GDR Model Weekly Insights for Mon 30 Jan 2023

Market Profile suggests there are very high odds of an imminent Liquidation Break

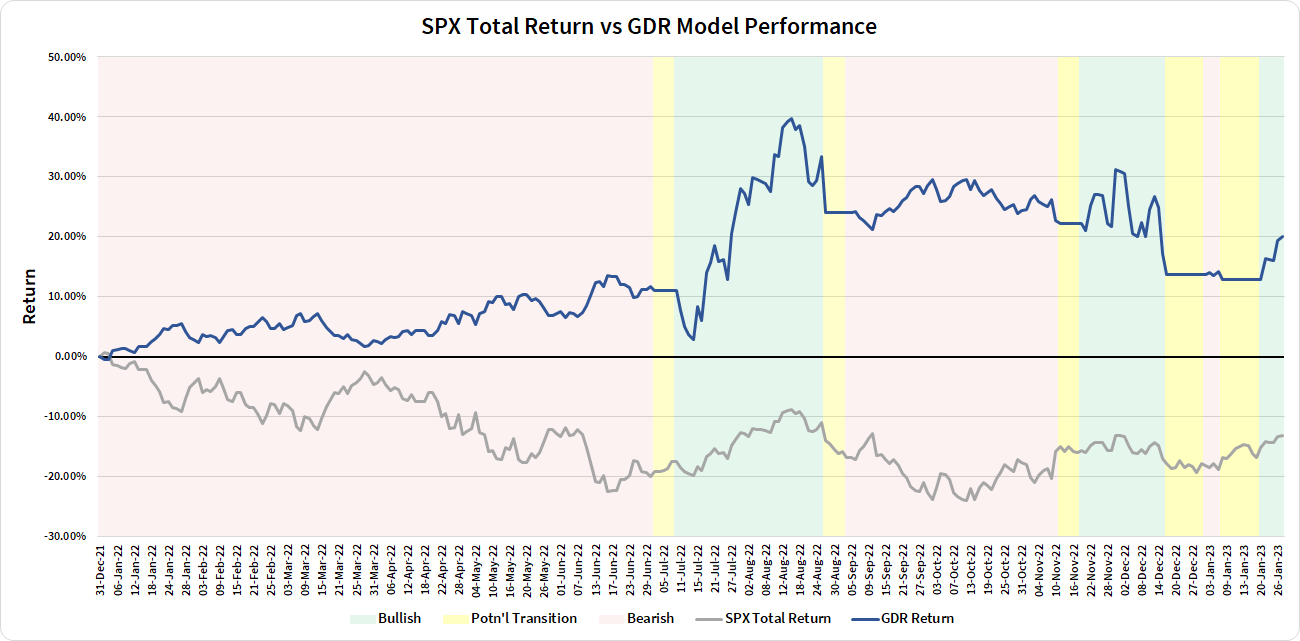

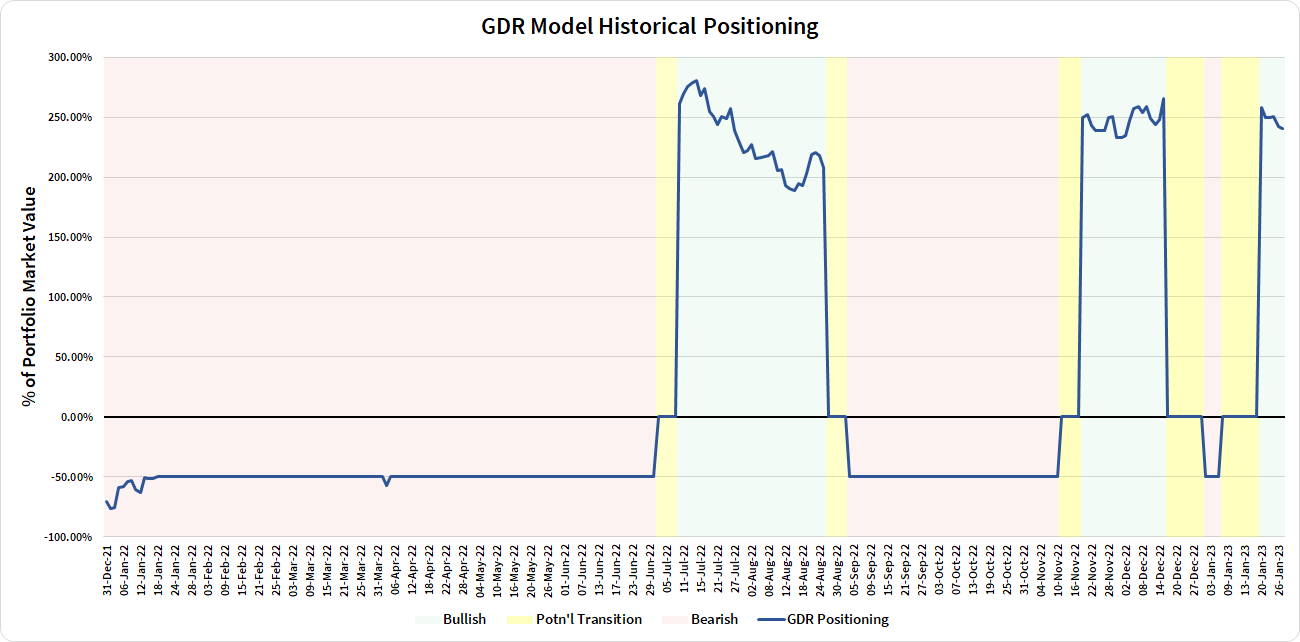

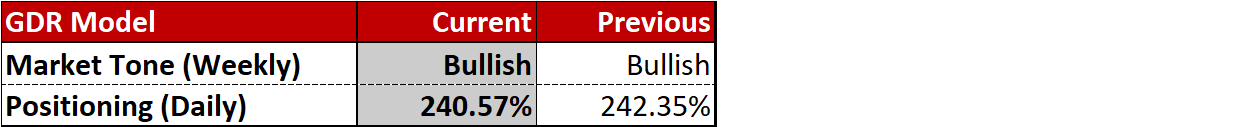

Review: Performance as of the close of 27 Jan 2023

GDR Model Insights for the Week Ahead

Commentary: GDR has remained strongly Bullish. The model will remain long until this changes definitively

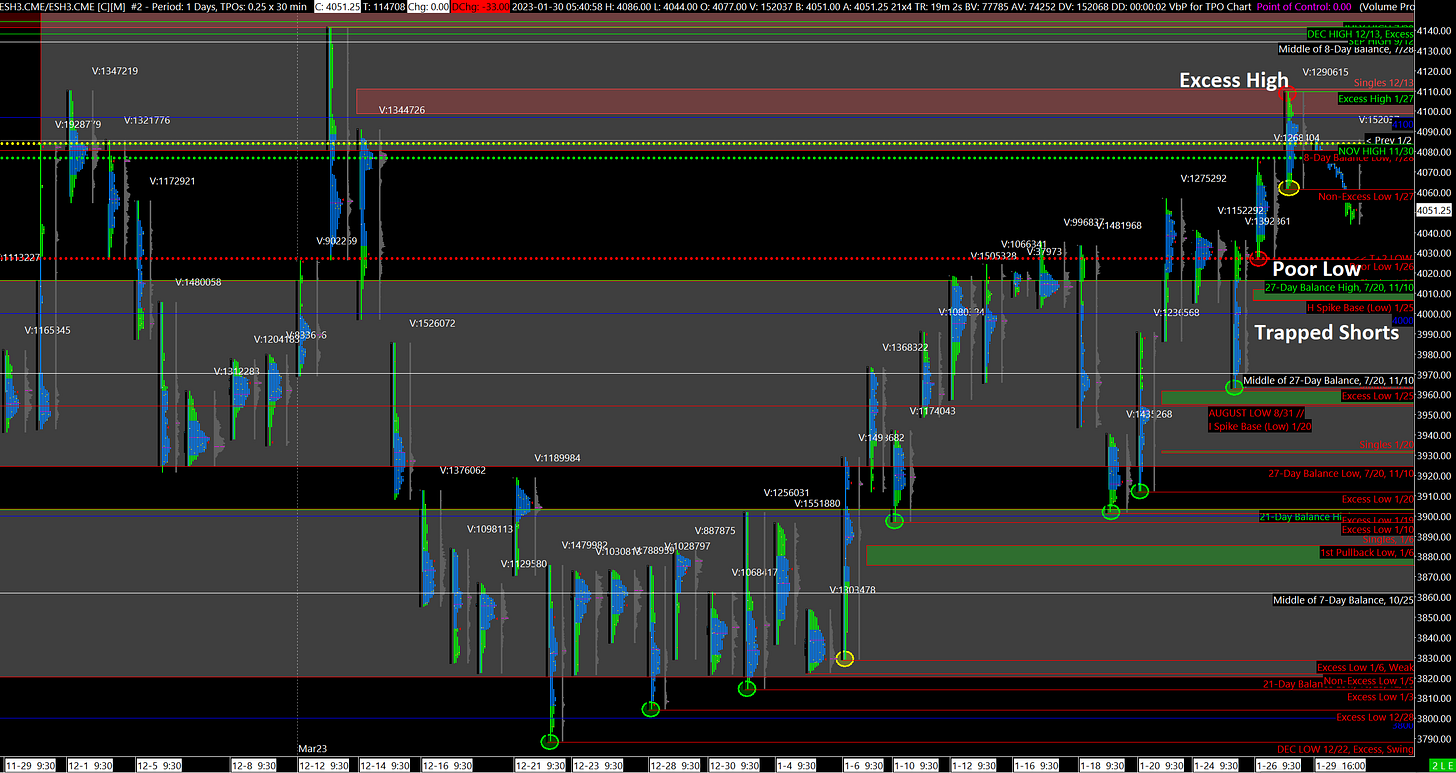

S&P 500 Futures Market Profile Insights for Today

Near-Term Outlook: Structure in Need of Repair, Potential Liquidation Ahead

Over the last several trading days, longer timeframe investors have shown little interest in the market, which has made the most recent leg of the current rally extremely fragile. We now have a combination of Poor Low and Excess High, which raises odds exponentially of the market having at least a Liquidation Break soon.

Broadly speaking, I would argue there are two scenarios to keep in mind for this week:

Bullish: the Liquidation Break mentioned above happens before Wednesday allowing overly long inventories to correct ahead of the Fed meeting and giving the current rally a fighting chance to continue on

Bearish: short-term, weak-hands traders keep pushing the market higher until Wednesday, which would give greater odds to a Bearish reaction to the Fed’s Interest Rate announcement

Finally, a reminder that in terms of releases this week is a busy (and potentially volatile) one with the Fed Interest Rate Decision, Unemployment Data, and roughly 20% of the S&P 500 reporting earnings, including AAPL 0.00%↑ , AMZN 0.00%↑ , and GOOG 0.00%↑.

Potential Market-Moving Events

Today - None

Later this Week: Fed Interest Rate Decision (Wed), Nonfarm Payrolls (Fri)