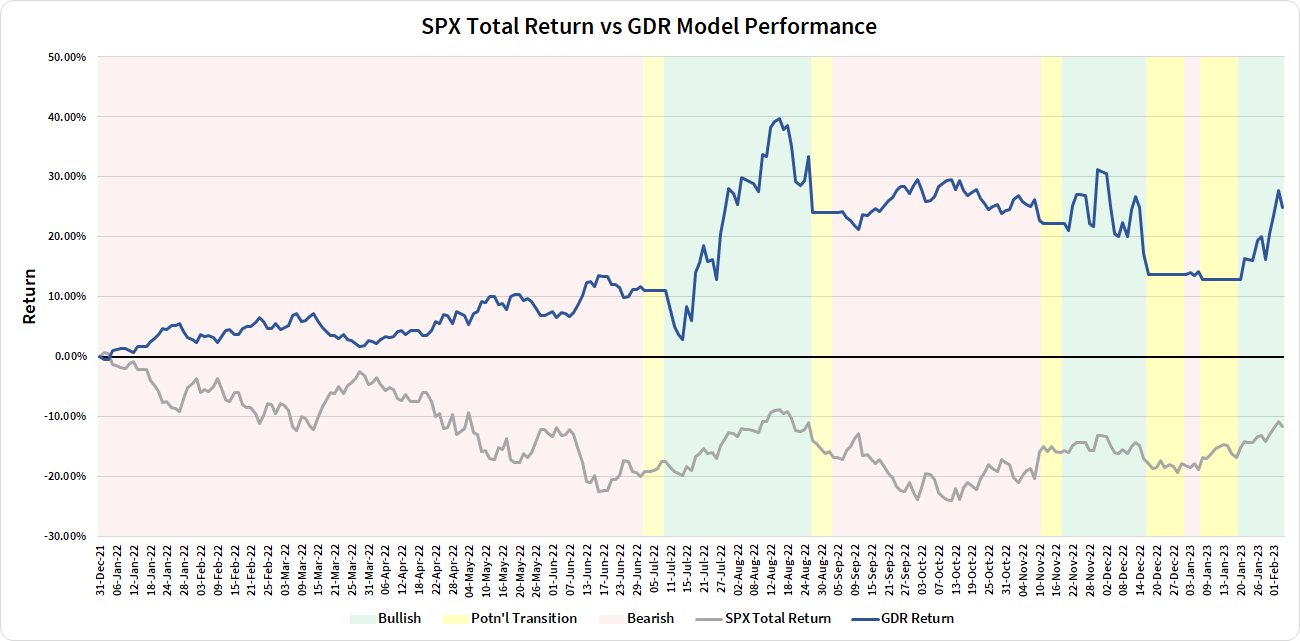

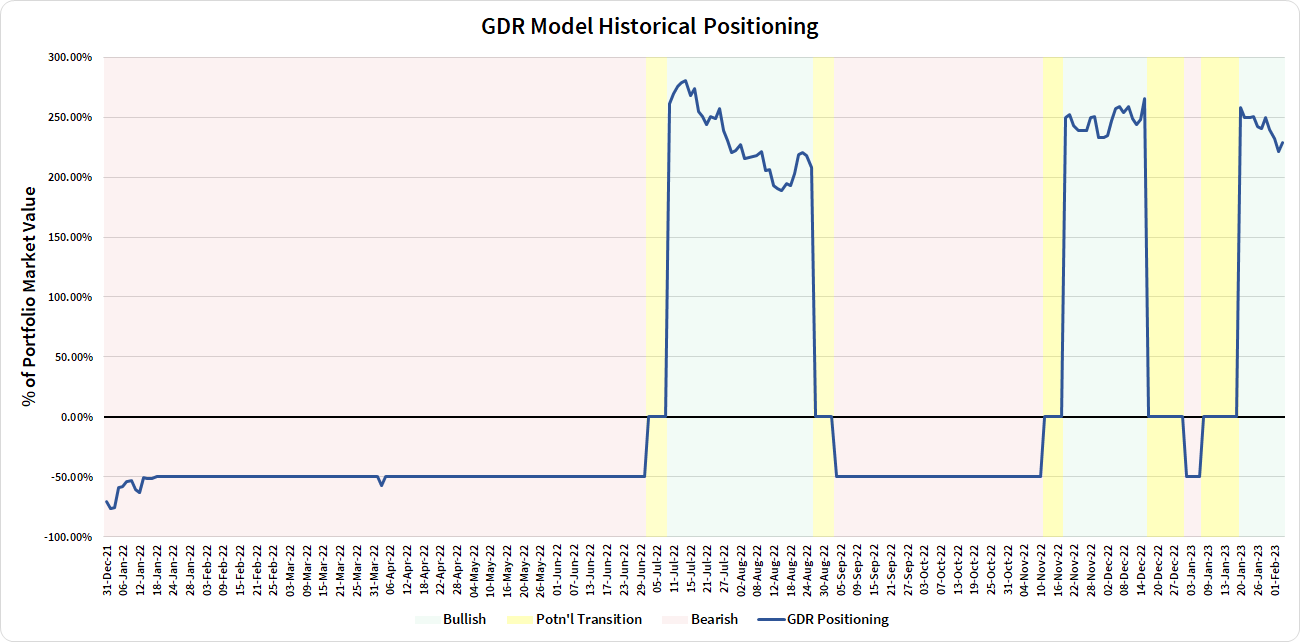

Review: Performance as of the close of 3 Feb 2023

GDR Model Insights for the Week Ahead

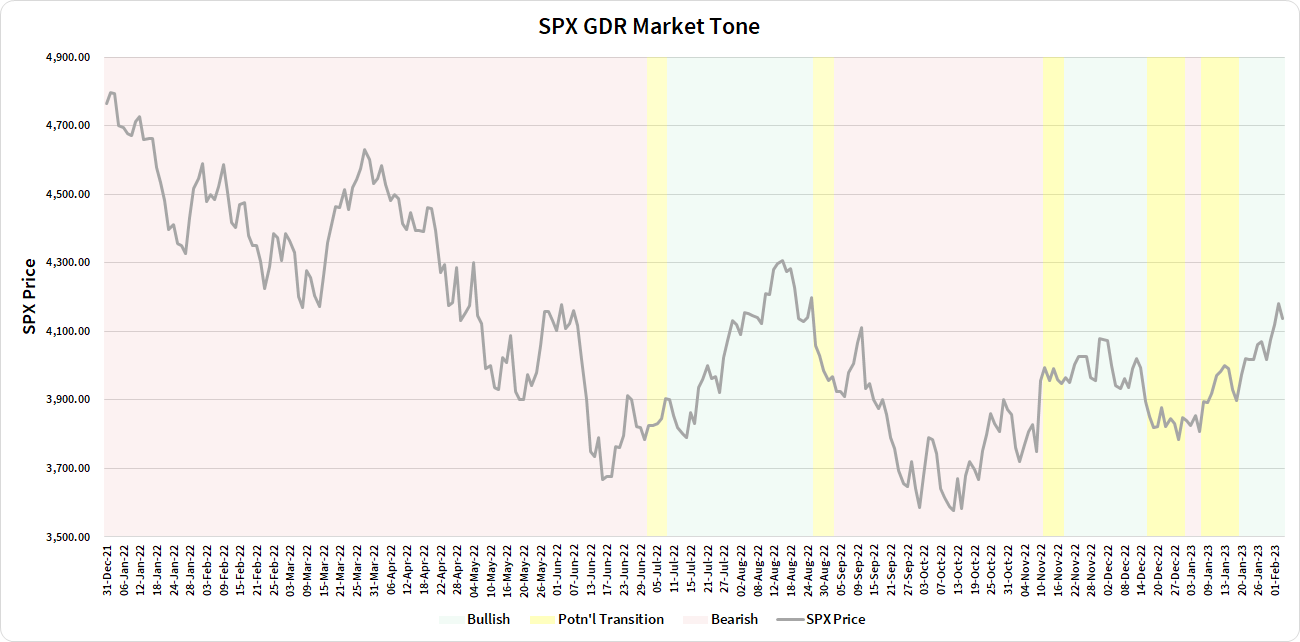

Commentary: the GDR Model has been strongly Bullish for a while, but seems to have ended the week on what seems more likely to be a pullback

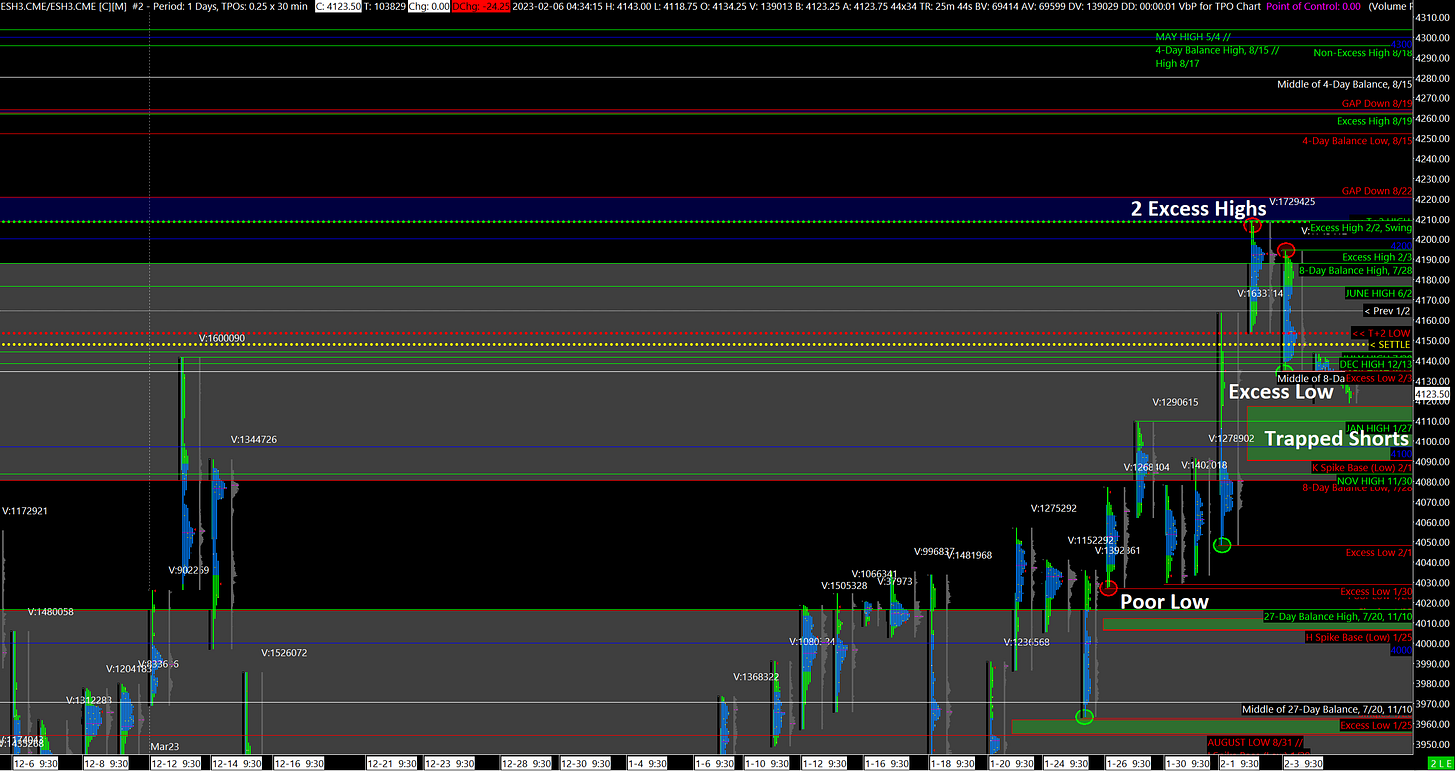

S&P 500 Futures Market Profile Insights for Today

Near-Term Outlook: Middle of Balance Zone, tilt Bearish

The market reacted negatively to the Unemployment Data released Friday morning. At the start of Regular Trading Hours (RTH), the ES rallied to attempt a breakout above the current Balance Zone and was rejected for the second time in a row before closing near the day’s Low. The two back-to-back Excess Highs in addition to the two consecutive failed attempts to breakout of the current Balance Zone are very compelling MGI suggesting the market is not (yet) ready to head higher.

While it’s entirely reasonable for the ES to correct the Poor Structure from Fed Day last Wednesday, it is critical that we carry in our minds the Poor Low from 1/26 that sits all the way down at 4026. I’m not suggesting you should expect the ES to reach that low, but do keep it in mind as a real possibility.

On the Bullish side, trading over the last couple of days suggests that so far this is only a Liquidation Break, in other words, a correction of inventories. Finding a way back above the December High (4142) is very important in the near-term.

Potential Market-Moving Events

Today - None

Later this Week: Fed Chair Powell Speaks (Tue), Michigan Consumer Sentiment (Fri)