GDR Model Weekly Insights for Mon 28 Nov 2022

GDR Model is solidly Bullish and market structure suggests continued upside - Santa rally coming?

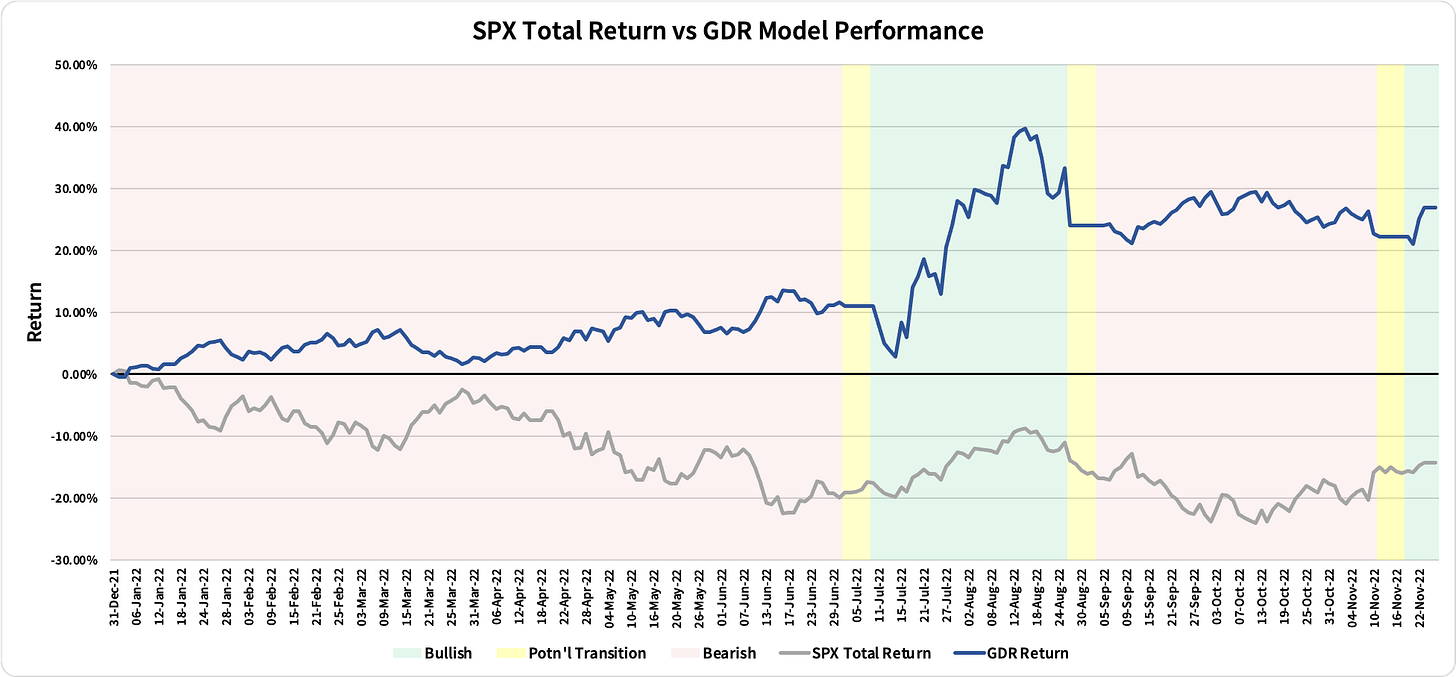

Review: 2022 Performance as of the close of 25 Nov 2022

GDR Model: +26.88%

S&P 500 Total Return: -14.29%

Information Ratio: 2.73

GDR Model Insights for the Week Ahead

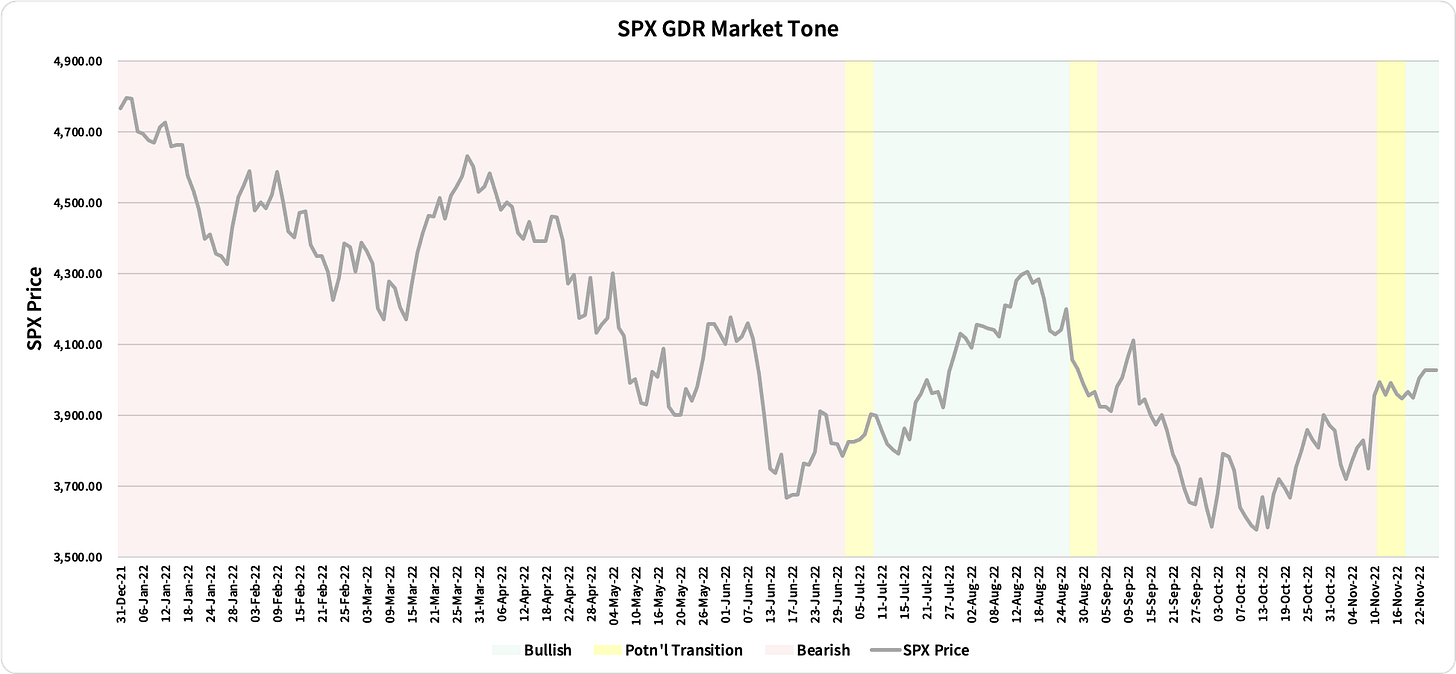

Market Tone: Bullish (previous week: Bullish)

Positioning: +238.68% Long (previous day: 238.47% Long)

Commentary: GDR Model is solidly Bullish at this point. These signals tend to persist for some time and the best risk-adjusted returns come from staying long. If you wish to follow the model but are uncomfortable using leverage, it is perfectly ok to go long up to 100% of your portfolio’s market value instead.

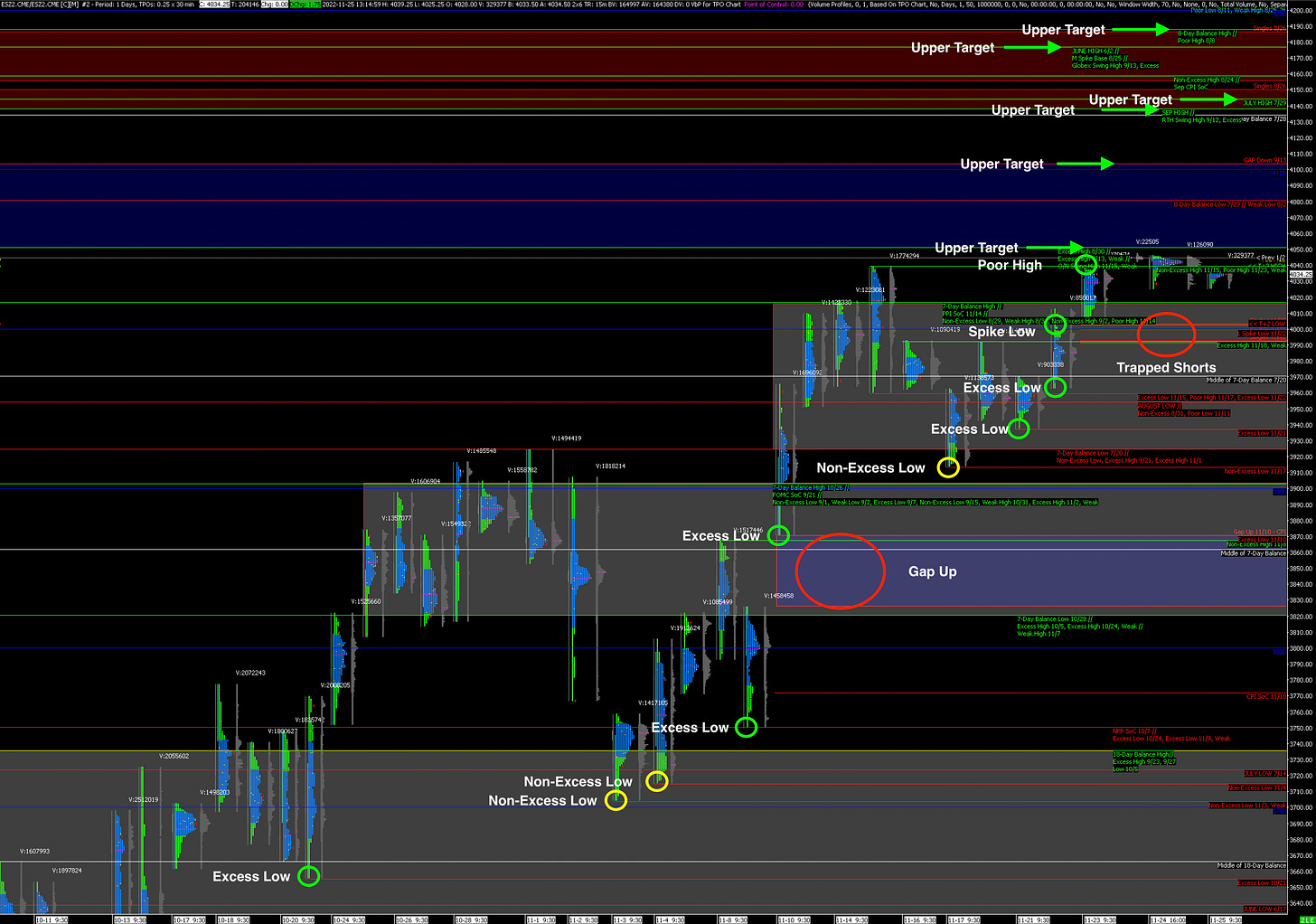

S&P 500 Futures Market Structure Insights for Tomorrow

To start the week off I will provide a recap of the market structure over the last month. Green markers are Bullish while red ones are Bearish. The yellow markers are most likely insignificant but it’s useful to remain aware of them. A cursory inspection makes it obvious why the current market structure points to further upside as Bearish markers are few and far between.

This is not to say that the only way is up, much on the contrary. Most seasoned traders would say that market conditions can and do change on a dime. Ultimately market structure only highlights where the highest probability trade is, although it’s far from providing any sort of certainty.

ES futures are currently holding a breakout from a Balance Zone, albeit during thin holiday trading. Holding above this Balance Zone will be key tomorrow for further upside. If the market finds supply and dips lower then the most likely scenario is that we return to the most recent Balance Zone and hang out there for a bit longer.

Potential Market-Moving Events

Monday 12:00pm - FOMC Member Bullard Speaks, FOMC Member Williams Speaks

Later this Week: CB Consumer Confidence (Tue), ADP Nonfarm Employment Change (Wed), GDP Revision (Wed), JOLTs Job Openings (Wed), Fed Chair Powell Speaks (Wed), PCE Price Index (Thu), Nonfarm Payrolls (Fri)