GDR Model Review: July 2025

Prices show you posture. What the GDR Model sees is structure.

Our vet recently thought my dog might have hip dysplasia—her gait is a little swingy, and she sits kind of awkwardly. But when we took X-rays, her hips were perfect. Turns out, the way she moves isn’t a sign of a problem—it’s just… her.

July felt a bit like that. Prices looked strong, but the GDR Model picked up on something under the surface. It’s not trying to chase every upswing—it’s trying to read the X-ray, not the posture.

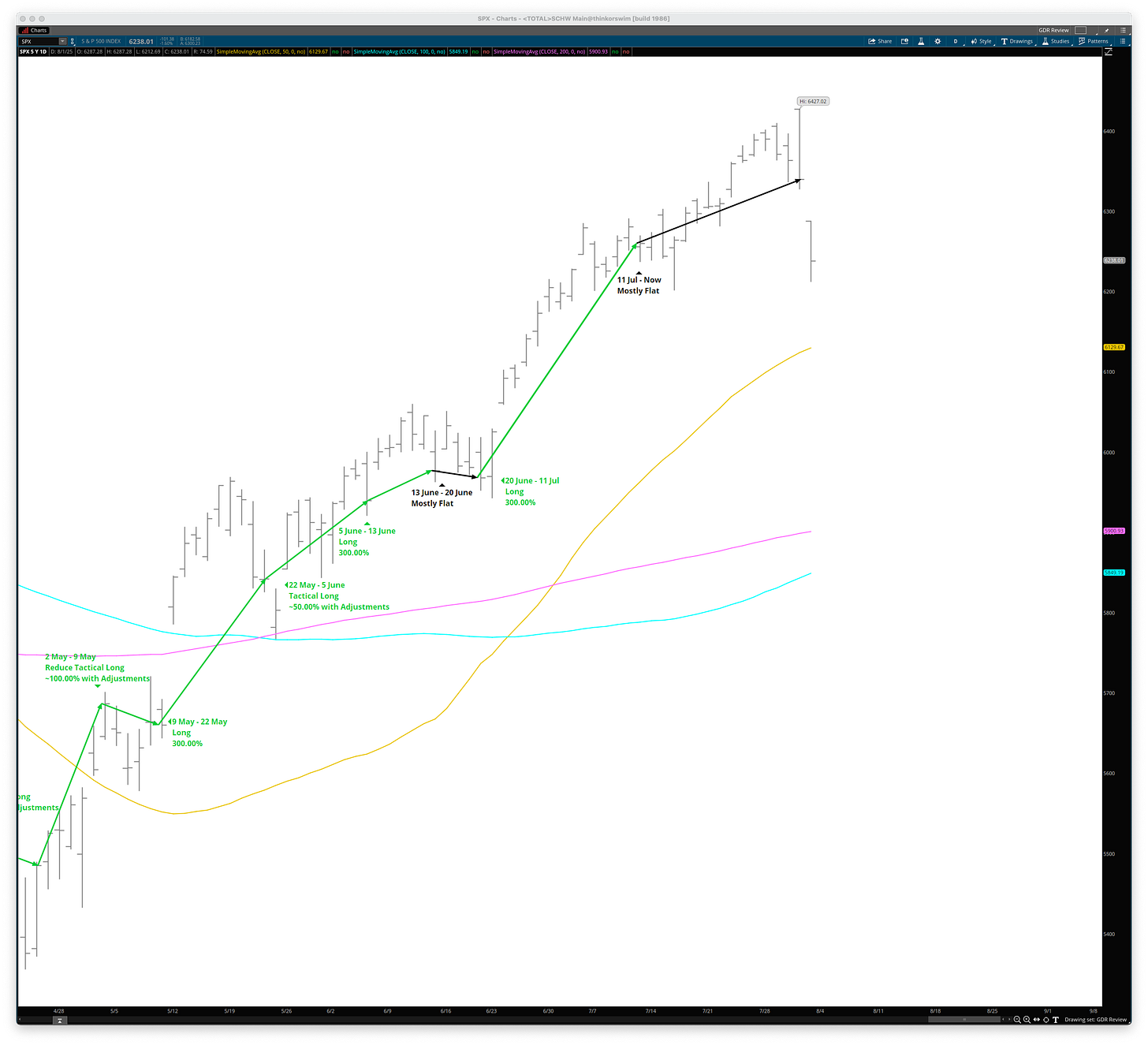

The GDR Model returned 2.80% vs the S&P 500’s Total Return of 2.24%, narrowly beating the index by 56 basis points in July.

The model is up 68.99% year-to-date as of the end of July 2025 compared with the S&P 500’s Total Return of 8.98%. The model is ahead by 6,001 basis points.

July started out strong and the GDR Model was 3x long almost through mid-month. This is where most of the modest outperformance from the month comes from.

However, just before mid-month, the model started detecting weakness in the market even though prices went up for the remainder of the month.

This month serves as two good reminders:

This is a model, which - assuming it’s a good one - is essentially a compressed version of reality. It’s definitely not a crystal ball, but rather more like an X-Ray - it allows us to have some insight into the markets, and yet it can’t show us everything or make us clairvoyant.

The GDR Model isn’t price-based. Moreover, asset prices are not an input at any point in the model. Therefore, it’s not meant to be long on every swing up or short on every sell-off. The model detects strength and weakness in the market and uses that to add risk in situations where odds are favorable.

The GDR Model certainly spoiled us to start this year, and boring month like this one was definitely overdue. Most months will be nothing to call home about, yet they are all cut from the same cloth that created outstanding returns so far.