GDR Model Review: Q4 2025

Sometimes you lose with pocket aces but you still play them every time...

Sometimes you guess wrong. And sometimes, you guess right—and still come up short.

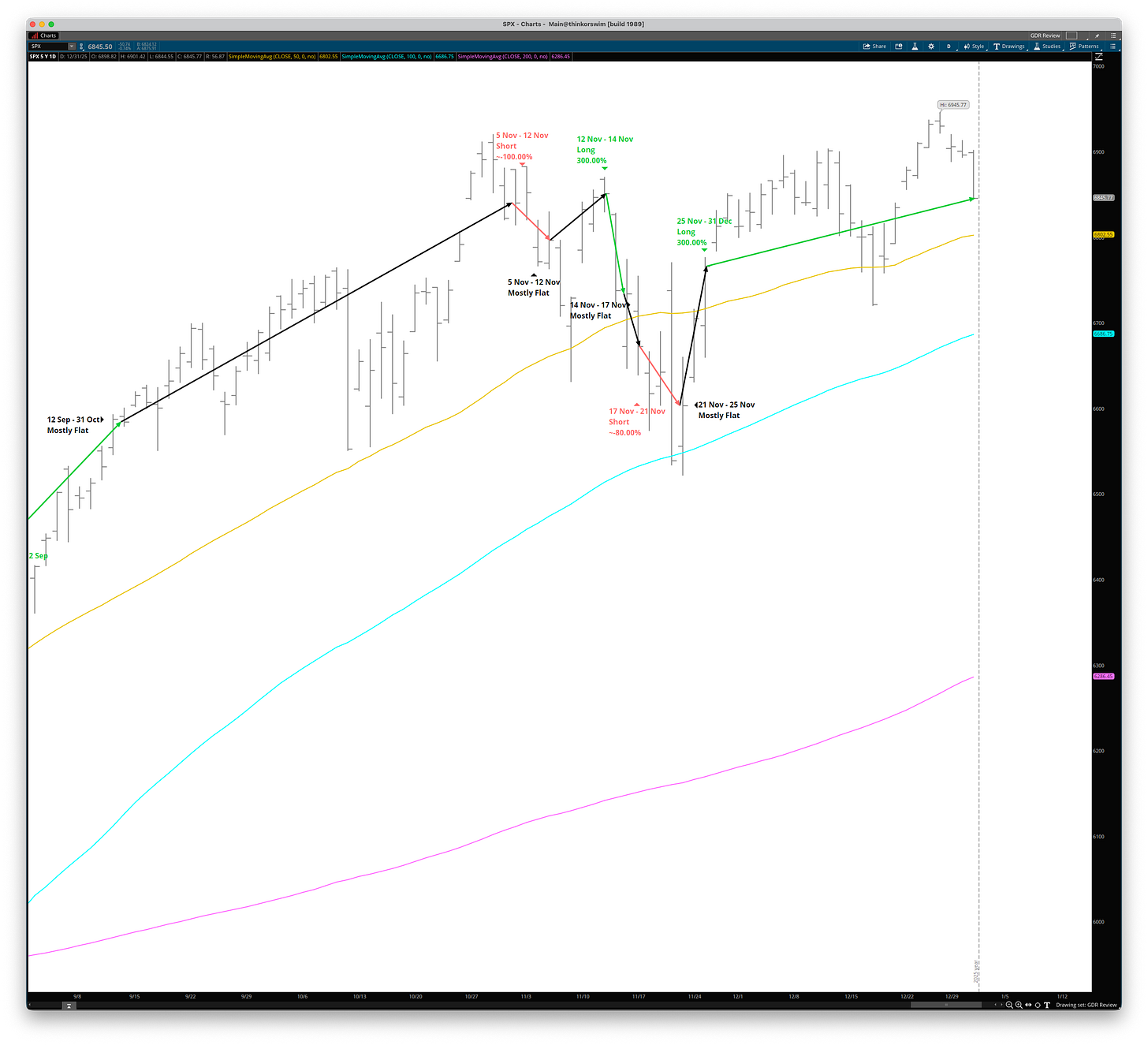

That’s what Q4 felt like for the GDR Model. In October, it correctly stayed cautious while the market pushed higher. In November, it spotted real strength—but just as it leaned in, the market turned. The reads were solid. The timing wasn’t.

These aren’t breakdowns—they’re just the cost of playing a probability game. Over time, it works. That’s how we end up with +71.50% for the year, even after a flat-to-down final quarter. But it’s also a reminder: good decisions don’t always come with good outcomes.

The GDR Model returned -0.48% vs the S&P 500’s Total Return of 2.65%, underperforming the index by 313 basis points in Q4 2025.

The model ended the year up 71.50% compared with the S&P 500’s Total Return of 17.88%. The model finished 2025 ahead by 5,362 basis points.

This was one of the rarest quarters where the GDR Model underperformed the S&P 500 index and posted a negative absolute return.

This was one of the rare quarters where the GDR Model underperformed the S&P 500 and posted a negative absolute return.

Most of the underperformance came from October, where the model stayed cautious despite a rising S&P 500. It correctly identified a weak or indecisive market, but the rally persisted anyway.

The majority of the negative absolute return came from a short-lived long position in mid-November. The model correctly picked up on market strength, but the day after it went long, the market turned down sharply.

Neither of these outcomes are bugs—they’re part of what happens when a model trades based on signal, not price. The signal was real. The follow-through wasn’t.