GDR Model Review: Q3 2025

Even when Steph Curry has missed five in a row, you still want him taking the next shot.

Steph Curry can miss five shots in a row and still take the sixth like it’s going in—and often, it does.

He’s not perfect. But the mechanics are. That’s why we trust his shot.

September felt like that for the GDR Model. The setup was there, but not every shot dropped. The model underperformed the market this quarter, which is rare—but the process didn’t break. In fact, it did exactly what it’s designed to do: recognize weakness and sit out when the odds aren’t favorable. And just like with Steph, the only way to keep hitting is to keep taking the right shots.

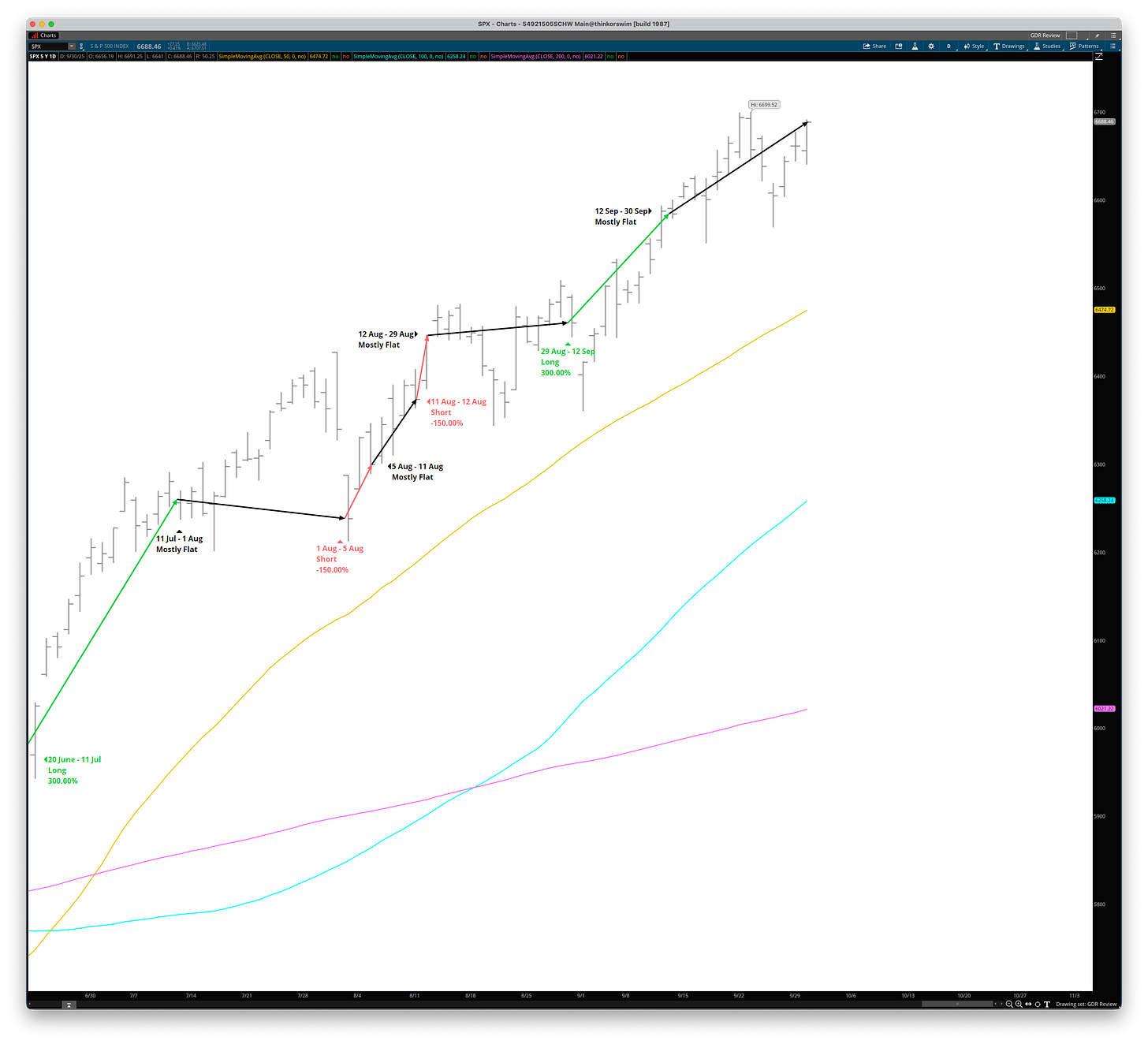

The GDR Model returned 4.76% vs the S&P 500’s Total Return of 8.12%, underperforming the index by 336 basis points in Q3 2025.

The model is up 72.33% year-to-date as of the end of Q3 2025 compared with the S&P 500’s Total Return of 14.83%. The model is ahead by 5,750 basis points.

This was a rare quarter where the GDR Model underperformed the S&P 500 index.

September was unusual: the market rallied from start to finish, but the model only participated in about half of it.

Still, the mechanics were in place. When the model detects underlying weakness, it stands down—even during a rally—because the odds of continuation are low.

Just like Steph Curry’s shot, the model’s logic is built on probabilities, not guarantees. Not every trade will go in. But that doesn’t mean it was a bad one.