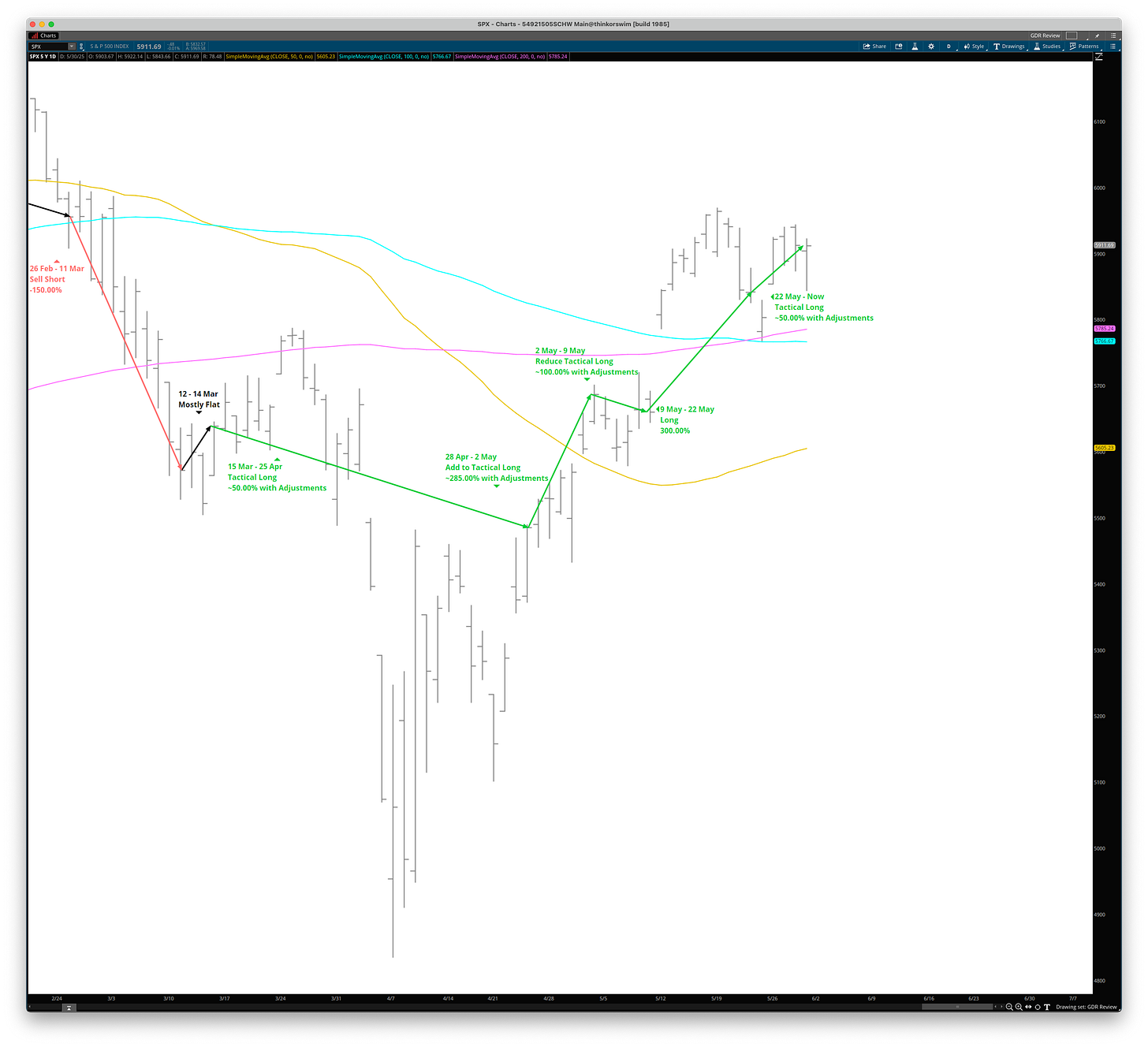

GDR Model Review: May 2025

The model's best performing month since inception

Most days, my 2-year-old Lab walks like she’s auditioning for the role of “world’s slowest sniff inspector.” But every now and then, she explodes into a sprint—ears flapping, leash taut, with me dragging behind like a poorly weighted ETF.

May was one of those sprint months for the market. And thankfully, the GDR Model didn’t trip over its own feet—it ran stride for stride with the market.

The GDR Model returned 15.02% vs the S&P 500’s Total Return of 6.29%, beating the index by 873 basis points in May.

The model is up 43.51% year-to-date as of the end of May 2025 compared with the S&P 500’s Total Return of 1.06%. The model is ahead by 4,245 basis points.

The model started out the month holding the tactical long at around 285% of the portfolio’s value, which was carried over from the end of April.

This long position was reduced to around 100% around a consolidation period early on in the month before the model boosted the long to 300% for the duration of the strongest upswing.

The month ended with a tactical long at around 50% when the market hit yet another consolidation period.

This was a straightforward bullish month and the GDR Model worked exactly as intended.