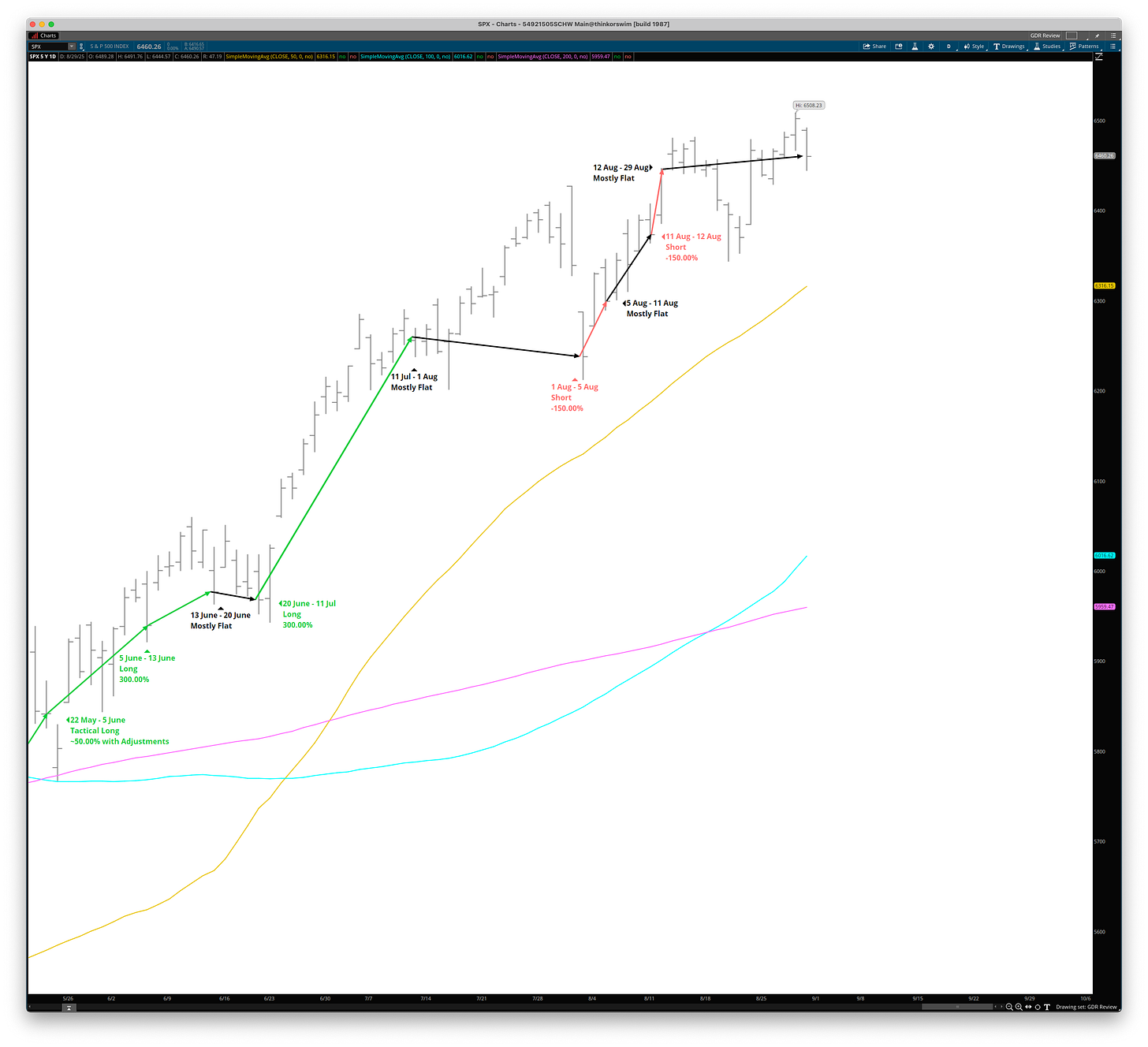

GDR Model Review: August 2025

The model doesn’t claim to be unsinkable—just seaworthy.

They said the Titanic was unsinkable. We all know how that went.

“Infallible” systems have a tendency to end up at the bottom of the ocean—and that’s why I never pretend the GDR Model is one. It’s had an extraordinary year so far, but that doesn’t mean it can’t be wrong. August was a rare losing month, and its first underperformance of 2025. But it wasn’t a failure of the system—it just ran into one of those moments when the market didn’t reward caution. That’s part of the game.

The GDR Model returned -3.34% vs the S&P 500’s Total Return of 2.03%, underperforming the index by 537 basis points in August.

The model is up 63.45% year-to-date as of the end of July 2025 compared with the S&P 500’s Total Return of 10.79%. The model is ahead by 5,266 basis points.

This was just the second month this year where the model posted a negative return (the other was February at -0.56%).

Moreover, it was just the first month this year where the model underperformed the S&P 500 Total Return. Despite everything, the GDR Model is having a stellar year in terms of performance.

While August performance wasn’t up to the standard I aim for, the model still worked as intended: it detected weakness in the market despite price continuing to go up, and attempted a switch to mean-reversion by going short at select spots.

It didn’t work out this time, but we are left with a reminder that this is a model, not a crystal ball. Nothing is infallible and crystal balls sink even faster than (unsinkable) ships.