GDR Model Weekly Insights for Mon 7 Nov 2022

The GDR Model is slowly turning more Bullish, but beware of volatility in the week ahead

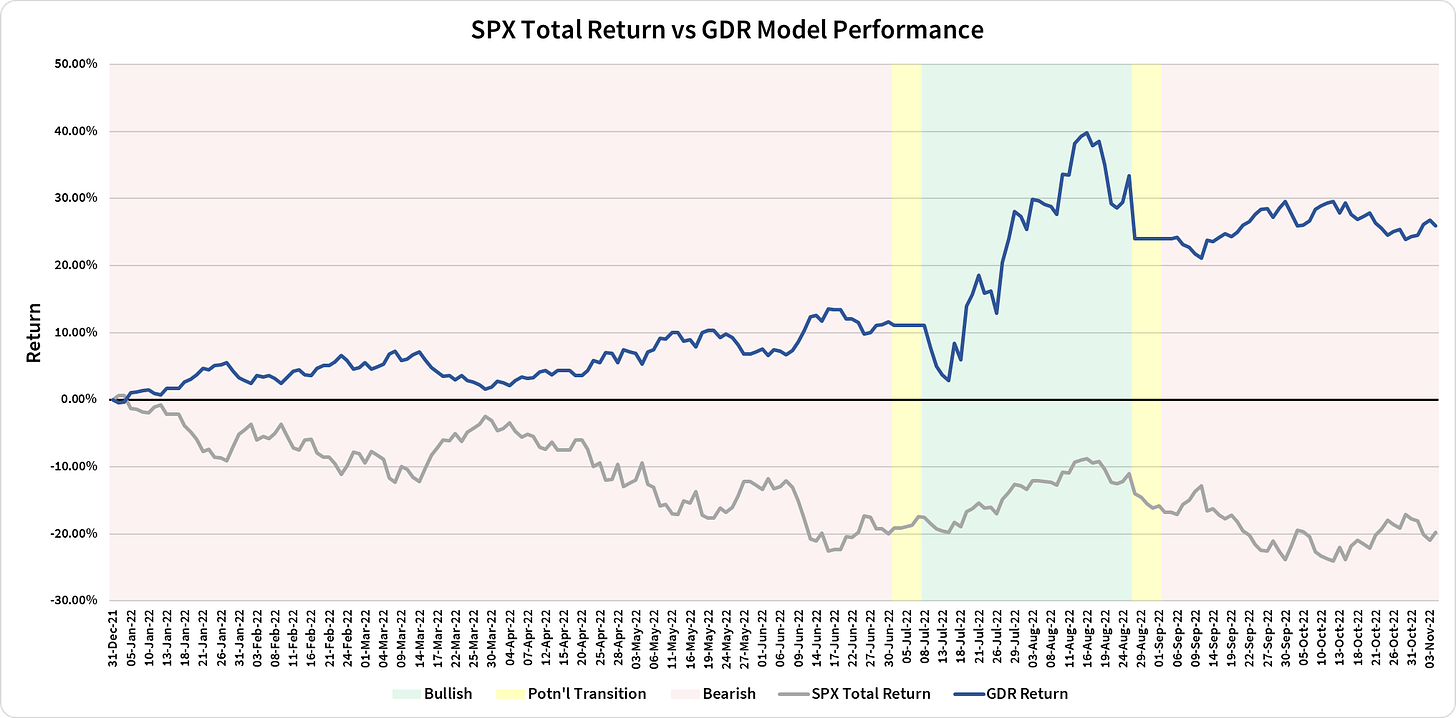

Review: 2022 Performance as of the close of 4 Nov 2022

GDR Model: +25.93%

S&P 500 Total Return: -19.83%

Information Ratio: 3.01

GDR Model Insights for the Week Ahead

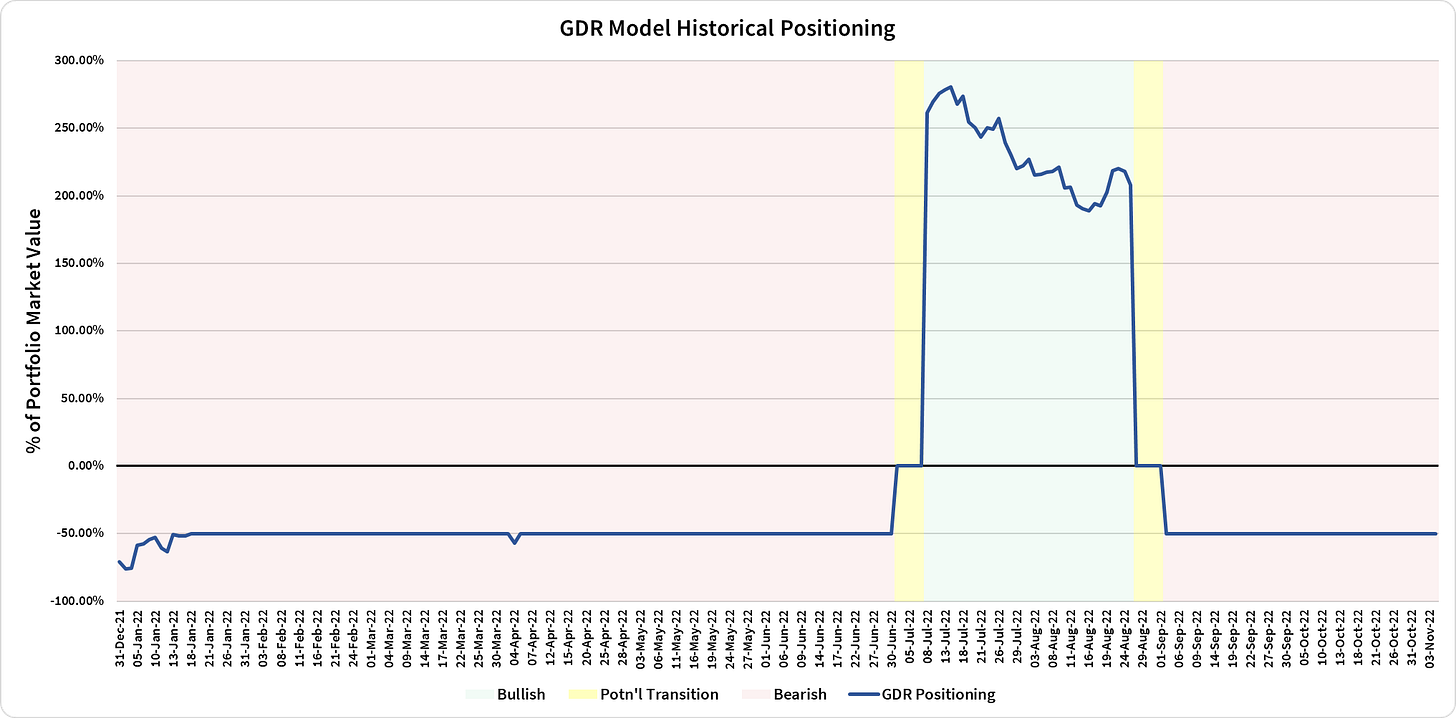

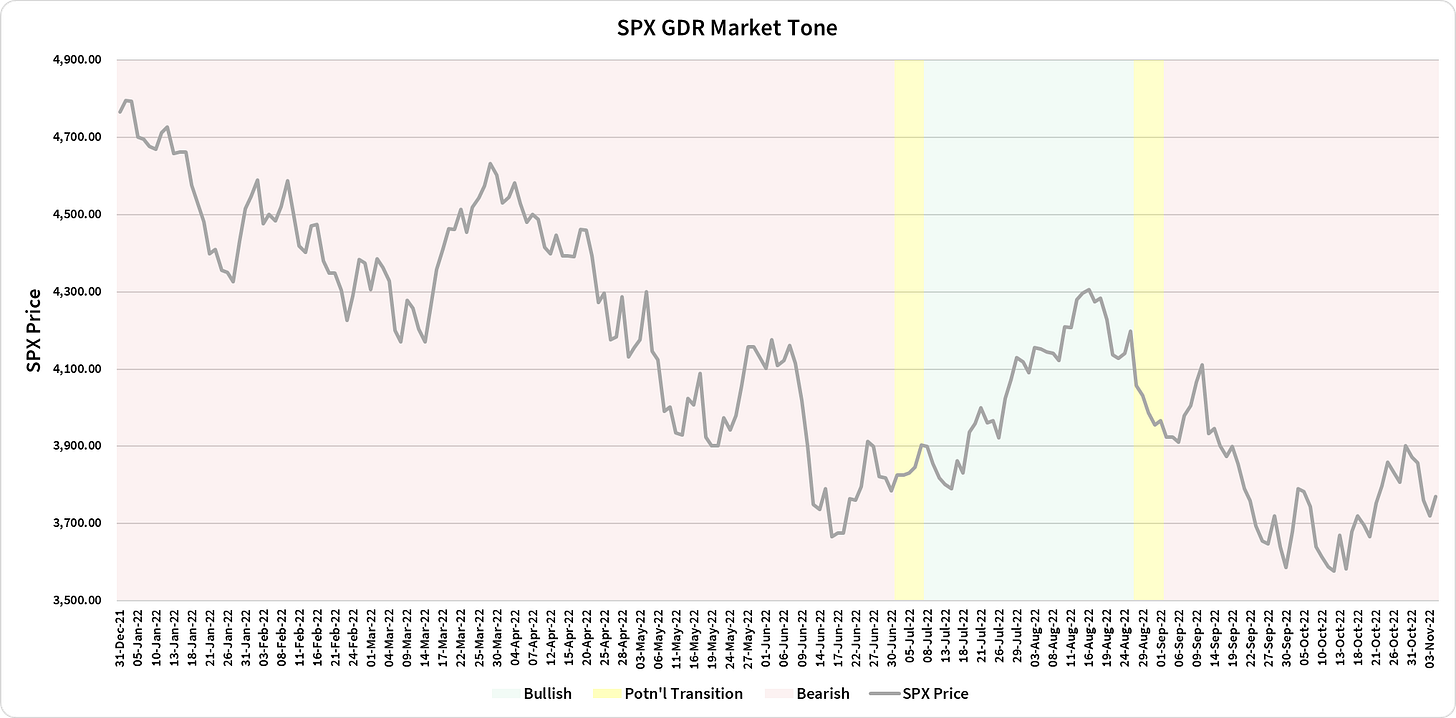

Market Tone: Bearish (previous week: Bearish)

Positioning: -50.00% Short (previous day: -50.00% Short)

Commentary: the GDR Model’s insistence on bearish positioning paid off last week. However, GDR has been steadily and slowly becoming more bullish. This week’s reaction to CPI data will likely be critical.

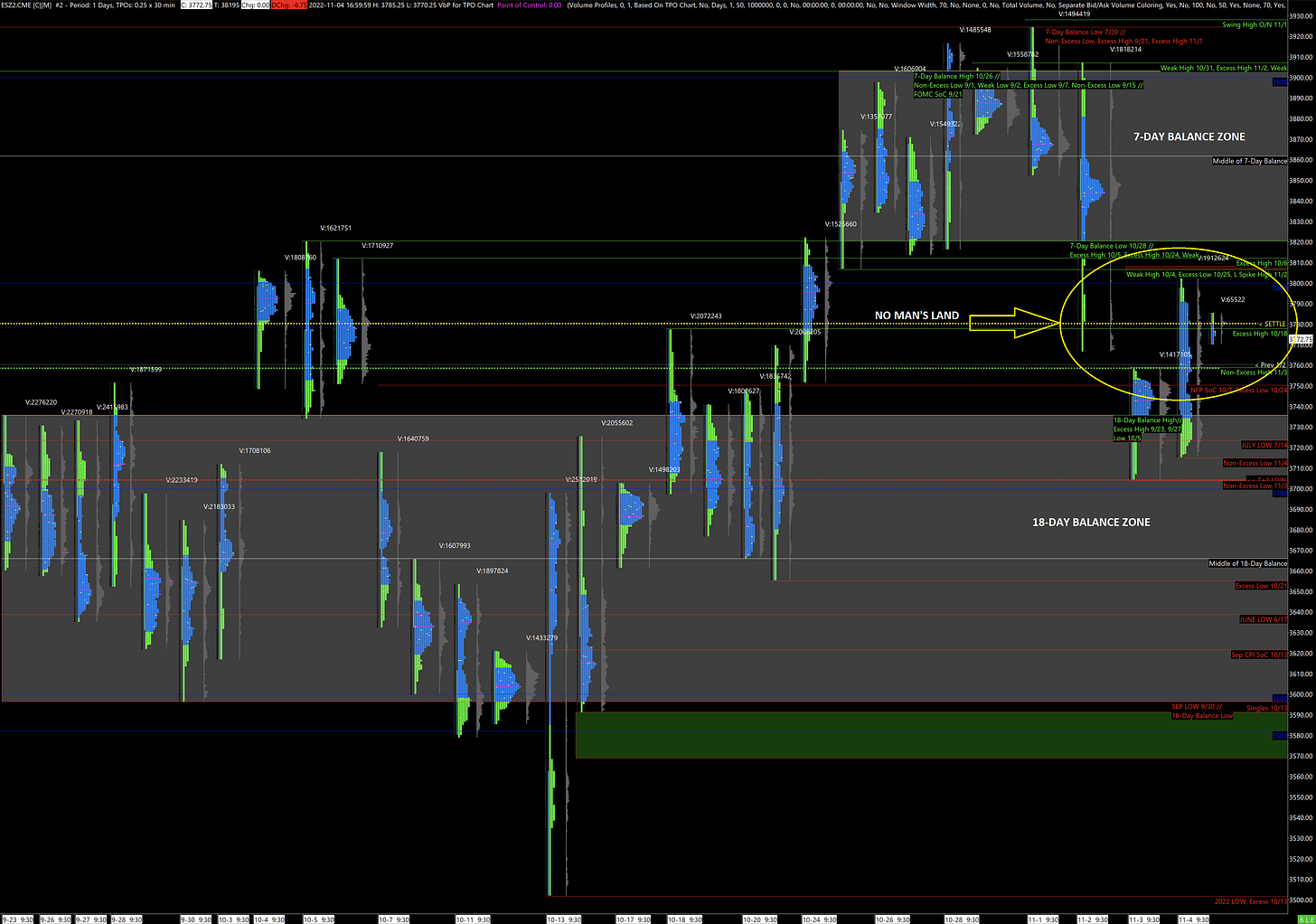

ES Market Structure Insights for Tomorrow

The ES is currently in no man’s land between two sizeable Balance Zones. This, along with sufficient markers on either side of unchanged make reading direction for the coming week challenging. Let’s recap:

Bullish Case:

The most recent swing high was made in the overnight session on 11/1 (3928)

The 11/1 day session high is weak as it coincides with the low of a 7-Day Balance Zone from mid-July (3925)

The 11/2 high is also weak - it roughly coincides with the 10/31 high (3907)

The 11/4 high is weak as well becuase it matches the base of the 11/2 Spike down and the low from 10/25 (3806)

Bearish Case:

The low from 11/3 doesn’t have a lot of excess, which suggests weak-hands buying at the bottom (3704)

The low from 11/3 is also weak as it’s extremely close to a psychological price level (3700)

The low from 11/4 barely has any excess (3715)

The maintenance session after hours on 11/4 sold off nearly 10 handles

The 11/4 trading session was also a fairly emotional one and all this culminates in a tough-to-read week ahead. If I had to take a guess, I would expect the market to take out the 11/3 and 11/4 non-excess lows before ultimately heading higher again. However, with CPI data coming out at the end of the week volatility will likely continue to be high and waiting for the market to reveal its agenda probably will ultimately reward patient traders.

Potential Market-Moving Events

Monday 03:40pm - FOMC Member Mester Speaks

Later this Week: US Midterm Elections (Tue), CPI (Thu), Jobless Claims (Thu)