GDR Model Review: June 2025

The GDR Model doesn’t feel fear. That’s probably why it wins.

If I were trading this market on gut alone, I’d still be on the sidelines—arms crossed, muttering “this is crazy” while the S&P marched to all-time highs without me.

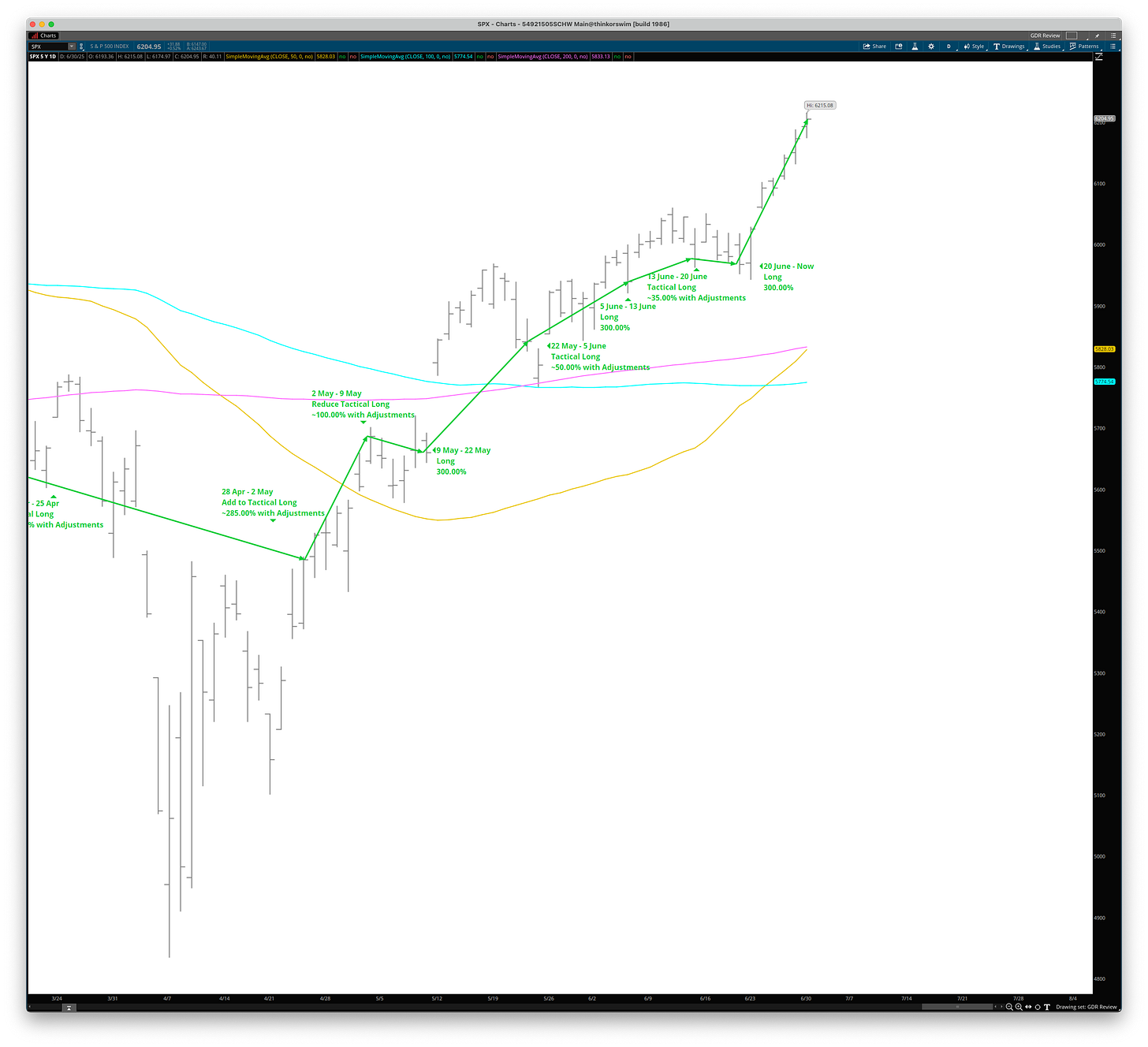

But the GDR Model doesn’t get emotional. It started going long in late April, right after Liberation Day spooked most of us into caution. And now, just halfway through the year, the model has already outpaced its strongest calendar year ever. I’ll be honest: I didn’t think we’d get here this fast. I’m just grateful I built something that doesn’t care what I think.

The GDR Model returned 14.62% vs the S&P 500’s Total Return of 5.09%, beating the index by 953 basis points in June.

Q2 was hands-down the strongest quarter for the model so far, posting a whopping 46.16% vs the S&P 500’s Total Return of 10.94%.

The model is up 64.49% year-to-date as of the end of June 2025 compared with the S&P 500’s Total Return of 6.20%. The model is ahead by 5,829 basis points.

Overall June was a straightforward bullish month. The model spent most of the time at 300% long, taking just a couple of brief reductions to allow for market consolidations.